Brownfield acquisitions across the businesses have been a predominant feature in the current scenario. Most of the companies look for entities with good product offerings and a decent market share. With the announcement of acquisitions/mergers/takeovers, the price of the stock becomes volatile and is largely driven by the price offered by the interested party.

Recently, the Australian unit of oil & gas major Royal Dutch Shell plc placed an acquisition offer to ASX-listed ERM Power Limited. Let us have a look at the offer, along with the recent performance of ERM Power in the year ended 30 June 2019 and on the Australian Stock Exchange.

Shell Offer to Acquire ERM Power:

On 22 August 2019, ERM Power Limited (ASX:EPW) announced to have reached a scheme implementation deed with Shell Energy Australia Pty Ltd, the Australian unit of oil & gas major Royal Dutch Shell plc. Under the agreement, the Australian subsidiary of Shell has made the proposal for the purchase of entire share capital of EPW. The company has offered to pay $ 2.465 per share in cash. The deal would be carried out by way of a scheme of arrangement.

The scheme is valued at ~ A$ 617 million. This transaction value depicts a 38.4% premium to the one-month VWAP of a share of the company valued at A$ 1.78 to 21 August 2019. EPW directors have unanimously favoured the deal, advising the companyâs shareholders to cash their votes in favour of the scheme in the absence of a better proposal. Meanwhile, Mr Trevor St Baker, the founding and major shareholder of EPW, intends to vote in favour of the scheme. However, it is subject to a thumbs up by a report by an independent expert, concluding that the scheme would be beneficial in all aspects to the companyâs shareholders.

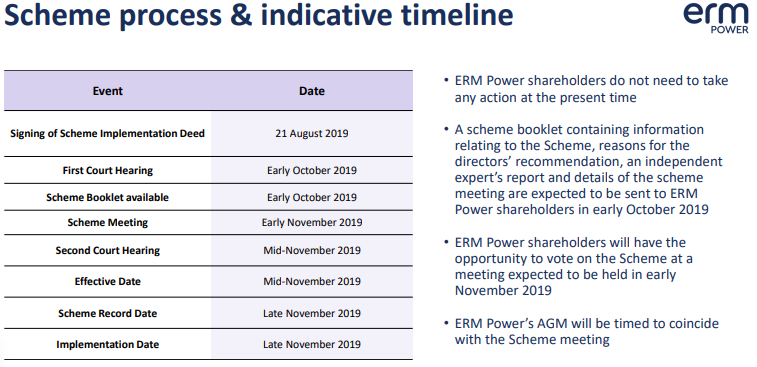

A scheme booklet is expected to be sent to the shareholders of the company in or around early October 2019, while the shareholders are likely to hold a meeting to take a decision regarding the scheme in or around early November 2019.

Source: Companyâs Report

About ERM Power Limited:

ERM Power Limited is the second largest Australian power company by load, engaged in serving commercial businesses and industrials in the country. The company is a provider of end-to-end energy management to large businesses. It deals in segments like electricity retailing and integrated solutions that improve energy productivity. ERM is the operator of gas-fired peaking power stations generating 662 megawatts, across the states of Western Australia and Queensland.

FY19 Financial Performance:

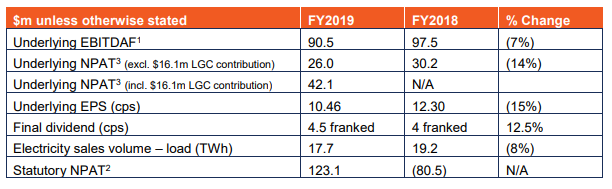

The company released its financial results for the full year ended 30 June 2019, posting contestable revenue at A$ 2,033.6 million, down 1% y-o-y, while underlying EBITDAF declined by 7% year-on-year to A$ 90.5 million. Statutory NPAT came at A$ 123.1 million in FY19 against a loss of A$ 80.5 million in FY18. Bottomline of the company includes unrealised net fair value gains of A$ 132.3 million.

(Source: Companyâs Report)

The company recorded net working capital at A$ 49.6 million in FY19, while net assets came at A$ 429 million, an increment of A$ 179.5 million (includes net derivative balances of A$ 113.1million) from the same period a year ago. Net debt decreased primarily due to favourable futures exchange variation margin movements. Total cash at hand at the end of the reported period stood at A$ 172.09 million.

Segment Performance:

Underlying EBITDAF from electricity retail and generation stood at A$ 70.7 million and A$ 41.4million, down 2% and 5% over pcp, respectively, while underlying EBITDAF from energy solutions and corporate segments stood at (A$ 3.9 million) and (A$ 17.7 million), respectively.

Electricity Retail â Under the segment, the company sold total load of 17.7 TWh during FY19 against 19.2 TWh in FY18. The segmentâs FY19 gross margin $/MWh stood at A$ 5.16/MWh vs A$ 4.9/MWh in FY18.

Generation â Oakey EBITDAF stood at $ 15.2 million, while Neerabup EBITDAF was reported at $ 27.1 million for FY19.

Energy Solutions â Revenue for the segment grew by more than 25% when compared with the same period a year ago, while EBITDAF was (A$ 3.9 million).

Dividend Announcement:

The Board has announced a final fully franked dividend of 4.5 cents per ordinary share held. It is scheduled for payment on 9 October 2019 to shareholders, with a record date of 16 September 2019. The dividend would not be covered under the companyâs dividend reinvestment plan (DRP). The ex-dividend date is 13 September 2019. Total dividend declared for FY19 came at 12 cents per share fully franked, including a 4.5 cents per share ordinary dividend and a 3 cents per share special dividend.

The board plans to declare and pay a special dividend of A$ 0.085 per share before the implementation of the scheme, provided it gets approved by ERM Power shareholders and the Court. Final decision related to the declaration and payment of the special dividend would be subject to several factors.

Financial Position:

Total current assets were valued at over A$ 800 million, including trade and other receivables at amortised cost of A$ 352.053 million, inventories at A$ 50.365 million and derivative financial instruments at A$ 188.139 million. Total non-current assets were valued at A$ 513.150 million. The major components of non-current assets were property, plant and equipment at A$ 378.878 million, intangible assets at A$ 60.330 million, derivative financial instruments of A$ 56.613 million and investments at A$ 7.343 million.

Total current liability of the company came at A$ 597.934 million followed by total non-current liabilities at A$ 286.605 million. Current liabilities include A$ 386.942 million of trade and other payables, A$ 127.854 million of borrowings, A$ 68.548 million of derivative financial instruments and A$ 10.285 million of provisions. On the non-current liabilities front, borrowings and deferred tax liabilities came at A$ 53.369 million and A$ 137.557 million, respectively. Derivative financial instruments stood at A$7 7.369 million.

Total equity at the end of 30th June 2019 came at A$ 428.960 million.

FY20 Outlook:

EPW is anticipating FY20 sales volumes in Australia Retail to be ahead of the financial year 2019, expected to reach 18.5TWh in Fy20, up from 17.7TWh in FY19. The company expects the large-scale generation certificates (LGC) strategy to help deliver further NPAT of A$ 20.7 million in FY2020. Moreover, generation earnings are likely to be in line with FY2019 for both Oakey and Neerabup.

The management expects energy solutions to be breakeven at the NPAT level in FY2020. Corporate expenses are expected to come around A$ 18 million, which increased in FY19 due to higher expensing of IT costs. The company expects capex to remain around A$ 19.5 million.

Stock Update:

The stock of EPW closed trading at a price of A$ 2.450 on 23rd August 2019. The daily volume of the stock on 23rd August was 3,683,273. It made a 52-week low of A$ 1.325 and a 52-week high of A$ 2.500. The total market capitalisation of the stock stands at A$ 613.21 million, while number of shares outstanding is 250.29 million. It has an annual dividend yield of 3.67%, while EPS is negative A$ 0.252. The performance of the stock during the last one year was impressive, as it delivered a return of ~34.99% in the last three months and ~53.57% in the last six months, while YTD return stands at 63.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.