Genesis Energy Limited (ASX:GNE) is New Zealandâs largest energy retailer primarily dealing in selling of electricity, LPG and reticulated natural gas through its retail channels of Energy Online and Genesis Energy. It has a customer base of around 500,000 customers. The firm is engaged in the generation of electric power using renewable and thermal generation assets spread across the country.

Genesis Energy Limited has announced a notification on 18 April 2019 regarding the issue of 7,439,478 Ordinary Shares under its Dividend Reinvestment Plan (DRP).

Further, Genesis Energy released its FY19 Q3 Performance Report on 18 April 2019 for the period ending March 31, 2019. The companyâs performance summary report incorporates the three main segments of Genesis - Customer Segment, Wholesale Segment and Kupe Segment. The performance of these three segments during the quarter is explained below:

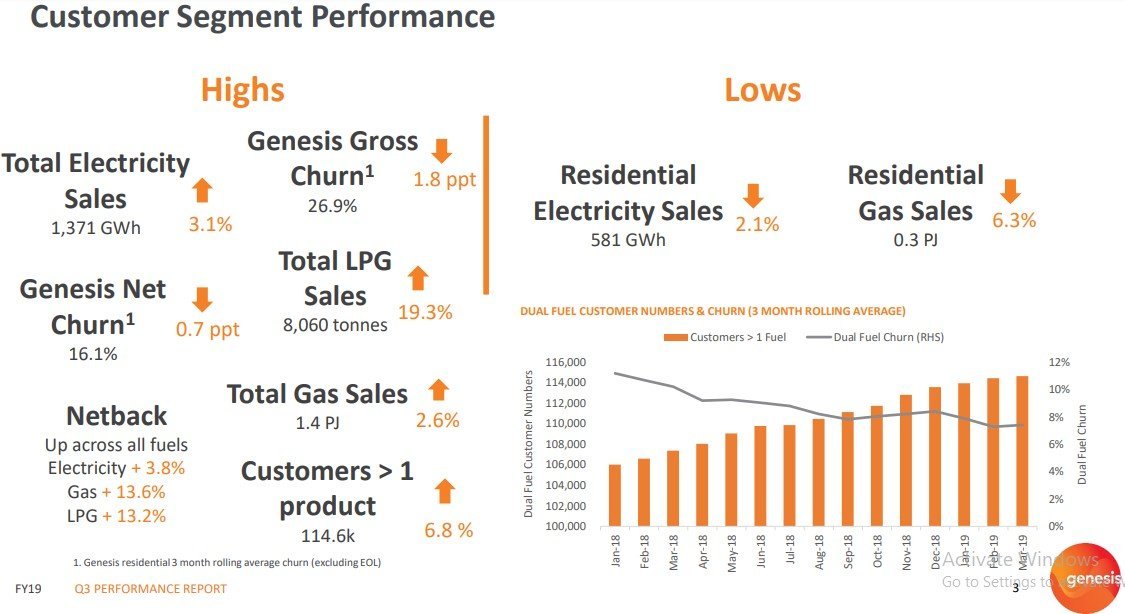

Customer Segment Performance

During the quarter, the company observed an improvement in both brand NPS and interaction NPS. The gross churn reduced by 1.8 ppt while the net churn also witnessed a reduction. With Genesisâ increased focus on customers, the dual fuel customer numbers have steadily increased in the quarter. Netback margins improved across all fuels. Sales into the residential segment are still struggling, but Genesisâ focus on optimisation of its portfolio has stimulated growth across its various segment.

Customer Segment Performance (Source: Company Report)

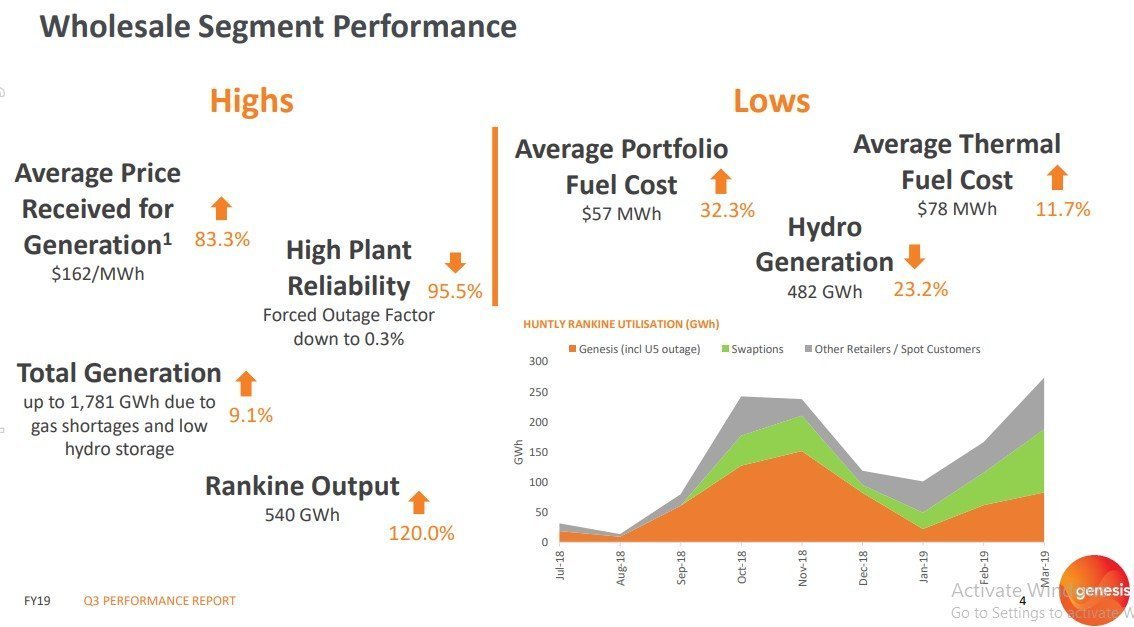

Wholesale Segment Performance

Genesisâ wholesale market saw a decline in the volume this quarter due to swaption calls, fewer inflows and ongoing market gas constraints. Due to the high cost of imported coal and downturn in hydro generation, the portfolio fuel costs rose by 32% in the same period last year. The total generation for the period increased by 9%, but below average hydro inflows (down by 23%) contributed towards high wholesale market prices throughout the quarter.

According to Tracey Hickman, Executive General Manager â Generation & Wholesale, the ongoing gas constraints and low hydro inflows impacted the large volumes in the wholesale market. This was partially balanced with the decision to bring back Unit 2 at Huntly.

Wholesale Segment Performance (Source: Company Report)

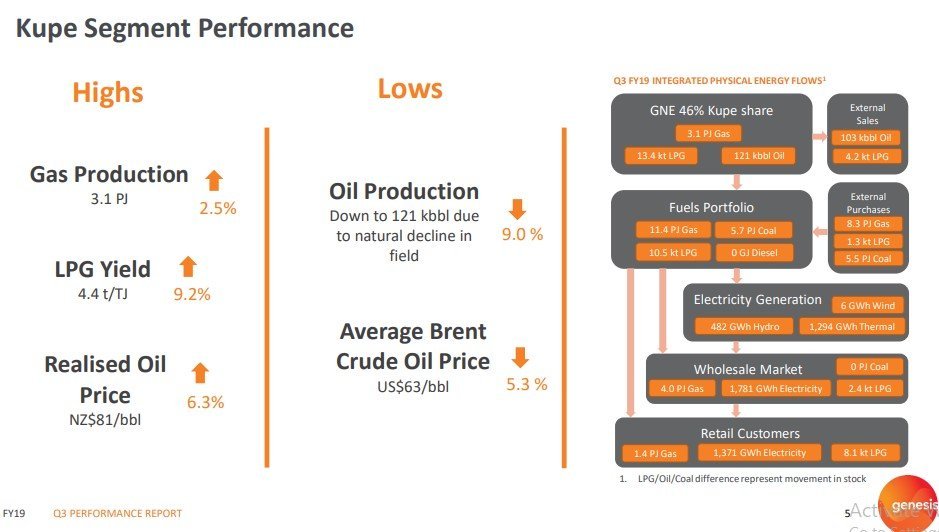

Kupe Segment Performance

Kupe in which Genesis Energy owns a 46% stake worked at nearly 96% of capacity over the period. The statutory maintenance undertaken in the previous quarter worked in favour of Kupe in this quarter. The gas production rose by 2.5% as compared to the corresponding period, LPG yield increased by 9.2% and oil sales also witnessed a surge of 7.6% versus the prior comparable period. The natural decline in the field led to the reduction in oil yield by 9%.

Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â

Â

Kupe Segment Performance (Source: Company Report)

The companyâs stock was trading at a market price of AUD 2.880 on ASX (as on 23rd April 2019 at AEST 12:20 PM). Genesis market capitalisation stood at 2.93 billion with 1.02 billion shares currently outstanding. The 52-week high and low value was recorded at AUD 3.165 and AUD 2.080 respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.