Healthcare is one of the largest sectors in Australia, not only in terms of size but also in contributions towards the countryâs economy. As demand for healthcare products and services is increasing across Australia, investments in the discovery of new technologies, treatment as well as diagnosis of multiple diseases are also anticipated to grow in the coming years.

Healthcare is a vast sector, with segments including hospitals, pharmaceuticals and therapeutic clinics. By keeping a sharp eye on how these segments are performing, investors can realise huge profits. In this article, we would discuss three stocks operating in the healthcare sector and listed on the Australian Stock Exchange.

The Australian benchmark index S&P/ASX 200 closed at 6,788.9, down by 20.3 points or 0.3% from the previous close, on 2 August 2019, while S&P/ASX 200 Health Care (Sector) closed at 35,470.3, up 0.98% from its previous close, on the same day.

Ansell Limited

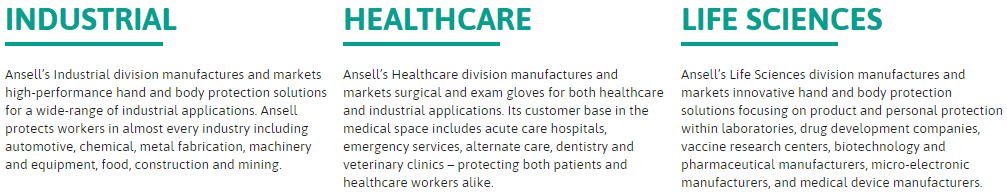

About the Company: A global leader in health and safety protection solutions, Ansell Limited (ASX:ANN) is engaged in research, development and investment activities related to the manufacturing and distribution of cutting edge product innovation and technology. The company, which operates in industrial, life sciences and healthcare segments, markets its product innovation and technologies under well-known brands. Its operations are spread across the regions of North America, Latin America/Caribbean, EMEA (Europe, the Middle East and Africa) and Asia-Pacific.

ANN Divisions (Source: Companyâs Website)

ANN is scheduled to hold a presentation of full year results for fiscal 2019 on 12 August 2019.

Investment in Thailand Facility Expansion: The company, in the month of May 2019, announced plans regarding a USD 32 million investment for expansion of its manufacturing facility located in Lat Krabang, Thailand. The expansion project, scheduled for completion by the mid of calendar year 2021, would involve the development of a new state-of-the-art production facility, which will cover an area of 12,000 square metres. A new biomass boiler would also be constructed as part of the project, with the boiler providing clean as well as renewable energy, in addition to lowering energy costs. The investment would also cover funding for innovative manufacturing processes and technologies.

The project would enable Ansell Limited to boost the plant capacity by 30%, which would be catered towards increasing demand for the companyâs chemical protection platform products from the global market. Moreover, the investment is expected to lessen the environmental impact of ANNâs global footprint, according to Ansell Managing Director and Chief Executive Officer, Magnus Nicolin.

Stock Performance: On 2 August 2019, ANN stock last traded at a price of $ 26.840, down 3.696% from its previous closing price. It has a market cap of $ 3.69 billion and 132.35 million outstanding shares. The stock has an annual dividend yield of 2.27% and a PE ratio of 23.78, while its EPS stands at $ 1.172. The stock has given positive returns of 2.54% and 19.13% in the last three months and six months, respectively.

Sonic Healthcare Limited

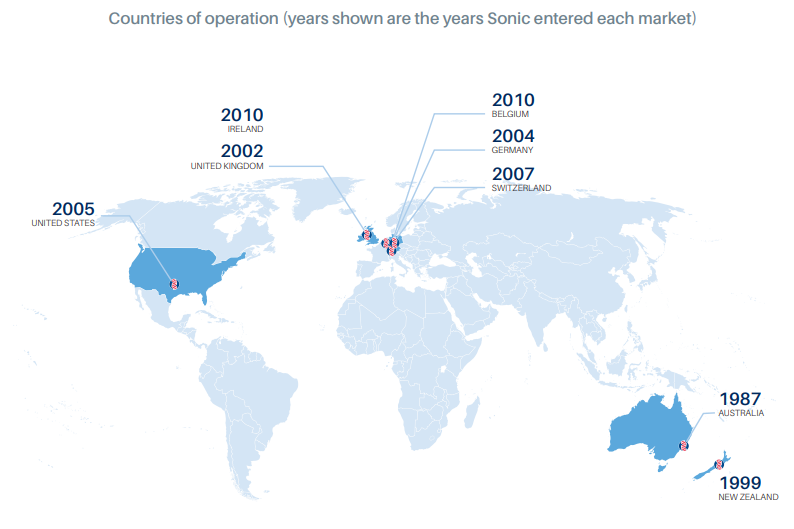

About the Company: Operating as a global healthcare company, Sonic Healthcare Limited (ASX:SHL) provides laboratory medicine/pathology, general practice, radiology primary care medical and other services. The company is headquartered in Sydney, Australia, with operations across eight countries including Australia, New Zealand, Belgium, Germany, Ireland, Switzerland, the United States and the United Kingdom. Every year, the company provides medical and diagnostic services to over 100 million people.

Global Operations (Source: Companyâs 2018 Annual Report)

GLP Systems Sale: Sonic Healthcare unveiled the sale of its 85% interest in Germany-headquartered GLP Systems GmbH to US-based healthcare company Abbott Laboratories in a market update announced on 27 June 2019. The remaining 15% in the divested company has already been acquired by Abbott. Sonic made the decision regarding the sale, considering GLP as a non-core asset for its business.

Sonic will realise an after-tax profit of nearly $ 48 million from the sale, in addition to receiving approximately $ 130 million in cash in the form of sale proceeds and shareholder loan repayments. The company has planned to use the cash for making repayments related to its existing Euro debt, in addition to creating additional balance sheet capacity for further laboratory acquisitions.

After the sale, Sonic plans to remain a key customer of GLP, which is expected to register approximately $ 23 million in revenue for FY2019.

Exercise of Options: In late June 2019, the company announced the issue of a total of 68,000 fully paid ordinary shares. Of the total, SHL issued 33,000 shares at a price of $ 27.34 each share on the exercise of options with an exercise price of $ 19.78 per option, while 35,000 shares were issued on the exercise of options with an exercise price of $ 12.57 per option. Dividend policy related to these shares remains the same as for the existing shares.

Stock Performance: On 2 August 2019, SHL stock last traded at a price of $ 28.340, up 0.854% from its previous closing price. It has a market cap of $ 13.32 billion and 473.96 million outstanding shares. The stock has an annual dividend yield of 2.92% and a PE ratio of 25.450x, while its EPS stands at $ 1.104. The stock has given positive returns of 8.20% and 27.02% in the last three months and six months, respectively.

Pro Medicus Limited

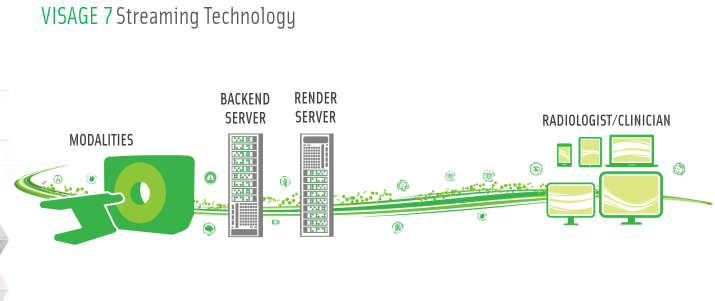

About the Company: Medical imaging IT provider, Pro Medicus Limited (ASX: PME) serves the public as well as private health sectors. The company is engaged in delivering advanced visualisation solutions and radiology information systems (RIS), as well as picture archiving and communication systems (PACS). Its wholly owned subsidiary Visage Imaging provides solutions for diagnostic imaging. The subsidiary gives access to enterprise imaging and advanced visualisation solutions.

According to a company update on 31 July 2019, S&P Dow Jones Indices will add PME in the S&P/ASX 200, effective at the open on 7 August 2019.

May 2019 Investor Presentation: For its product Visage RIS, the company entered contracts with two radiology providers Primary Healthcare and I-MED. The five-year contracts would result in a combined revenue of $ 4.4 million, after the complete deployment of the product. The contracts repositioned the company as an undisputed market leader.

PME reported that its operational (transaction model) is being used in vast majority of US contracts. Moreover, it is being delivered as a Software-as-a-Service model and used in RIS contracts in Australia.

The company reported a 31% increase in exam (transaction) revenue in the first half of FY19 when compared with the second half of FY18. Moreover, it announced the revenue as recurring in nature. While its new products include â Enterprise Imaging, which is a single viewer of all images in the medical record (EMR). The product boosts Visage value proposition, as well as expected to deliver growth opportunities within existing contracts.

Pro Medicus unveiled contracts with Partners Healthcare and Duke Health, which would step up the companyâs operations in FY2020. Duke Health is the largest health system in the US state of North Carolina and is ranked amongst the leading 20 hospitals in the United States. As part of a seven-year, $ 14 million deal, transaction-based licensing model, Visage 7 would be implemented across all the radiology departments of Duke Health. Partners Healthcare is the major health system in the US state of Massachusetts. The contract with this health system is PMEâs largest ever. Under the seven-year, $ 27 million deal, transaction-based licensing model, Visage 7 would act as the cornerstone of the Partners Radiology Enterprise Platform.

Source: Companyâs Report

Stock Performance: On 2 August 2019, PME stock last traded at a price of $ 32.600, down 1.955% from its previous closing price. It has a market cap of $ 3.45 billion and 103.62 million outstanding shares. The stock has an annual dividend yield of 0.21% and a PE ratio of 204.620x, while its EPS stands at $ 0.163. The stock has given positive returns of 55.30% and 154.33% in the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.