Australia is at the forefront of developing renewable projects and offering aid for Pacific Island nations to switch from high cost and environmentally unfriendly diesel to renewable energy which in turn, cast a major impact on coal industry. In the latest, S&P/ASX 200 Energy (Sector) was seen in green closing at 10,545.8 points, up 1.31% on 6 September 2019. Letâs have a look at 4 famous coal related stocks.

Yancoal Australia Limited (ASX: YAL)

Hong Kong-based energy company Yancoal Australia Limited has recently announced its interim results for the half - year ended 30 June 2019. The company reported a net profit after income tax attributable to members of $564 million, up 56% in 1H FY 19 compared to the previous corresponding period. EPS (basic) after non-recurring items stood at 42.7 cents per share whereas excluding non-recurring items declined to 26.1 cents per share.

The Groupâs financial results are largely dependent on the demand for thermal and metallurgical coal, which in turn depends on macroeconomic trends, including regional and global economic activity, and the price and availability of alternative forms of energy production. Yancoalâs customers are located throughout the Asia-Pacific region with Singapore, Japan, China, Taiwan and South Korea accounting for ~72% of its revenue from coal sales in the six months ended 30 June 2019.

On 21 August 2019, the Directors announced an unfranked dividend of $137 million (10.35 cents per share), with a record date of 6 September 2019 and payment date of 20 September 2019, which represents 24% of profit after tax consistent within the guidelines as approved at the annual general meeting.

The Groupâs overall average ex-mine selling price of coal decreased by 3% from A$128 per tonne in 1H 2018 to A$124 per tonne in 1H 2019 a decrease in global US$ coal prices beside sales being largely offset by weakening of Australian dollar against the US dollar. Saleable coal production was up 4% from 25.4Mt in 1H 2018 to 26.4Mt in 1H 2019.

Operating cash flow increased by 10% compared to 1H18, with increasing production, sales volumes and the additional ownership stake at Moolarben all contributing positively. The corporate gearing ratio improved from 34.6% in 1H 2018 to 32.5% in 1H 2019.

Outlook:

Yancoalâ s stated performance targets for 2019 remain unchanged:

- Saleable coal production of around 35 mt (attributable).

- Cash costs (excluding government royalties) to remain around A$62.50/tonne.

- Expected capital expenditure around A$285 million (attributable).

- A target dividend pay-out of 50% of net profit after tax (adjusted for the impact of foreign exchange hedge reserve movements and any other non-operating items).

Stock Performance:

YALâs stock last traded at A$2.950, slipping by 2.349 percent from the previous close on 6 September 2019, with a price to earnings multiple of 3.650 x and a market capitalisation of A$3.93 billion. Over the past 12 months, the stock price has declined 27.73% including a negative price change of 6.88% in the past three months.

To know more about the previous update on Yancoal, click here.

New Hope Corporation Limited (ASX: NHC)

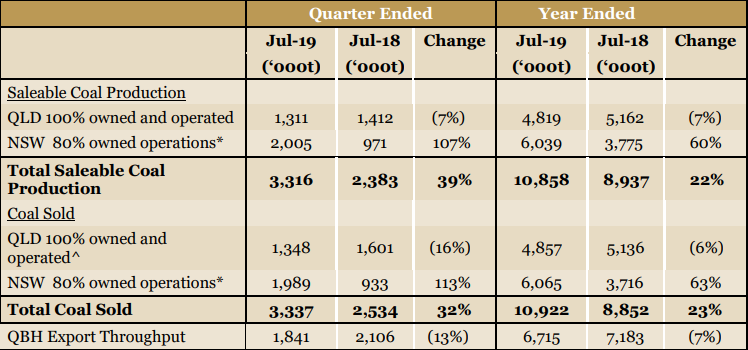

New Hope Corporation reported its quarterly results from its 100%-owned QLD operations and 80%-owned (as on 25 March 2019) NSW operations.

The company reported total saleable coal production of 3.3 million tonne for the quarter ended 31 July 2019, up 39% compared to the previous corresponding period. Total coal sales was 32% higher mainly to the increased ownership in the Bengalla mine, which led to a quarterly growth of 113% in NSW coal sales.

Snapshot of New Hopeâs Quarterly Results (Source: Company Announcement)

New Hopeâs share of coal produced at Bengalla NSW during the July quarter was 2.0 million tonne. This translates an annualised run rate of 10 mtpa. Since increasing its ownership interest in Bengalla, the Company has focused on the integration of Bengalla into the broader New Hope Group business. Integration activities have included transferring a number of support services, including HR support, commercial functions and life of mine planning to New Hopeâs corporate office.

Bengalla has commenced activities to improve utilisation of its surrounding farmland areas during the Quarter and is establishing plans to commence livestock and cropping activities in the coming months.

However, the company experienced a disappointing safety result, with 7 people experiencing a recordable injury. A refocus on hazard identification and the implementation of effective controls has reportedly occurred across all sites including a focus also on personal risk management and safe behaviours.

NHCâs stock last traded flat at $2.340, on 6 September 2019. The stock closed at the price to earnings multiple of 12.650 x with a market capitalisation of A$1.95 billion. Over the past 12 months, the stock has declined 39.69% including a negative price change of 8.95% in the past three months.

Stanmore Coal Limited (ASX: SMR)

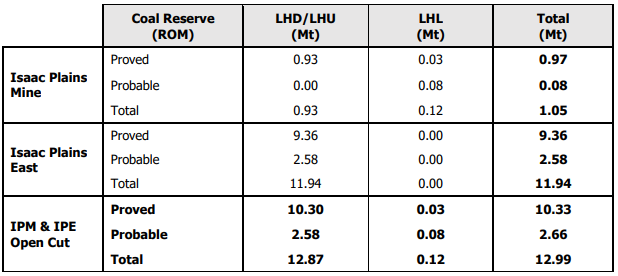

Stanmore Coal Limited recently announced that its open cut coal reserves at Isaac Plains Mine and Isaac Plains East have been updated to total 13.0 Million tonnes (Mt) as at 30 June 2019. Marketable coal reserves now stand at 9.95 million tonne of which 0.4 Mt is thermal coal and 9.6 Mt is semi-soft coking coal.

The report further read that its Isaac Plains East and Isaac Plains Mine open cut Marketable Reserve of 9.95 Mt has been derived with an estimated overall yield for IPM and IPE of 77%.

Table 1: Isaac Plains Mine and Isaac Plains East Open-Cut Coal Reserves (Source: Company Announcement)

Moreover, as announced on 12 August 2019, Stanmore has processed a deed with Winfield Energy to facilitate the conduct of due diligence with respect to the indicate offer to Winfield made to acquire the 100% share of the company.

SMR stock price last traded at A$1.405, moving down by 3.103%, on 6 September 2019. The stock closed on a price to earnings multiple of 4.010x with a market capitalisation of A$371.39 million. Over the past 12 months, the stock the surged up by 67.63% including a positive price change of 5.45% in the past three months.

Pacific American Holdings Limited (ASX: PAK)

Pacific American Holdings has recently announced its quarterly activities report in which the strategic partnership with the Singapore originated GP Hydro has been the highlight.

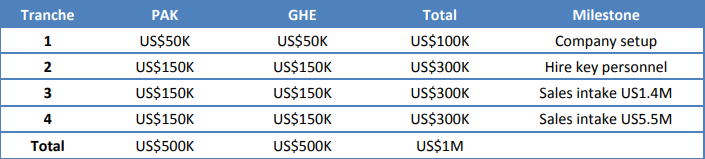

During the quarter, Pacific American Holdings finalised a joint venture agreement with international leaders in the renewable hydro generation sector, Global Hydro Energy GmbH. Based on the 50/50 JV, Pacific American Holdings (PAK) and Global Hydro Energy GmbH (GHE) have formed GP Hydro Pte Ltd, a Singapore based company with the strategic focus to develop a renewable energy business in the Pacific region including Australia.

GP Hydroâs business model will be to give PAK shareholders the opportunity to: ? Participate in an advanced but proven hydroelectric generating business, and ? Take advantage of the energy efficiencies provided by hydropower through the introduction of Global Hydro Energy GmbH products into the Australasian market. The funding structure of GP Hydro is to ensure the investment by the Company is only made when milestones are reached. The milestones are set as:

(Source: Company Announcement)

The JV partners have identified a significant opportunity within the clean energy sector across the Pacific and Australasia regions where the private and public funding of renewable energy has grown substantially over the last five years.

PAK, through its 50% owned joint venture GP Hydro, has an opportunity to develop projects with a world leader in hydro and micro hydro products.

With respect to resourcing and advancing of the Elko Coking Coal Project, the company has made the appointment of USA investment firm B. Riley FBR to advise on project fundraising to move the project forward. Also, it has conducted additional coal quality analysis of RC drill samples during the quarter and completed an independent market report to identify key target markets for indicative products types.

Matt Wall, CEO Coal stated: âThe results are encouraging as they highlight better than expected coal quality characteristics attributed to Seams 1 and 3. The findings from Commodity Insights point towards the coal from these seams being a Mid Volatile Semi Hard Coking Coal. This is encouraging in that these seams represent a large portion of the In?Situ Resources and would provide a significant improvement in long term price expectations and revenue flows if further detailed metallurgical analysis and coke oven testing from core samples validates the results.â

The company engaged the independent consultancy firm Stantec, to review all available data generated to date the of announcement, so as to provide guidance on the activities the Elko Coking Coal Project is required to undertake so as to achieve Prefeasibility status.

PAKâs stock last traded at $0.037 with a market capitalisation of $6.12 million on 4 September 2019. Over the past 12 months, the stock has declined by 21.28% with a negative price change of 9.76% in the past three months.

Also click here for further insight on the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.