Utilities Sector

According to Global Industry Classification Standard (GICS), the Utilities Sector encompasses companies engaged in Electric Utilities, Gas Utilities, Multi-Utilities, Water Utilities & Independent Power and Renewable Electricity Producers.

This article talks about five such companies listed on ASX, and a few on NZX (New Zealandâs Exchange) as well. Some of these companies are actively unlocking the renewable energy potential for a sustainable future. The focus on renewable energy is entirely justified when the world is pushing for lower carbon emissions.

In this article, we have also discussed the full-year results provided by these companies very recently, and some material developments related to the companyâs business. Also, on 30 August 2019, S&P/ASX 200 Utilities (Sector) index was at 8,005.7 slightly up 0.53% or 42.3 points from the previous close. Concurrently, the S&P/ASX 200 was up 96.8 points at 6,604.2 relative to the prior close.

Infigen Energy (ASX: IFN)

Renewable energy producer, Infigen Energy own windfarms in New South Wales (NSW), South Australia (SA), and Western Australia (WA). Infigen is committed towards leading the transition of the country towards a clean energy future.

Recently, on 28 August this year, the company notified on the agreement to lease 120MW of open cycle gas turbine equipment from the South Australian Government for 25 years, starting from May 2020. Subsequently, the development allows the company to increase electricity sales to Commercial & Industrial customers in the National Electricity Market.

Reportedly, the capital expenditure associated with the transaction is budgeted at $55 million, which includes relocation, civil works, gas connection, electricity connection and equipment installation. In addition, the company would be making annual lease payments of $5.02 million per year.

This month, on 22 August 2019, the company also released full-year results for the period ended 30 June 2019. Evidently, the revenue of the company stood at $257.5 million up 15.1% over FY2018 revenue of $223.7 million. Statutory NPAT was down 10.5% to $40.9 million in FY2019 compared to NPAT of $45.68 million in FY2018.

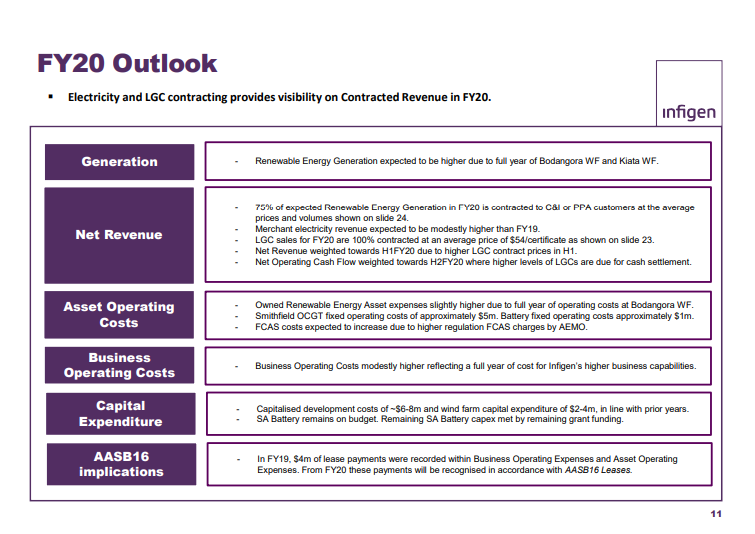

FY20 Outlook (Source: IFNâs Full Year Results Presentation)

Outlook

Reportedly, the company intends to increase the volumes of renewable energy under the Capital lite model and increase the level of customer contracting under Customer & Industry. It would manage the construction of the Cherry Tree Wind Farm to deliver new renewable energy sale.

Meanwhile, the commissioning of the SA battery, and progressing Flyers Creek Wind Farm in NSW towards financial close would be emphasised as well. It is expected that business operating costs would increase given pipeline in development.

On 30 August 2019, IFNâs stock last traded at A$0.59, up by 4.425% from the previous close. Over the year-to-date period, the stock has delivered a return of +28.41%.

Tilt Renewables Limited (ASX: TLT)

Domiciled in New Zealand, Tilt Renewables is engaged in the development, ownership and operating of electricity generation facilities. It is also engaged in trading electricity and associated products from renewable energy sources.

Recently, on 28 August 2019, the company had approved the investment decision for a wind farm. Reportedly, it gave a nod for the investment, to be made in the one hundred and thirty- three MW Waipipi Wind Farm, earlier known as the Waverley Wind Farm.

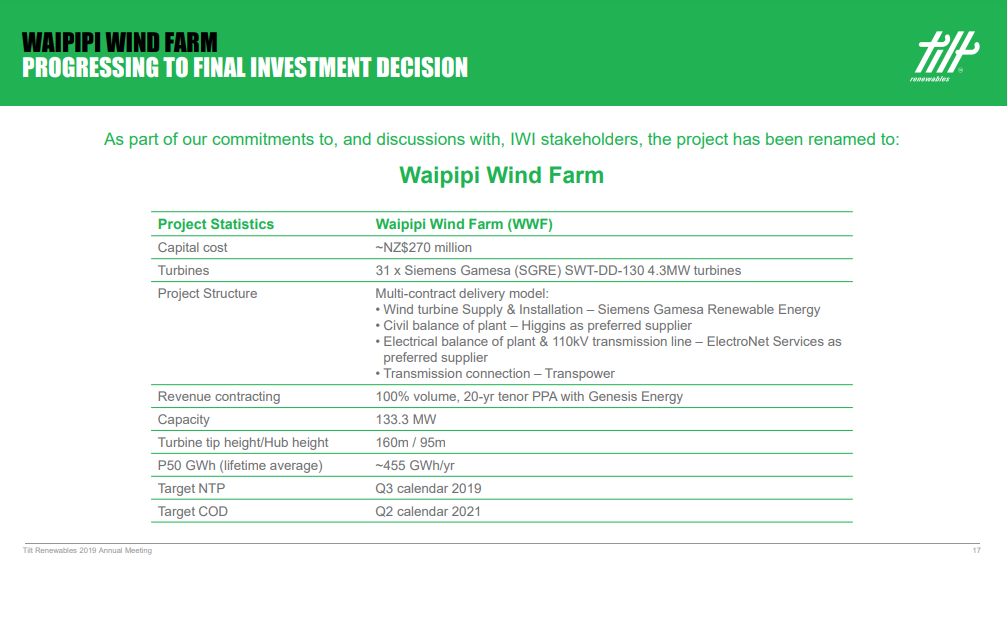

Investment Decision (Source: TLTâs 2019 Annual Meeting Presentation)

Meanwhile, the cost of the project is NZ$276 million, and the project includes 31 4.3MW Seimens Gamesa turbines with a 130m rotor diameter, which is the largest ever in New Zealand. The average annual capacity of the project is 455Gwh of clean & green electricity.

Besides, the company had signed a 20-year offtake agreement with Genesis Energy Limited (ASX:GNE), who would purchase the energy. The project would be funded via project debt financing, equity generated internally and retained earnings. The company expects the project to progress with financial close during the upcoming month.

TLTâs stock last traded on ASX at a price of A$2.42. Over the year-to-date period, the stock has delivered a return of +22.39%.

Genesis Energy Limited (ASX: GNE)

Based in New Zealand, Genesis Energy is a diversified energy entity, and it is the countryâs largest energy retailer. Genesis also operates retail brands to sell electricity, reticulated natural gas and LPG. In New Zealand, the company has thermal and renewable energy assets to generate electricity, and a Joint Venture for oil & gas.

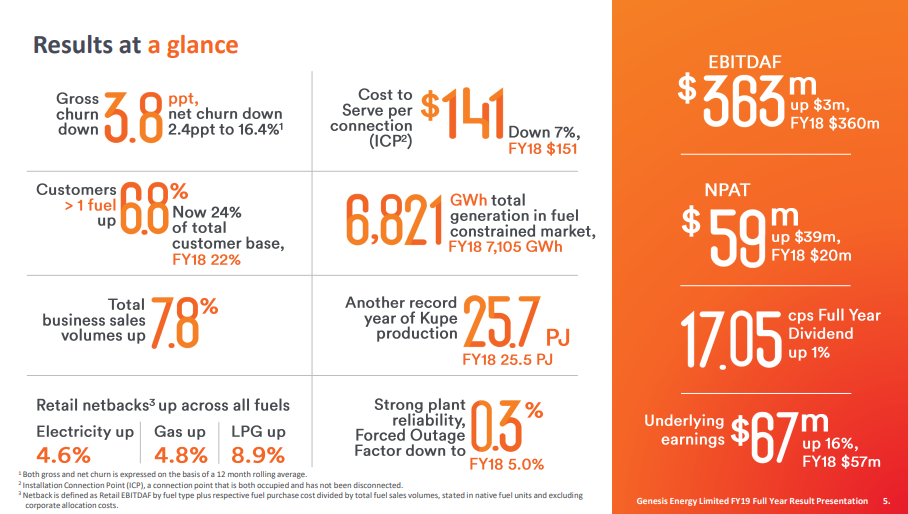

Recently, on 28 August 2019, the company has released full year results for the period ended 30 June 2019. Accordingly, the revenue for the period was $2.7 billion compared to revenue of $2.302 billion in FY2018. The profit after tax for the period was $59.2 million against a profit of $19.7 million in FY2018.

Reportedly, the basic EPS for the period was 5.84 cents in FY2019 compared to 1.97 cents in the previous corresponding period. The company was able to offset higher fuel costs through the well-balanced spread of fuel contracts, which underpinned the earnings growth.

FY2019 Results (Source: Genesis Energy Full Year FY19 Results Presentation)

Meanwhile, the company is committed to a renewable energy future, and it had partnered with Tilt Renewables on a new wind farm in South Taranaki, which would be capable of removing 250k tonnes of carbon each year.

Besides, the company is actively exploring new opportunities to play a role in the countryâs low-carbon future. It has focused on retail markets with customer engagement with rewards to loyal customers, and, in May 2019, Genesisâ 150k customers took part in its fifth Power Shout.

Outlook FY2020

As per the release, the company expects to report EBITDA (A-fair value changes and other gains and losses) in the range of $360 million to $380 million, and the capex guidance for the period is $100 million.

On 30 August 2019, GNEâs stock last traded at A$3.13, down by 0.949% from the previous close. Over the year-to-date period, the stock has delivered a return of +28.98%.

Infratil Limited (ASX: IFT)

Infratil invests in businesses engaged in energy, social infrastructure, and transport. Recently, the company held an Annual Meeting â 2019 on 22 August 2019, and all the resolutions were passed in the meeting.

On 20 August 2019, the company opened its offer of unsecured unsubordinated Infrastructure Bonds. Accordingly, the company had offered up to $200 million of infrastructure bonds in aggregate across series, which include 3.35% per annum due on 15 December 2026, and 3.5% per annum due on 15 December 2029.

Reportedly, the company has an option to accept up to $100 million of oversubscription at its own discretion. The offer of debt securities is consistent as the same class of existing debt securities.

Meanwhile, the infrastructure bonds due on 15 December 2029 are having a fixed rate of interest for the initial fifteen months. The initial rate reset is scheduled on 15 December 2020, and annually thereafter.

Important Terms (Source: Infratil Infrastructure Bond Announcement)

Besides, the offer is available to all investors in New Zealand, which closes on 20 September 2019, and the company has an option to close the offer earlier.

On 30 August 2019, IFTâs stock last traded flat at A$4.3. Over the year-to-date period, the stock has delivered a return of +24.64%.

ERM Power Limited (ASX: EPW)

Energy Business Solutions Provider, EPW operates in the business to business segment with energy management services, including retail energy solutions, energy productivity optimisation. Its assets are situated in Western Australia & Queensland regions.

On 22 August this year, the company released full year results for the period closed 30 June this year. The revenue for the period stood at $3.196 billion down by 3% from $3.279 billion in FY2018. Statutory profit for the period was at $123 million for the period compared to a loss of $80 million in the previous corresponding period.

Reportedly, the forward contracted load grew 11% to 32.2TWh compared to 28.9TWh in the previous year end. The company witnessed a decline in C&I load, which was down 8% against the previous year.

Meanwhile, the company recorded an increase in gross margin per MWh compared to the previous year. The gross profit margin was at $5.16/MWh for the period above the full-year outlook provided in August 2018.

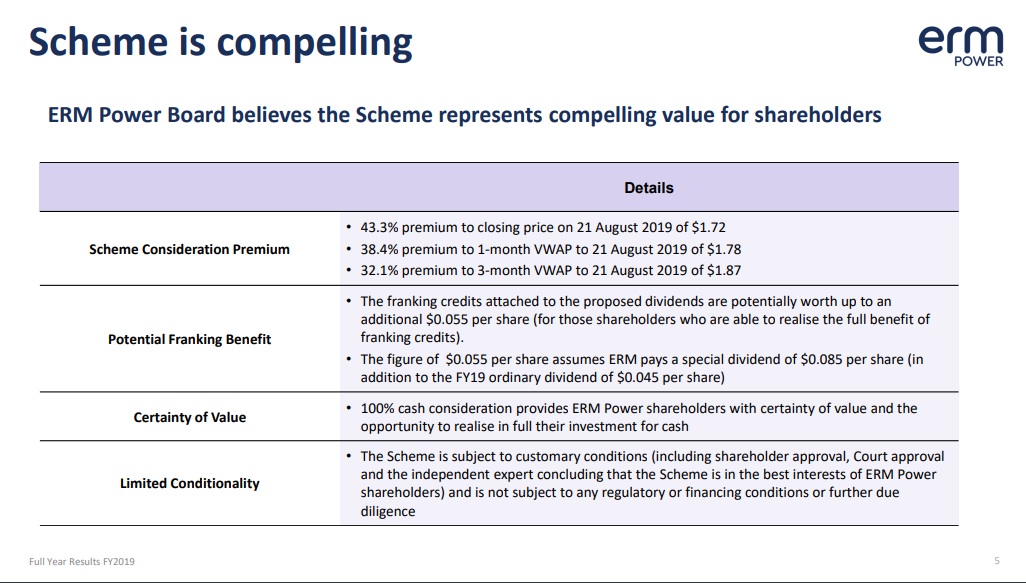

Terms (Source: EPWâs FY2019 Full Year Results & Presentation)

Concurrently with full-year results, the company also broke the news related to the proposed acquisition by Shell Energy Australia Pty Ltd, and it has entered into a scheme implementation deed with Shell Energy. Under the scheme, Shell Energy has proposed to wholly acquire the share capital in ERM Power.

Reportedly, the consideration for the transaction is $2.465 per share, and the Board of the company has proposed shareholders to vote in favour of the scheme in the absence of the superior proposal. Besides, the offer price represents a premium of 38.4% to the one-month VWAP of share price to 21 August 2019.

On 30 August 2019, EPWâs shares last traded at A$2.44, down by 0.408% from the previous close. Over the year-to-date period, the stock has delivered a return of +63.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.