If you want to invest in stocks, you must be aware of the positive and negative aspect of an investment. Investing across multiple asset classes, sector, geographies help the investor to manage their risks effectively. It helps to narrow down the range of outcomes between expected and best returns. It helps to reduce the dependency on any one class of investment.

Why Diversified stocks are Important ?

It helps to reduce the risk by allocating the investible resources into different sectors. Sometimes investment may not perform the way we expect, and diversification helps us not to rely on a single source of income, thus creating more stable returns. It helps the investor by achieving a positive return on their investments when one asset class may be underperforming. Investors may allocate capital for further investment and diversification helps to maintain the level of returns, instead of focussing on a single asset class which may be subject to vagaries of the market.

In this article, two stocks from different sectors along with their recent updates have been discussed, i.e. Hotel Property Investment (Real Estate sector) and Polynovo Limited.

Hotel Property Investments (ASX:HPI)

Hotel Property Investment is an Australian based owner of freehold hotels and associated specialty tenancies located in Queensland and South Australia. The company’s ~93 per cent revenue has been derived from pubs leased to QVC and ALH, and the rest of the income is derived from Speciality Tenants leasing the On-site Specialty Stores.

Extension of 28 leases with HPI

On 28 January 2020, the company has announced that Queensland Venue Company (“QVC”), a joint venture between Coles Ltd and Australian Venue Co has agreed to extend the 28 leases with the company that is due to expire in June and December 2021. Fifty seven percent of the company’s gross rental income as on 31 December 2019 were sourced from these 28 properties.

As a result, the Pro-Forma Weighted Average Lease Expiry by income as on 31 December 2019, has increased to 11.8 years from 3.8 years. The impact of extensions to the company’s lease expiry profile as follows;

The Queensland Venue Company has exercised options for 20 properties to extend its existing leases with HPI for a further period of 15 years, and the rent review mechanism remains unchanged for these properties. For the rest 8 properties, the base rent has been reset $3.0m which is 47 per cent lower than the base rent payable under the current lease. QVC has exercised options for additional 10 years for these properties. The new rent will start from 1 July 2020, with the rent review mechanism remaining unchanged.

In conjugation with lease extensions, the company has committed to a 30 million capex program across the portfolio over 2 years starting early in 2020. The company also re-affirmed FY20 distribution guidance of 20.7 cents per security.

Dividend Distribution

On 13 December 2019, the company has announced an expected distribution of 10.3 cents per stapled security from trading operations for the half year ending 31 December 2019. The company is expected to pay a final distribution of 10.4 per cent per stapled security for the half year ending 30 June 2020 resulting in a full year distribution of 20.7 cents per stapled security.

Dividend Re-Investment Plan

The security holders that are participating in DRP will be issued new securities at 1 per cent discount to the volume weighted average trading price for initial twenty days that the company’s securities trade on exe-entitlement basis.

Short Term Incentive Program for CEO

On 13 December 2019, the company has announced the Short-Term Incentive (STI) program for its Chief Executive Officer (CEO) with immediate effect.

The STI will align management rewards with the successful execution of the business strategy of the company.

It will encourage the Chief Executive Officer (CEO) to identify and execute new acquisition and capital deployment opportunities that will bring value to shareholders.

The STI opportunity available for the CEO is limited to 60 per cent of total fixed component of remuneration for any given financial year.

Stock Performance of Hotel Property Investment

The stock of HPI was last traded at $3.320 on ASX on 29 January 2020, up by 0.912 per cent from its previous close. The company has approximately. 146.72 million outstanding shares and a market cap of $482.7 million. The 52-week low and high values of the stock are at $3.050 and $3.690 respectively. The stock has generated a negative return of 4.64 per cent in the last six months.

Polynovo Limited (ASX:PNV)

Polynovo Limited is a healthcare company which focusses on the commercialisation and development of innovative medical devices using its NovoSorb® technology which is used in the medication of surgical wounds, burns and Negative Pressure Wound Therapy.

NovoSorb BTM applied to the first two patients in the UK

On 28 January 2020, the company has announced that NovoSorb BTM has been applied to the first two patients in the UK. One patient was treated for Necrotising Fasciitis in an English NHS hospital and other patient treated for a defect in the scalp. The other NHS hospitals are in the process of selecting patients for surgeries.

In the last 14 months, the company has been establishing a direct sales infrastructure and business processes in the UK. The company has also announced the appointment of two additional sales staff for the UK and Ireland. PNV also appointed a marketing manager for UK and Europe who will be based in England. The new staff recruited are being trained and expected to be in the field by March 2020.

The company’s CEO and Chairman commented:

Europe Update

On 22 January the company has received the first order of BTM from PMI for use in European countries, i.e. Germany, Austria and Switzerland. The NovoSorb BTM’s first order was shipped to hospitals for the first surgery. At the Launch of 38th DAV 2020 burns conference in Austria, several surgeons have shown their interest to use the product soon; This is materialising now.

The company and PMI have hosted seventy surgeons for dinner at DAV, and the company’s CEO has spoken about the NovoSorb technology and the partnership with PMI.

Two Million Dollar Month

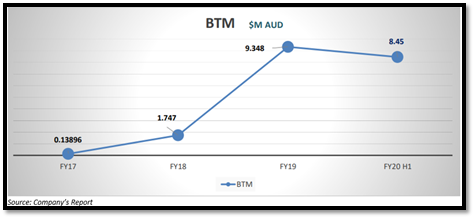

On 7 January 2020, the company has announced the month of December as a two-million-dollar month. The company’s revenue from NovoSorb BTM for the month of December 2019 has just crossed $2 million compared to $890k in December 2018. Earlier the company has announced the first one-million-dollar month on 2 May 2019.

The company will make further announcement soon about the EU/UK prospects post CE approval.

Technology in Pipeline

- The Hernia device preparing for manufacturing scale up will complete factory build in May 2020 and is expected to enter in the US in early stages of CY 2021.

- The five drugs were at initial exploration stages for mix/extrusion/consistency, the further Research and Development is needed to develop robust elution test data and accelerate developments in FY21.

- The company’s breast products are in advanced design and preliminary commercial manufacturing process mapping.

The company’s FY2020 plans can be viewed here

Stock Performance of Polynovo Limited

The stock of PNV was last traded at $2.930 on ASX on 29 January 2020, up by 1.034 per cent from its previous close. The company has approximately. 661.09 million outstanding shares and a market cap of $1.92 billion. The stock’s 52-week low and high value are at $0.635 and $2.960 respectively. The stock has generated a positive return of 76.83 per cent in the last six months.