The recent outbreak of the deadly COVID-19 originating from China has been dominating global headlines since past few months, and its effect is also spreading to the Australian stock market.

Already, travel and leisure stocks like Sydney Airport, Crown Resorts and Flight Centre have taken a hit. Dairy and infant formula shares form a component of one such industry that has challenged the trend. On the other hand, big pharma stocks have gained this week. Now, investors are keeping an eye on the retail and dairy stocks.

Pharma Related: The Run-up for Seven Quality ASX Shares in Healthcare Space

Nutritional and essential products have undergone a sharp surge in customers demand amid the COVID-19 pandemic. One of the most significant businesses in agricultural, the dairy industry of Australia produces considerable revenue across the entire supply chain, manufacturing a variety of dairy products such as yoghurt, cheese, butter and milk powder. Furthermore, in the supply of crucial dairy products in the domestic market, Australian dairy market has been graded as the 3rd largest dairy exporter at global level, which exports 50 per cent of its production internationally.

Supermarkets in Australia have been offering a stable marketplace for the dairy industry, wherein the value development for all major dairy products has been reported. Though, the recent COVID-19 pandemic might interrupt the growth of the dairy business, which exports a substantial portion of its manufacturing to China.

COVID-19 Related: COVID-19 Treatment- Mesoblast partners with the CTSN to Conduct Human trials of Remestemcel-L

Let us acquaint you with three such dairy stocks listed on the ASX that have recently updated on the impact of coronavirus on their businesses-

The a2 Milk Company expands into the Canadian market under licence

An infant formula company The a2 Milk Company Limited (ASX:A2M) was founded in 2000 in New Zealand by Dr. Corran McLachlan and is engaged in commercialising A1 protein-free milk under the a2 and a2 MILK brands. The Company also operates in the United States, Vietnam, Korea, Singapore and China.

The a2 Milk is committed to a focused approach to pursuing its three strategic growth priorities-

- Maximise growth from its existing products in core markets;

- Expanding the product portfolio in the core markets;

- Expand in other targeted markets.

The a2 Milk Company revealed that the Company signed an exclusive licensing agreement with Agrifoods Cooperative for the manufacturing, distribution as well as marketing and sale of a2 Milk™ branded liquid milk for the Canadian market.

Moreover, the Company notified that it would offer Agrifoods with access to its intellectual property (IP) and marketing holdings along with the proprietary techniques and know to relate the sourcing and processing of a2 Milk™. Besides, the Company would combinedly work with Agrifoods and local dairy farmers of Canada for outsourcing milk in the vicinity.

Increases its investment in Synlait Milk- The a2 Milk has expanded its shareholding in Synlait Milk Limited and has acquired shares on market at a per-share price of NZD 4.95, below the Company’s average entry price for its interest in Synlait.

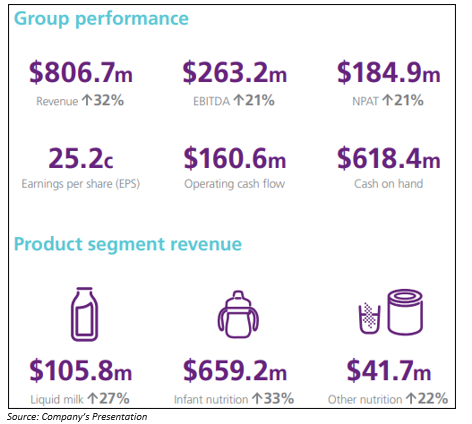

Results highlights for the half-year ended 31 December 2019

Stock Information-

On 9 April 2020, A2M stock settled the day’s trade at $16.920, up by 0.595% compared to its previous close, with a market capitalisation of nearly $12.39 billion. The A2M stock has ~736.73 million outstanding shares on ASX. The 52 weeks high and low price of the stock was reported to be $17.420 and $11.280, respectively.

Bubs Australia Limited’s Business Minimally affected by COVID-19

An ASX listed infant formula company Bubs Australia Limited (ASX:BUB) is engaged in providing a broad range of organic baby food and goat milk formula products for infants. The Company’s products are also available across various retail outlets in Australia and cross-border e-commerce platforms of China.

In the first half-year period of FY2020 (ended 31st December 2019), BUB recorded a 19% upsurge in direct sales to China as compared to pcp, and this is supported by infant formula sales which nearly doubled (improving 99%) to China over the period. The data recommend reliable traction with the consumers in China after the establishment of the new partnerships made with Alibaba Tmall and Beingmate, as well as the deployment of improved resources for marketing.

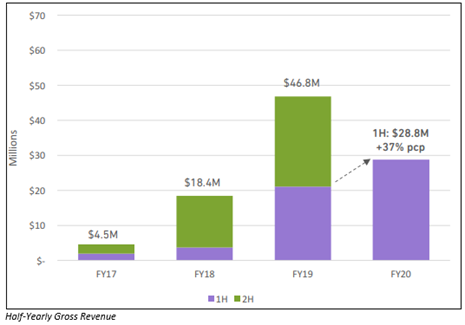

Bubs Australia is targeted towards becoming a leading specialist brand in the super-premium market of infant formula across China and Australia and has reported 37% increase in the half-year revenue for FY2020 as compared to the previous corresponding period (pcp).

The gross revenue increase in the period reveals that BUB has seen steady half-year growth craze since its listing in 2017.

The stronger forecasted requirement for infant formula is expected through all distribution networks in the second half of the fiscal year 2020. Furthermore, launch of new products is anticipated to build on current foundations to drive incremental revenue flows.

The Company considers that new distribution partnerships in Hong Kong and Vietnam for Bubs® products would contribute further growth in the second half of the fiscal year 2020 from Southeast Asian markets.

Given the Company’s vertically integrated model and existing partnerships with Australian packaging manufactures, its supply chain for raw materials has not been impacted to date. Moreover, the Company will monitor the position and advise the market should its perspective change.

Stock Information-

On 9 April 2020, BUB stock closed the day’s trade at $0.770, soared by 10.791% from its last close, with a market capitalisation of nearly $389.41 million. The BUB stock has ~560.3 million outstanding shares on ASX. The 52 weeks high and low price of the stock was reported to be $1.615 and $0.400, respectively.

Keytone Dairy Corporation Limited signs new agreement with significant opening orders

Australia and New Zealand based company Keytone Dairy Corporation Limited (ASX:KTD) is an established producer and exporter of formulated dairy products as well as products for health and wellness. The Company has its operation in the dairy products division of the FMCG industry. Keytone’s products are produced under its brands KeyHealth® and KeyDairy®, and in ranges, including nutrition powders and premium milk.

Recently, Keytone Dairy inked a manufacturing agreement with a substantial international strategic client, Iovate Health Sciences and Confirmed opening orders received of $3,600,000. Moreover, the Company mentioned the opening orders represented 143 per cent of Keytone’s total revenue for the fiscal year 2019.

Addition to this Keytone disclosed that the Company continues to secure new and repeat orders with select global health and wellness brands, hence demonstrating the quality and expertise of the operation, the deep experience of the group and the records of the in-house manufacturing capability.

Further, Keytone confirmed that the term of the contract was indeterminate and the volumes to be developed were to be confirmed on an order basis of continuing buying, that is in line with the forecasts of client for Australia and China, which is distinctive of contracts in the industry.

On 8 April 2020, Keytone revealed the receipt of confirmed purchase orders from Walmart Investment and Nouriz Fine Food Co Ltd for a combined total of $1,688,000. These combined orders of $1,688,000 represent significant follow-on orders from the Chinese Retail divisions of Walmart China and Nouriz.

Stock Information-

On 9 April 2020, KTD stock settled the day’s trade at $0.410, climbed up by 2.5% from its last close with a market capitalisation of nearly $86.05 million. The KTD stock has nearly 215.12 million outstanding shares on ASX. The 52 weeks high and low price of the stock was reported to be $0.700 and $0.195, respectively.