Coal prices are dropping in the international market, and the industry is besieged amid environmental concerns. The coal futures (CME) prices fell significantly from the level of $78.05 (Octoberâs high) to the level of $67.05 (Marchâs low). The factor which exerted pressure on coal prices is the increased stance of various countries across the globe to put a restraint on environmental pollution in line with Euro-6 Standards.

In the recent event, China, one of the biggest consumer of coal and coal products imposed higher restrictions on coal imports across the Chinese ports. The increased global stance to curb the global pollution in exerting pressure on thermal coal majorly, while other types of coal such as coking coal, which is used for steel construction is still in sustainable demand.

Coal prices are plunging, and the miners are taking the heat; however, miners are now playing safe and focusing on high-quality coal, which is still in industrial demand from counties such as Japan and China. Apart from high quality the miners are diversifying the product portfolio and including coking coal as a significant product.

Three Coal miners on ASX:

Jameson Resources Limited (ASX: JAL)

The company is engaged in coal exploration business in Canada, and it recently presented a quarterly activity report. The highlights of the report are as:

The company is advancing on the Crown Mountain Coking Coal Project, which remains the primary focus and is the flagship program of the company.

Jameson recently received four additional coal exploration licenses in January 2019 in Elk Valley Coal Field in British Columbia. During the quarter the company collected pit coal samples and processed them in the Calgary lab, the result of the samples confirmed the findings of the past Pre-Feasibility Study, that the north pit coal is a premium hard coking coal.

The presence of a project devoted to coking coal is worth noticing as the demand for steelmaking raw material is high in the global market amid high steel production and demand in China.

The shares of the company last traded at A$0.210 (as on 1st May 2019).

Pacific American Coal Limited (ASX: PAK)

The Elko Coking Coal project of the company has been tested, and the test confirmed the presence of contained coking properties in the coal of Elko Region, which as per the company is mostly sought by the steelmaking mills in South East Asia. As per the company, the Elko enjoys an advantage of established infrastructure and is on a known coking coal mining area.

The company undertook an exploration program in 2018 and completed it recently; the exploration drilling resulted in 9 holes for a total of 3,451m.

Pacific American Coal also focuses on the coking coal majorly, and as mentioned above, the companies are focusing on product diversification and majorly on coking coal.

The shares of the company last traded at A$0.037 (as on 1st May 2019).

Aspire Mining Limited (ASX: AKM)

The company focuses on discovering and developing premium coking coal deposit in Mongolia and host a significant coal prospect at Orkhon-Selenge Coal Basin. Aspire recently presented its quarterly report for the quarter ended 31st March 2019. The highlights from the update are as:

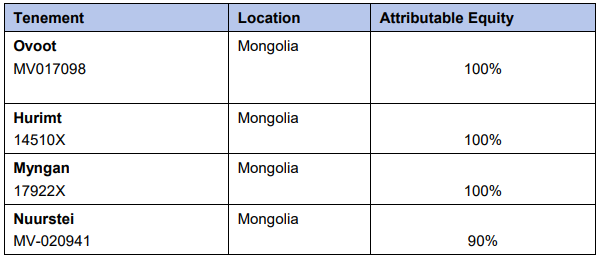

The company mentioned that it focused on the development of metallurgical coal asset in Mongolia, and it owns 100% of the world-class Ovoot Coking Coal Project.

The other tenements include:

Source: Refer companyâs announcement on 30th April 2019; Quarterly Report

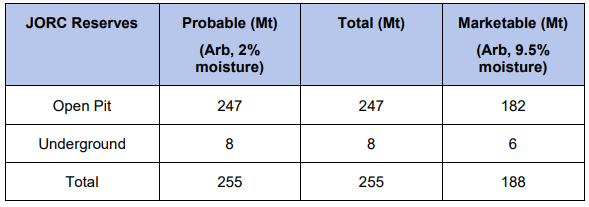

The Coal Reserves at Ovoot Coal Prospect are as:

Source: Refer companyâs announcement on 30th April 2019; Quarterly Report

The shares of the company closed at A$0.020 (as on 3rd May 2019), up 5.263% as compared to its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.