Lithium prices are under pressure over the supply glut in the market amid high global production, and ASX lithium stocks such as Galaxy Resources Limited (ASX: GXY) are facing the heating at the moment. The prices of lithium chemicals also plunged in the market with lithium hydroxide prices reaching to USD 10.75 per Kg for the week ended 2 January 2019, down by over 4.70 per cent against its December 2019 average price of ~USD 11.25 per Kg on the London Metal Exchange (or LME).

Likewise, the prices of lithium carbonate fell to USD 8.75 per Kg down by over 5.40 per cent against its December 2019 average price of ~USD 9.25 per Kg.

The plunge in lithium prices and its corresponding chemicals have exerted tremendous pressure on the small producers, even in Australia, an example of which was clearly provided by Alita Resources (ASX A40), the Senior Loan Facility of which was later acquired by Galaxy Resources.

To Know More, Do Read: Galaxy Acquires Alita’s Senior Loan Facility; While Orocobre Wraps Competitive Chemical Pricing

Australian lithium miners had played out a major role in the global supply glut along with major producers such as Albermarle, and Chile-based giant- SQM in high hopes of electric vehicle penetration across the global front.

To Know More, Do Read: Australia Vs Chile- A Race for the Lithium Crown, and we would like to further encourage you to read the hyperlinked article to better track the overall lithium industry outlook.

In the status quo, many global miners are now slashing the production and deferring the expansion plans, as industry experts anticipate, that at present, threefold of lithium supply is available to meet the demand.

While the lithium mining companies across the globe are experiencing a tough time due to weak lithium prices amid abundant supply, investors and stakeholders are suggesting that miners now adopt measures to reduce the cost in sync with the lithium market price to sail through these turbulent times, faced by the global lithium industry.

In the recent past, we have witnessed many Australia lithium mining companies adopting such measures, one such example is Galaxy Resources.

To Know More, Do Read: Galaxy to Adopt Cost-Cutting Measures and leap into Lithium Downstream Processing

The adoption of various cost-cutting measures is seeming to be helping Galaxy at the current moment, which could be inferred from the two weeks gain on ASX, despite fall in lithium concentrate sales below the guidance.

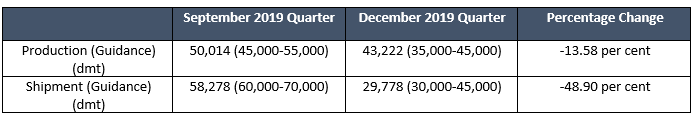

Galaxy would soon present its quarterly activities for the quarter ended 31 December 2019; however, the company announced today that it achieved the lithium concentrate production of 43,222 dry metric tonnes, which remained close to the upper range of the production guidance of 35,000-45,000 dry metric tonnes from Mount Cattlin.

However, the lithium miner sold 29,778 dry metric tonnes of lithium concentrate, which remained slightly below the lower range of the guidance of 30,000-45,000 dry metric tonnes. GXY shipped 14,778 dry metric tonnes of lithium concentrate and deferred a shipment of further 15,000 dry metric tonnes, as customers elected to delay the shipment until the first quarter of this year.

The sales below the guidance were further justified by incorporating the market conditions, which remained narrowed in the wake of the bilateral trade issue between the United States and China- one of the largest lithium chemical consumer and producer.

In its November 2019 release, the lithium chemical giant- Albermarle warned investors about the tough market conditions, which the lithium supplier could face for the next 12 to 18 months amid oversupply conditions, a countermeasure of which, as suggested by industry experts, would be to implement cost-cutting initiatives.

Several measures, as adopted by Galaxy Resources seem to be working out for the miner, and the stock of the company rose from $0.840 (intraday low on 6 December 2019) to the present high of $1.140 (as on 9 January 2020, 4:48 PM AEDT).

While in both September and December 2019 quarter, the production remained near the upper range of the guidance, the sales volume witnessed a slight improvement in the percentage terms. In September 2019 quarter, the shipment remained 2.95 per cent lower against the lower range of the guidance, whereas, in December 2019 quarter, the shipment/sales remained just 0.74 per cent lower against the lower range of the guidance.

The lower December 2019 forecast (guidance) by Galaxy had exerted tremendous pressure as the stock price saw a correction from its peak of $1.412 (high in July 2019) to the level of $0.815 (low in November 2019), a correction of over 42 per cent.

However, Galaxy mentioned that the December 2019 quarter sales would be dictated by the pace at which customers are able to destock existing inventory levels in its September 2019 quarterly report and anticipated weak conditions ahead.

The lowering of sales forecast and production volumes along with the embracing of cost-cutting measures seem to be finally paying off the company, and despite oversupply condition in the market, Galaxy managed its sales volume in sync with the guidance.

Investors currently seeming to be fathoming out such improvements across the company level, and stock seems to be doing good so far; however, the industry outlook still remained unchanged, i.e., supply presently dominating the demand with some margin, which is not going to vanish anytime soon.

Thus, an improvement at the company level, be it terms of cost-cutting, measuring sales, managing offtakes, etc., would act as the oar for lithium miner to sail across the turbulent market conditions.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.