If you ponder over the concept of population from purely an economyâs perspective, you would admit that a slower increase in the population raises concerns about economic competitiveness. In this article, we would discuss the population growth and consider the investment opportunity that population growth provides, specifically with regards to property, while we as global citizens, are getting fuller, richer and older. Letâs dive right in:

Population Growth and Its Impact

According to a report issued by UNâs Department of Economic and Social Affairs, the worldâs population is expected to increase by 2 billion in the next 30 years, from 7.7 billion currently to 9.7 billion in 2050, with varying growth rates across the regions.

The increase in the number of individuals enables an economy to make better use of its human resources. There is a benefit of the economies of scale as the size of markets would increase. Besides this, in case of a population boom, the expanding industries can recruit new workers to the labour force, which satisfies the consequent rise in demand. All these factors are likely to stimulate investment and once the competitive edge is taken into account, innovations, technological advancement and international relations are an obvious result.

However, we should not ignore the fact that an over-populous environment could also have an adverse impact on the economy. The foremost drawback of increase in population is the risk that the country might not be able to feed more dependents, and the pressure on agricultural productivity increases tremendously. There is a natural increase in demand for healthcare facilities, properties and infrastructure, employment opportunities, and often, the demand overtakes the supply. There is persistent pressure on maintaining the economyâs balance of payment, as imports might rise, and some products would be diverted from the export to the home market.

Australiaâs Population Landscape

As on 9 September 2019, the resident population of the Aussie land was estimated to stand at 25,479,702. The preliminary estimated resident population of Australia at 31 December 2018 was 25,180,200 people, up by 404,800 people on the prior corresponding period. Considering three series of projections (A, B and C) and the variables of fertility, life expectancy at birth and migration, where series A and series C are based on higher and lower assumptions and Series B largely reflects current trends, in the 10 years to 30 June 2027 (considering 2017 as base year), Australia's population is projected to increase at an annual average rate of between 1.4 per cent (series C), 1.6 percent (series B), and 1.8 per cent (series A).

(Source: ABS)

The ageing of Australia's demographic is likely to persist over the period, driven by persistent slumped replacement levels pertaining to fertility amid the rising life expectancy rate at birth across years. All capital cities in the country are estimated to grow at a rate above their respective state/ territory. Sydney is projected to increase from 65 per cent of NSWâs population in 2017 to between 67 per cent and 68 per cent in 2027 while Melbourne would be from 77 per cent of Victoria's population in 2027. Brisbane would be up from 49 per cent of Queensland's population to 51 per cent in 2027 and Hobart would grow from 44 per cent of Tasmania's population in 2017 to 46 per cent in 2027. Adelaide, Perth and Darwin are expected to follow a similar trend.

Investing Amid Rising Population

Since time immemorial, historians have been warning civilians about the planetâs inability to feed the growing human population and the need of the hour of population control. But with time, we evolved and progressed to be able to vouch for the fact that growth can be good, as with population growth and people getting older, theyâre also becoming wealthier, which results in increased consumption of resources. This gives rise to several business opportunities, and businesses, in order to raise capital and drive towards growth go to the public to meet their capital needs. This is where the investing ball game begins, with investors pooling in with the aim to fill in their pockets.

In the Australian context, crises breed opportunities. The strong population growth of the country encourages fundamental economic activities and thus, investment implications, which is inclusive of the increase in infrastructure and property investment. Being a tech-savvy country, the new age advancements would help Australians to lead a prolonged life. Market experts believe that this would have a direct economic and government policy implication and stimulate the economy in the housing and infrastructure segment, particularly, catalyzed by the increase in demand for residential properties, roads, schools, hospitals and likewise amenities. This major demographic trend would consequently influence the business line of these segments and increase investment interests.

Investing in Property Amid Rising Population

Investing in property continues to be a popular choice and is often seen as one of the best ways to invest money in Australia. Property is tangible, has tax benefits, limited in availability, bears potential to deliver long-term returns and gives control to the investor. Australian migrants have depicted a trend of becoming homeowners in Australia, especially in capital cities of Sydney and Melbourne. This has laid down numerous investment opportunities to tap capital growth and income. The property growth is being catalyzed by the prevailing job opportunities, cheaper real estate and new transport infrastructure, even though the Australian economy is not in the stage of boom presently. Companies equipped to transport and distribute water, and upgrade or build infrastructure, are likely to witness impressive growth, which would attract both domestic and international investors to safeguard their shares with them.

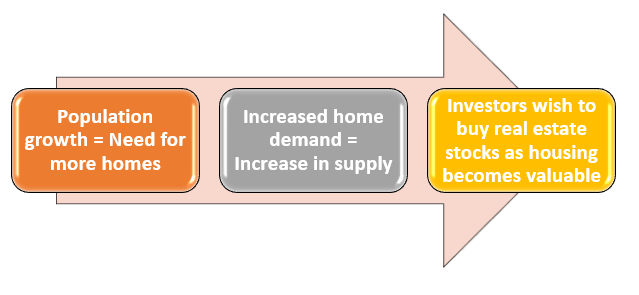

The relationship between population and property is a simple equation of supply and demand. When more people need houses to live in, the supply of new properties on the market makes present housing to be accounted for at a higher value, so prices increase. Investors eye on options where they can tap real estate in areas where the population growth is likely to be on a higher end. Let us consider the below flowchart to understand the reason one should invest in property amid the rising population scenario:

It can be safely said that understanding the ways in which the prospective land values influence the returns generated by property related companies aids the investors in making better investment choices. Once one understands how the appreciation of land can offset the depreciation of a home, the location of the investment takes over. Therefore, to put it across in a nutshell, successful real estate investors should ideally look beyond the aesthetic characteristics of their prospective home purchases and rather pay heed to the property's potential of appreciation, to add value and benefit to their investments.

The Property Performance on ASX

The S&P/ASX 200 Real Estate (Sector) has delivered an impressive ~19.15% returns on a year to date basis beating the S&P/ASX 200 index by ~84 bps, S&P/ASX 200 delivered ~18.31% in the same time period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.