Coal being the most abundant fossil fuel is currently used in either power generation or iron and steel production. As per the World Energy Council, Australia is among the top exporters of Coal in the World. Using this as a background, letâs take a look at a few Junior Coal players trading on ASX.

Stanmore Coal Limited (ASX:SMR)

An independent Australian coal company, Stanmore Coal Limited (ASX: SMR) is primarily involved in operating Isaac Plains coking coal mine, which produces primary coking coal with some secondary thermal coal by-products.

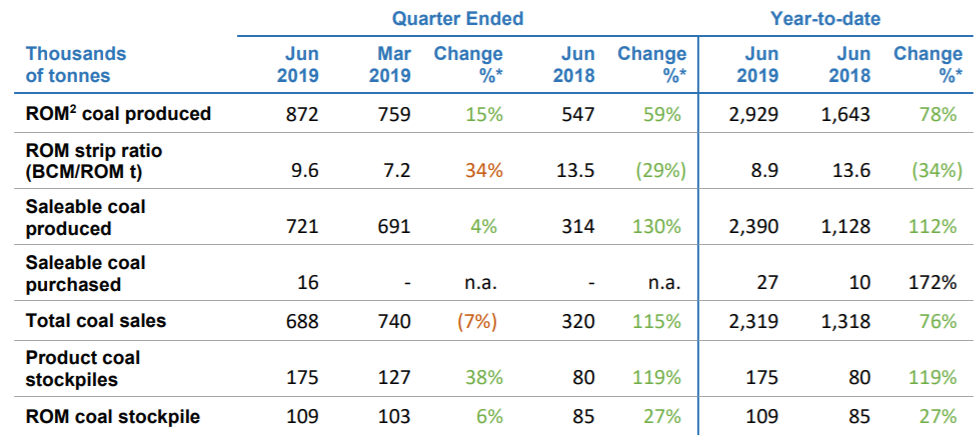

In the June quarter, the company mined a record 872kt of (run-of-mine) ROM coal and sold 688kt of coal at an average price per tonne of $174 (US$122).

Production and Sales in June Quarter (Source: Company Reports)

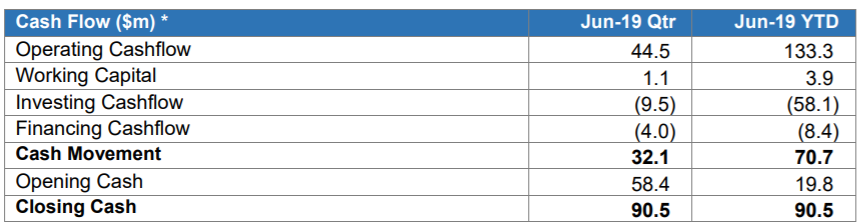

At the end of June quarter, the company has net cash of $90.5 million.

Cashflow for June Quarter (Source: Company Reports)

For FY19 (year ended 30th June 2019), the company expects its underlying EBITDA to be between $154 million and $156 million.

On 8th July 2019, the company issued a notice with regards to the change in substantial holding, stating that its substantial holders M Resources Pty Ltd and Matthew Latimore have increased their voting power from 17.76% to 19.86%.

In the month of July 2019, the company entered into binding agreements to acquire a 600-tonne excavator for the Isaac Plains East mine from Hasting Deering Limited to increase overburden removal productivity rates and reduce average unit overburden costs.

For the six months ended 31st December 2018, the company reported revenues from ordinary activities of $148.284 million, which was 79% higher than the pcp. For the half year period, the company reported a net profit of $21.278 million, which was 165% higher than pcp.

For the half-year period, the company declared an interim fully franked dividend of 3 cents per share, which was paid on 30th April 2019.

On the stock performance front, in the past six months, SMR stock has exhibited a return of 43.24% as on 25 July 2019. The stock is trading at a PE multiple of 17.390x and an annual dividend yield of 3.77%. At market close on 26 July 2019, SMRâs stock was trading at a price of $1.280 with a market capitalisation of circa $339.38 million and a daily volume of 536,712. The stock has a 52 weeks high price of $1.550 and 52 weeks low price of $0.810 with an average volume of 758,503. SMRâs stock has provided a year till date return of 29.90% to its shareholders.

Bowen Coking Coal Limited (ASX:BCB)

A Queensland-based coking coal exploration and development company, Bowen Coking Coal Limited (ASX: BCB) holds the Cooroorah, Isaac River, Hillalong and Comet Ridge Coking Coal Projects.

During the June quarter, the company commenced and completed a maiden drilling program at its wholly-owned Isaac River Coking Coal Project, which a significant milestone achieved by the company.

The drill site locations for the Isaac River 2019 exploration program can be seen in the below image.

Drill Site Locations for Isaac River 2019 Exploration Program (Source: Company Reports)

The raw coal quality results received during the quarter were extremely positive, suggesting that the Vermont Upper 2 seam and the bottom section from the Leichhardt seam may be able to produce high-quality coking coal.

For its Cooroorah Coking Coal Project, the company further updated the Mineral Resource estimate during the June quarter. Now, the total Mineral Resource estimate is projected at 177 million tonnes, including 96 million tonnes of Indicated Resource and 81 million tonnes of Inferred Resource.

During the quarter, the company appointed a well-versed Mr Michael McKee as the new Chief Operating Officer of the company, which was a significant addition to the Board. The company also appointed Brisbane-based highly experienced Chartered Accountant, Duncan Cornish as Chief Financial Officer and Company Secretary.

In the June quarter, the company spent $765k on the exploration and evaluation activities, $154k on staff costs and $160k on administration and corporate costs. The total net cash used for operating activities for the June quarter was $1,065k. During the quarter, the company received $110k as proceeds from the exercise of share options. At the end of the June quarter, the company had cash and cash equivalents of $2,043k.

In the September quarter, the company expects to spend around $671K on the exploration and evaluation, $204k on staff costs and $147k on administration and corporate costs.

On the stock performance front, in the past six months, BCBâs stock has exhibited a return of 95.00% as on 25 July 2019. At market close on 26 July 2019, BCBâs stock was trading at a price of $0.041 with a market capitalisation of circa $27.63 million and a daily volume of ~1,084,209. The stock has a 52 weeks high price of $0.059 and 52 weeks low price of $0.013 with an average volume of 2,275,056. In the past one year, SMRâs stock has provided a return of 116.67% to its shareholders.

Allegiance Coal Limited (ASX: AHQ)

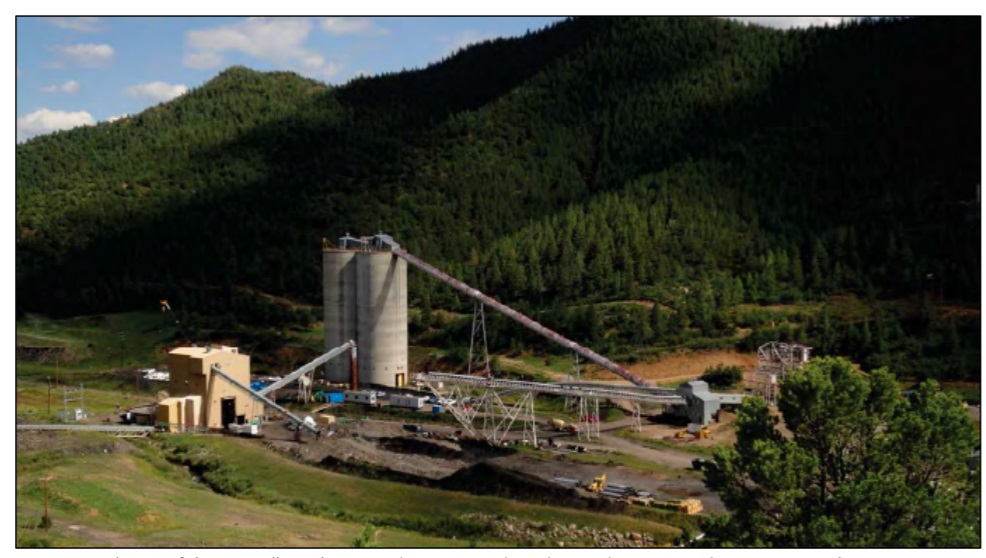

Australian coal miner, Allegiance Coal Limited (ASX:AHQ) entered into a binding and conditional terms sheet (Terms Sheet) to acquire all the shares in New Elk Coal Company, an owner of New Elk Coal hard coking coal mine, which according to the US Geological Survey Paper 1625-A, has an estimated 15 billion metric tonnes of coal.

Aerial View of the New Elk Coal Mine (Source: Company Reports)

The company is now going to undertake legal due diligence to ensure the permits for the mine and title to the coal are in good standing and in addition, the company will undertake financial due diligence to ensure NECC has no liabilities other than the debt. The company is also going to undertake an independent feasibility study to declare coal reserves under JORC 2012 as well as to develop a mine plan to bring the Mine back into production.

In order to fulfil the Terms Sheet conditions, Allegiance will perform the following activities:

- Undertake legal and financial due diligence by 14th September 2019;

- Review the geological model to the Mine by 14th October 2019;

- Undertake a feasibility study to develop a mine plan for production by 14th April 2020;

- Raise US$3 million to meet the cash payment part of debt reduction by 14th June 2020;

- Raise US$5 million to replace the Colorado State Mine reclamation bond by 14th June 2020;

- Raise sufficient working capital to bring the mine back into production by 14th June 2020;

- Obtain shareholder approval to the purchase by 14th June 2020;

- Enter into transaction documentation with Cline by 14th June 2020; and

- Completion shall be no later than 14th July 2020.

The company recently announced the appointment of an industry veteran, Larry Cook for the position of Director. Mr Cook has a degree in Mine Engineering from West Virginia University and is highly regarded as an extremely capable underground coal mining engineer. He held various senior level roles in big organisations like Mistic Energy Inc. and Eastern Associated Coal Corporation.

The company has also appointed, Mr Amon Mahon, a coal mining engineer with 36 years of experience and Mr Bernie Mason, a geologist with 40 years of experience in the coal exploration, mine development and production as a Joint Project Manager to the acquisition and recommissioning of the New Elk Coal Mine.

On the stock performance front, in the past six months, AHQâs stock has exhibited a return of 169.23% as on 25 July 2019. At market close on 26 July 2019, AHQâs stock was trading at a price of $0.130 with a market capitalisation of circa $76.4 million and a daily volume of ~1,224,805. The stock has a 52 weeks high price of $0.150 and 52 weeks low price of $0.038 with an average volume of ~459,518. In the past one year, AHQâs stock has provided a return of 141.38% to its shareholders.

NuCoal Resources Limited (ASX:NCR)

NuCoal Resources Limited (ASX: NCR) via its wholly-owned subsidiary, Dellworth Pty Ltd, holds exploration licence EL 6812, which is near to the mining operations owned and operated by Glencore, Coal & Allied and Anglo Coal.

In the year 2018, the company acquired Exploration Licence 7270 (EL 7270), however, later in 2014, the NSW Government cancelled the licence. On 21st June 2019, the company advised its shareholders that the Legislative Council Standing Committee on Law and Justice has opened up a submission process with respect to the Mining Amendment (Compensation for Cancellation of Exploration Licence) Bill 2019 (the Bill) introduced into the NSW Upper House by member Rev Fred Nile on 6th June 2019. The company has informed that it will be lodging a detailed submission on behalf of the shareholders. As at 31st March 2019, the company had cash and deposits of $3.83 million.

On the stock performance front, in the past six months, NCRâs stock has exhibited a return of 100.00% as on 25 July 2019. At market close on 26 July 2019, NCRâs stock was trading at a price of $0.020 with a market capitalisation of circa $15.37 million and a daily volume of ~416. The stock has a 52 weeks high price of $0.033 and 52 weeks low price of $0.008 with an average volume of ~ 603,204. In the past one year, NCRâs stock has provided a return of 66.67% to its shareholders.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.