Cannabis: An Overview

The cannabis industry is booming at a rapid pace with governments across the globe creating the opportunities for investors by legalising recreational and medicinal cannabis. Legalisation of cannabis by government authorities for different legal uses are attracting the investors and entrepreneurs to jump into this industry. Tobacco and pain relievers manufacturers are also watching this industry closely. Apart from the usage in drug industry, there are wide range of cannabis related consumer products available in the market that include drinks, coffee, sleep inducing teas, edibles etc.

Legalisation of Cannabis

The first European country recently reported to legalise the use of cannabis was Luxemburg. The health minister confirmed to the country to legalise production & consumption of marijuana drugs. Draft legislation will be unrevealed later providing the full details on type of cannabis that will be sold and level of tax that will be imposed. Previously, Australia became the fourth country to legalise the medical use of cannabis at the federal level on 24 February 2016. In US, medical use of cannabis is legalised in 33 states with personal consumption legalisation in 11 states.

Three Reasons why Investors are interested to buy Cannabis Stocks

- The Marijuana industry is fast - paced Industry that is expected to get triple in next five years. Investors are expecting significant uptick on their investments in this space.

- This industry is aiding the investors to get the opportunity to gain exposure of a massive market, as, more and more countries are stepping into legalisation process.

- Investment deals and partnerships by several huge domestic/global companies is acting as a major driver in the industry.

IDT Australia Limited (ASX: IDT)

IDT Australia Limited, fully licensed for medicinal cannabis operations, is a provider of Research and Development activities and manufacturer of active pharmaceutical ingredients and drug products globally.

On 29th August 2019, the company announced that it is working to leverage its fully licenced GMP manufacturing assets to expand its footprint in Cannabis manufacturing. The company has a long history in GMP manufacture of APIs and finished dosage forms. The GMP licences are required for manufacturing of APIâs and finish dosage forms. The company now has the required licenses with the TGA, The Department of Health ? ODC and the Victorian Department of Health and Human Services manufacture medicinal cannabis products to Good Manufacturing Practice (GMP) standards.

IDTâs GMP API Medicinal Manufacturing Capabilities

The company has the capability of taking the biomass directly from the cultivator. The company has the critical equipment installed, and no facility modification is needed.

- The technical team is working in a secured environment for high containment products

- IDT has the capabilities to synthesize any of the cannabinoidâs forms to GMP specifications

- The technical team is currently working on the conversion of tonnage quantity of medicinal cannabis biomass

IDTâs GMP Finished Dosage Form Medicinal Manufacturing Capabilities

- Solid oral dosage forms, dermal, liquid fill products, and package medicinal cannabis biomass under GMP conditions are the GMP finished dosage forms which the IDT can convert & formulate.

- The company has its forte in dealing with any botanical variation in the medicinal cannabis starting material.

- The analytical labs offer a wide range of GMP testing and stability service support

On 20th May 2019, ODC Granted license for medicinal Cannabis to IDT.

Stock Performance : IDT is trading higher on ASX at AUD 0.150 on 30th August 2019 at 1:56 PM AEST with a surge of 3.448% in comparison to the last closed price of AUD 0.145 with ~236.36 million shares of the company in the market, and a market cap of AUD 34.27 million. The 52-week high and low value of the stock was at AUD 0.245 and AUD 0.115, respectively, at the time of writing the report.

Althea Group Holdings Limited (ASX: AGH)

Althea Group Holdings Limited is engaged in the supply and production of pharmaceutical cannabis both domestically and internationally. Headquartered in Melbourne, the Group contain various licenses for import and cultivation of medicinal cannabis. The company was listed on ASX on September last year.

As per the recently released annual report, the company reported loss after income tax amounting to $8,675,000 as compared to $1,871,000 loss during pcp. During the year, company reported $6.16 million operating cash flow, $1.67 million investing cash flow and $20.49 million financing cash inflow. The net cash and cash equivalents at the end of the year stood at $14.92 million.

On 7th August 2019, The company announced Tetra agreement and record break patient uptake with 1,523 Australian patients and 245 healthcare professionals being prescribed the companyâs medicinal cannabis products.

Few highlights of the update are as follow:

- In July ~334 patients were added at an average rate of 14.5 patients per day

- The Australia Medicinal market increased at higher rate in July

- The company entered an agreement with Tetra Health Pty ltd for continuous growth in secondary clinic channels

- The record-breaking update continued in the month of August with 19 patients per day.

On 1st August 2019, the company made its first shipment of medicinal cannabis to the UK. The company has expanded its partnership with Cannvalate Pty ltd which act as key additional channel for additional channel in UK.

Stock Performance: AGH is currently trading at AUD 0.830 on 30th August 2019 at 2:15 PM AEST with a surge of 0.592% in comparison to the last closed price of AUD 0.830 with ~233.1 million shares of the company in the market, and market cap of AUD 193.47 million. The 52-week high and low value of the stock was at AUD 1.445 and AUD 0.175, respectively, at the time of writing the report.

Cann Group Limited (ASX: CAN)

Cann Group Limited is a medicinal cannabis company engaged in cultivating cannabis as well as medicinal cannabis products for the use and sale within Australia and globally. The company obtained cannabis research licence in February 2017 and cultivation license in March 2017.

On 27th August 2019, The company has announced to increase capacity at Mildura facility by 40%

Few highlights of the announcement are as follows.

- Production capacity targeted to increase to 70,000kg of dry flower per annum.

- Expected Annual Revenue generation of ~$220 - 280 million based on the wholesale price of flower

- Facility completion to be expected in Q42020

- Signed a debt facility term sheet with major Australian bank.

Financial Performance for FY 2019

- Revenue from ordinary activities increased to $4.2 million from $1.5 million.

- Loss before income tax of $10.9 million as compared to $4.7 million loss pcp

- Net Tangible asset per ordinary share was $0.5443

Stock Performance: CAN is trading on ASX at AUD 1.885 on 30th August 2019 (2:13 PM AEST), down 2.84% with ~141.8 million outstanding shares and a market cap of AUD 275.1 million. The 52-week high and low value of the stock was at AUD 2.950 and AUD 1.525, respectively, at the time of writing the report.

Cann Global Limited (ASX: CGB)

Cann Group Limited cultivates medical cannabis for research, development and medicinal purpose. The groupâs focus is to legally grow, cultivate & develop cannabis medicinal products to meet the demand domestically and internationally. The company was publicly listed on Australian Stock exchange on 14th Jan 2008.

On 29th August 2019, the company announced that its T12 Food business segment, has become an official supplier to retail player, Costco.Few Highlights of the updates are as follows:

- The company becomes the official supplier to Costco, a substantial step towards building a strong relationship with the global wholesaler.

- Secured first order of 6900 bottle purchases from Costco for its Vitahemp certified hemp oil capsules.

- The purchase order for other T12 products are soon to be expected.

On 26th August 2019, the Company entered into a 50/50 partnership with the leading cannabis company Pharmocann.

Stock Performance: CGB is trading at AUD 0.034 on 30th August 2019 (2:13 PM AEST), up by 9.7% with ~3.09 billion outstanding shares a market cap of AUD 95.9 million. The 52-week high and low value of the stock was at AUD 0.035 and AUD 0.023, respectively, at the time of writing the report.

Elixinol Global Limited (ASX: EXL)

Elixinol Global Limited is a global leader in cannabis industry. The companyâs products include hemp-derived CBD dietary supplement, Food and wellness products & medicinal cannabis products. The global business includes Elixinol USA and Hemp Foods Australia.

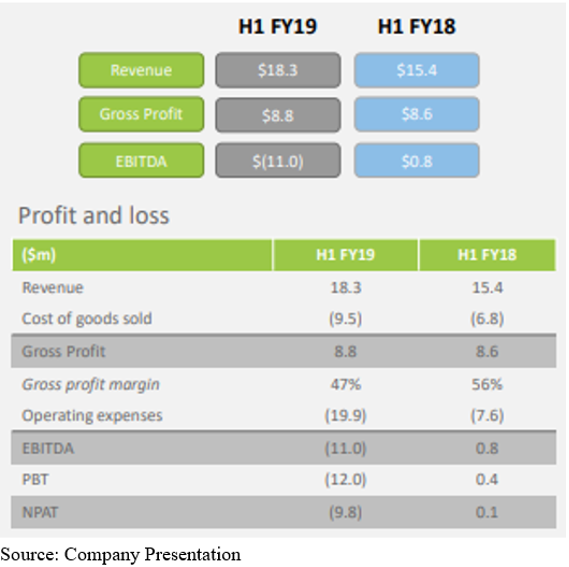

Operating & Financial Performance for H1 FY 2019

- Revenue increased by 19% to $18.3 million from $15.4 million previous year.

- Elixinol USA brand revenue increased by 63% to $7.5 million.

- UK and Europe generated first revenues in later stage of H1 2019.

- Operating expenses have been increased for the future growth.

- Increase in number of employees to 139 as compared to 39 in the previous corresponding year.

- Cash in hand stood at $48.1 million from $14.2 million last year.

- Advance payment of $4.3 million incurred to secure future raw materials.

Stock Performance: EXL is currently trading at AUD 2.220 on 30th August 2019 (2:13 PM AEST) with dip of 3.057%. The 52-week high and low value of the stock was at AUD 5.930 and AUD 1.375, respectively, at the time of writing the report.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.