Brief about S&P/ASX 200 Information Technology (Sector)

The S&P/ASX 200 Information Technology (Sector) last traded upwards by 4.5 points (or 0.31%) to 1447.9, while the benchmark index S&P/ASX 200 closed at 6648, up 0.7 point on 9th September 2019. Besides, the two IT stocks - Xero Limited and WiseTech Global Limited have performed well in the past trading sessions on ASX. Let us now look at how and why these stocks have performed well in the market and have given significant gains to their investors.

Xero Limited

About the company:

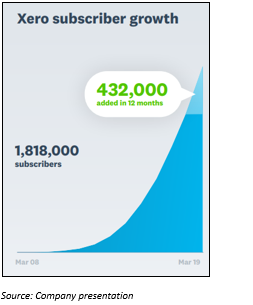

Xero Limited (ASX: XRO) has a very distinguished business model and is a SaaS (Software as a Service) company. The company is engaged with the work related to the provision of a platform for online accounting and business services for the small businesses and their advisors. XRO operates through two operating segments: Australia and New Zealand (ANZ) and International. Xero integrates with over 400 add-on applications allowing people to customise Xero to their needs. The company has a total subscriber base of more than 1.8 million globally.

Investment rationale:

Performance of the company in FY19:

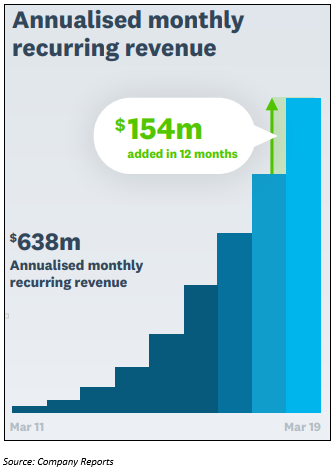

In the annual meeting presentation, released on 15 August 2019, the company mentioned that it had delivered a strong set of numbers for FY19 period. The important indicator for the company, AMRR, which shows how the company is performing, grew by 32% to $638 million- depicting an increase in AMRR of $154 million over the previous year.

Finally generated positive cash flows:

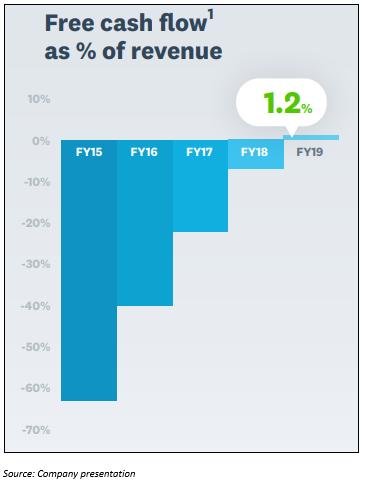

The free cash flow is also an important indicator of the company and shows the ability of the company to generate funds. In the past four years period, Xero had made significant and positive strides with its first ever positive cash flow of $6.5 million in FY19, equivalent to 1.2% of the operating revenues. Free cash flow of $6.5 million was an improvement of $35 million from last yearâs negative $28.5 million. Total operating and investing outflows for the year were $26.2 million, with operating cash flow up by $53 million or 87% from the prior year, standing at $114.2 million.

Increase in subscriber base:

There has been an increase of 31% in the subscriber number over FY19 which reflects businessâ continued strong traction, with particularly strong progress in the international market. There was an increase of 432,000 subscribers in FY19, taking overall subscribers to more than 1.8 million. These are very strong numbers, but with an eye on global ambitions, FY19 was more pleasing on international net subscriber addition front, with a total of 239,000 subscribers and for the first time exceeded those from the ANZ region of 193,000.

Stock Performance:

On 9th September 2019, by the closure of the trading session, the stock of XRO was at a price of AUD 67.010, and traded near to the 52-week high of AUD 68.880, with a market cap of around AUD 9.4 billion and approximately 141.37 million outstanding shares. In the previous six months period, the stock of the company has given a positive return of 35.55%.

WiseTech Global Limited

About the company:

WiseTech Global Limited (ASX:WTC) is an innovative global developer of cloud-based software solutions for the international and domestic logistics entities. CargoWise One is the companyâs main platform and it provides a complete end-to-end logistics solution and has become an essential link in the global supply chain.

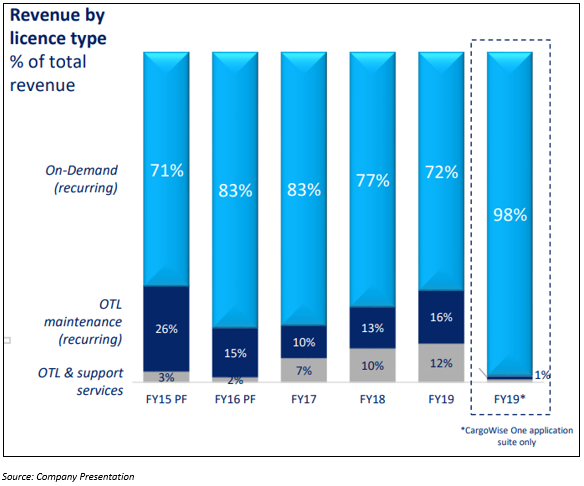

Performance of the company:

The company reported strong numbers for FY19 period. There was a huge revenue growth of 57% mainly through continued strong organic growth across global business, and the addition of over 830 internally developed product enhancements and features to CargoWise One technology platform, along with the attainment of strategic assets in new geographies and end-to-end technologies to quicken the future growth.

Strong organic growth:

The company reported a strong organic revenue growth with revenues from existing and new customers moving up by 33% to $54.5 million. The company now has ten of the worldâs largest logistics providers, in global rollout or in the process of rolling out- including DHL Global Forwarding, DSV, Toll, Bollore Logistics, Yusen and GEODIS.

Good EBITDA movement:

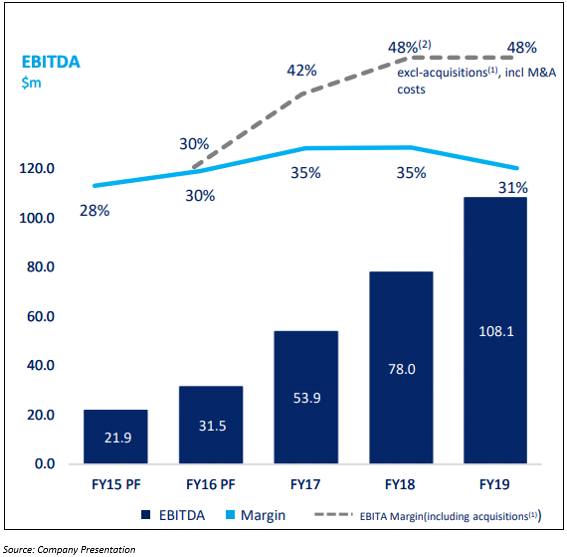

EBITDA overall has more than doubled since FY17, while EBITDA margin came at 48%, which reflects continued improvement in CargoWise Oneâs efficiency.

Expansion of its global platform:

During the period, the company invested about $113 million and 47% of its people in product development, expanding the pipeline of commercialisable innovations. Also, it delivered over 830 product enhancements and upgrades seamlessly across the CargoWise One global platform.

Greater use of existing customers:

Further, WTC experienced a continuous strength in customersâ revenue growth of $46.8 million, providing 86% of organic revenue growth in FY19period. WTCâs customer base increased for CargoWise One platform usage, increasing transactions, users, new sites, and geographies taking up new products and movement towards utilising more modules.

Increased organic growth through acquisitions:

Increasing its footprint geographically, the company bought market positions that would take years to build, and it would mix the acquired industry and developer aptitude and consumers over time to quicken its organic growth. The company has advanced product development in Australia, US, Ireland, China, Italy and Germany. In addition to that, WTC has proclaimed a further 15 valuable geographic acquisitions across Singapore, Australia, Italy, Spain, Turkey and North America regions.

Outlook for FY20:

The company expects the revenue to range from $440 million to $460 million, representing a growth of 26%-32% for FY20 period. Also, it anticipated the EBITDA growth of 34%-42% in FY20 period to stand between $145 million-$153 million.

Stock Performance:

On 9th September 2019, the stock of WTC last traded at a price of AUD 38.390, near to the 52-week high of AUD 38.800, with a market cap of around AUD 12.12 billion and approximately 318.18 million outstanding shares. In the previous six months, the stock of the company has given a positive return of 79.75%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.