Small-Cap Stocks

The cap in small - cap stocks denotes the market capitalisation of an entity as determined by the total market value of publicly traded shares.

Based on the current capitalisation value stocks are categorised under small medium and large-cap. Small-cap companies are those which have a market capitalisation in the range of a few hundred million dollar to two billion dollar. Market capitalisation refer to the companyâs total number of outstanding shares multiplied by current price/ share.

The companyâs market capitalisation provides its approximate valuation. The main advantage of investing in small-cap stocks is the positive potential of the company.

Small-cap stocks are more prone to volatility because of their sizes. It is very common for the small cap to fluctuate nearly 2-5 per cent on a single trading day. The investor who is ready to take more risks generally invest in small-cap stocks, as the rate of fluctuation in share prices is more as compared to the other type of stocks.

Let us discuss five small-cap stocks and their recent updates

Greenvale Energy Limited (ASX: GRV)

Greenvale Energy Limited is an energy company that concentrates on the exploitation and discovery of oil shale deposits. GRV is officially listed on Australian Securities Exchange and has one oil shale deposit being a 99.9 per cent stake in Alpha located in Queensland, Australia.

Results of Annual General Meeting

On 22 November 2019, GRV declared the results of the Annual General Meeting. Below are the resolutions which were passed during the AGM:

- Resolution 1 - The Remuneration Report;

- Resolution 2 - Re-election of Justin Dibb as a director;

- Resolution 3 - Re-election of Stephen Gemell as a director;

- Resolution 4 - Approval of 10% placement capacity;

- Resolution 5 - Approval to issue up to 30,000,000 of ordinary share capital.

Stock Performance

On 13 December 2019, the stock of GRV settled at $0.019, down by 5 per cent from its previous close. The company has ~93.36 million shares outstanding and has a market cap of $1.87 million. The stock has generated negative returns of 31.03 per cent in the last six months, while its YTD return stands negative at 9.09 per cent

Smart Marine Systems Limited (ASX: SM8)

Smart Marine Systems Limited is an Australian Marine technology company.SM8 has developed and commercialised various award-winning patented products. The companyâs portfolio includes 2 areas i.e. Clever BuoyTM and Harvest Technology.

Acquisition of Advanced Offshore Streaming

On 11 December 2019, the company is notified on the acquisition of 100 per cent stake in Advanced Offshore Streaming Pty ltd (AOS) with effect from 6 December 2019.

The shareholders gave their approval in the companyâs Annual General Meeting to issue Convertible Notes of $4 million to fund the first tranche of the acquisition, as well as provide additional working capital for ongoing development.

Also, $3.5 million as initial payment has been made to AOS shareholders. The AOS technology is already being run for numerous blue-chip consumers in the offshore environments throughout New Zealand, European and Australian regions.

To know about the various activities of the company carried out during the quarter ended 30 September 2019 click here

The companyâs Managing Director Paul Guilfoyle commented:

Stock Performance

The stock of SM8 last traded at a price of $0.053 on 12 December 2019. The company has ~310.77 million shares outstanding and a market cap of $16.47 million. The stock has generated positive returns of 104.48 per cent in the last six months, while its YTD return stands negative at 208.38 per cent.

Great Northern Minerals Limited (ASX:GNM)

Great Northern Minerals Limited is an ASX listed metal and mining company. The company has a vision for carrying out exploration work and development of lithium, cobalt and such projects to offer its investors with excellent prospects to make an investment in the crucial metals.

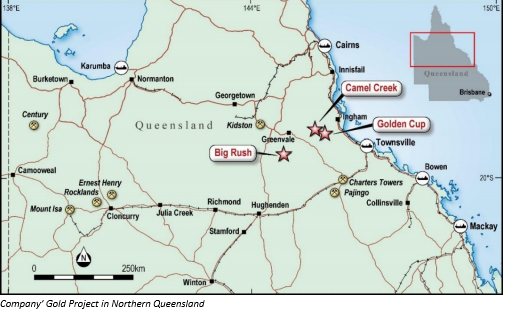

High Grade Intercept at Golden Cup

On 12 December the company updated the market with the receipt of assay results from the first two Reverse Circulation drill holes at the Companyâs Golden Cup Gold Project in Northern Queensland.

A few highlights from the announcement are as follows:

- From the Golden Cup Project Intercepts of 7m @ 7.49 g/t Au from 38m (hole GCRC074) and 9m @ 4.72 g/t Au from 35m (hole GCRC078) have been received.

- The assay results from the 6 remaining RC drill holes are expected to be received in the next 10 days.

GNM also notified that RC drilling has now been concluded at the Big Rush Project. A total of 8 holes for 1,042 m were drilled and 794 samples have been submitted for gold and multi-element evaluation.

Stock Performance

On 13 December 2019, the stock of GNM settled at $0.011, down by 8.333 per cent from its previous close. The company has ~346.94 million shares outstanding and a market cap of $4.16 million. The stock has generated negative returns of 20 per cent in the last six months, while its YTD return stands negative at 70 per cent.

Wellard Limited (ASX: WLD)

Wellard Limited is a major supplier of livestock and quality meat to all the customers across the globe. The International Agribusiness of the company connects primary producers of cattle, sheep and other livestock consumers worldwide.

Wellard inked Term Sheet to sell M/V Ocean Shearer

On 12 December 2019, the company announced that it has signed a Term Sheet to sell the MV Ocean Shearer for US$53.0 million, which would conclude the Companyâs recapitalisation program on the successful closure of the transaction.

The company expects to apply around US$42.3 million of the sale proceeds to lessen the Companyâs financial debt to US$16.7 million and US$10.7 million would be retained as cash in hand. Wellard would be able to concentrate solely on increasing earnings and profits from the WLDâs MV Ocean Drover and others.

The companyâs stakeholders are not needed to approve this transaction.

Click here to know about the full-year results of the company for the period ended 30 June 2019

Stock Performance

On 13 December 2019, the stock of WLD closed flat at $0.062. The company has ~531.25 million shares outstanding and a market cap of $32.94 million. The stock has generated positive returns of 100 per cent in the last six months, while its YTD return stands negative at 19.23 per cent

Anson Resources Limited (ASX: ASN)

Anson Resources Limited is a metals and mining company. The company owns and develops precious metal and mining assets. Anson Resources operates lithium, graphite and gold projects in the United States and Australia.

Anson Resources Produces Lithium Carbonate Bulk Sample

On 12 December 2019, the company announced that it has completed the small-scale demonstration of how to produce battery grade lithium Carbonate (Li2CO3), which was produced directly from concentrated Lithium Chloride brine via a Lithium Hydroxide Electrolysis process.

The company achieved 99.9 per cent LCE with a recovery of 85.7 per cent. The bulk sample of Lithium Carbonate is to be offered to potential off-take parties and end-users.

To know about the results of four clastic zones of the company click here

Stock Performance

On 13 December 2019, the stock of ASN settled at $0.028, down by 3.448 per cent from its previous close. The company has ~599.96 million shares outstanding and a market cap of $17.4 million. The stock has generated negative returns of 46.30 per cent in the last six months, while its YTD return stands negative at 62.34 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_20_2025_02_57_35_613912.jpg)