Highlights

- Leverage trading enables users to control larger positions with minimal capital by using margin.

- Crypto leverage trading offers amplified market exposure, with higher reward potential and elevated risk.

- Volatile markets driven by geopolitical tensions are accelerating the adoption of leveraged strategies.

- Short-term leverage is becoming a key tool for navigating macroeconomic uncertainty.

- Retail users are shifting toward high-leverage, no-KYC platforms to capitalize on tactical opportunities.

Leverage trading involves using borrowed funds to increase one’s buying power across various asset classes. This widely used strategy enables individuals to control positions larger than their capital alone would permit. To access leverage, it is only required to provide a portion of the trade’s total value as collateral, known as margin capital. This margin represents the minimum investment needed to open and maintain leveraged positions.

In recent years, leverage trading has gained popularity in the cryptocurrency market. Crypto leverage trading enables individuals to borrow capital, allowing them to take on positions far greater than their original investment. This amplified market exposure can amplify potential benefits, but it also heightens the risk of substantial losses.

How Crypto Leverage Trading Works

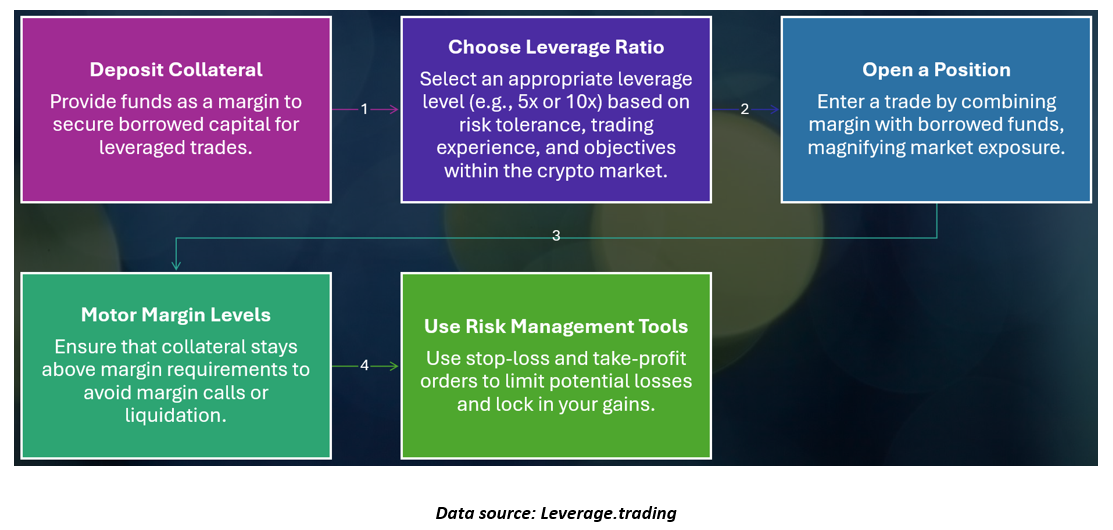

Effective crypto leverage trading involves a series of strategic steps aimed at optimising performance while effectively managing risk. Individuals must carefully consider market conditions, margin requirements, liquidation thresholds, and risk management tools such as stop-loss orders.

Individuals must carefully consider market conditions, margin requirements, liquidation thresholds, and risk management tools such as stop-loss orders.

Leverage Trading Rises amid Geopolitical Tensions

Global markets are currently experiencing heightened volatility driven by geopolitical tensions, escalating tariffs, and uncertainty surrounding future U.S. policy moves. The cryptocurrency market has experienced the effects of these changes too. In recent weeks, the cryptocurrency market has experienced sharp declines, creating both challenges, risks, and openings for market participants.

Leverage trading, when used responsibly, allows market participants to amplify positions and potentially benefit from rapid price swings. In volatile conditions, this strategy can unlock short-term possibilities, enabling skilled users to navigate both upward and downward trends more effectively, even during bearish phases.

As observed by Leverage.Trading, user activity have surged on high-leverage, no-KYC exchanges during recent geopolitical flare-ups, rising by 21% month-over-month. This behaviour signals a broader trend: retail participants are increasingly turning to crypto leverage platforms as tactical tools to hedge against macroeconomic risks and take advantage of market volatility, often sidestepping traditional exchanges.

There has been a noticeable rise in U.S. participants increasingly turning to margin trading and crypto futures platforms as a way to hedge against broader macroeconomic risks, highlights Leverage.Trading. By using short-term leverage, these individuals aim to manage volatility and protect their portfolios in an uncertain economic environment.

If the Federal Reserve continues to tighten monetary policy or new tariffs, this might further disrupt global liquidity, leveraged crypto trading volumes are expected to climb even higher as individuals look for short-cycle exposure outside conventional markets.

Staying Proactive in Uncertain Times

During periods of geopolitical instability, staying proactive is essential when navigating the crypto market. Digital assets can serve both as speculative tools and hedges against global risks. However, such instability often pushes capital toward perceived safe-haven assets, increasing crypto’ volatility.

Building a diversified portfolio and closely tracking geopolitical shifts enables more informed decisions. In a rapidly evolving environment, strategic use of leverage combined with disciplined risk management is key to navigating uncertainty in the crypto landscape.

Risk Disclosure: Trading in cryptocurrencies involves high risks, including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.