Despite being one of the best healthcare systems in the world, Australiaâs Healthcare sector has been victim to a number of challenges including rising chronic diseases, increasing demand of new treatments, more hospital beds and the ageing population. These challenges call for adoption of new technologies and platforms to offer best experience for customers.

Let us now have a look at few ASX-listed companies operating in the healthcare sector.

Healius Limited

Healius Limited (ASX: HLS) is primarily engaged in providing healthcare services through its Medical Centres. The company also owns a pathology division.

Change in Directorâs Interest: The company recently updated that one of its directors, Robert Hubbard has acquired 25,000 shares for a consideration of $3.086 per share.

Appointment of Company Secretary: In another recent announcement, HLS notified about the appointment of Alison Stephenson as the additional Company Secretary while Charles Tilley would continue serving as the Company Secretary on the Board.

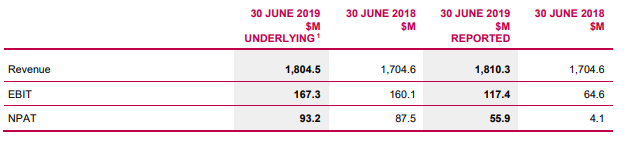

FY19 Results: During the year ended 30 June 2019, HLS generated underlying revenue amounting to $1,804.5 million, as compared to $1,704.6 million in pcp. Underlying EBIT for the period was reported at $167.3 million, as compared to $160.1 million in pcp. Underlying NPAT for the period also increased in comparison to pcp, with FY18 NPAT at $87.5 million and FY19 NPAT at $93.2 million.

FY19 Financials (Source: Company Reports)

The company witnessed positive momentum in all the three divisions- Imaging Centres, Medical Centres and Pathology. The period was marked by double-digit growth across the Imaging and Medical Centres. The Pathology divisionâs performance was strong in the second half after a subdued first half. Growth from the segment was reported at 46%.

Divisional Results: Pathology being the largest division of the company, reported revenue amounting to $1,128.3 million, up 3.5% compared to pcp. The divisionâs EBIT improved in the second half of the year owing to delivery of productivity programs and resumption of volume growth towards the end of the second half. Overall EBIT for the division was reported at $111.1 million. The positive momentum continued into FY20 with June and July volume trend reverting to long-term averages.

Medical Centres division reported revenue amounting to $327.4 million owing to acquisition of Montserrat and increased the Health & Co. revenue. EBIT for the division stood at $37.6 million, improving 19.0% on prior corresponding period.

Emerging Businesses: Dental revenue stood at $35.2 million, up 4.8% on pcp and EBIT increased to $5.7 million. Three new day hospital facilities were opened under Montserrat, providing the company with a substantial platform for growth and diversification. Revenue for Montserrat was reported at $19.5 million with EBIT contribution of $0.6 million.

Imaging Centres division reported revenue amounting to $391.3 million, up 7.9% on FY18. Market share of imaging increase during the year with growth from existing and new sites contributing to increase in revenue. The growth in revenue was also a factor of continued strength in MRI. EBIT for the division stood at $38.7 million, up 14.5% on prior corresponding year, leading to double-digit growth for the third successive year.

Outlook: The company expects underlying NPAT for FY20 to be higher than FY19. The company sees strong underlying demand in Australia owing to expanding per capita income, rising patient expectations, increase number of people with chronic illness and the ageing population.

The stock of the company quoted A$3.040, down by 0.97% on 23 August 2019 after close of trading hours on ASX.

Nanosonics Limited

Nanosonics Limited (ASX: NAN) is a manufacturer of the trophon® EPR ultrasound probe disinfector.

Board Changes: The company recently appointed Geoff Wilson as a Non-executive director on the Board. He was also appointed as Chairman of the Audit and Risk Committee on the retirement of the previous Chairman, Richard England. Geoff holds an extensive experience of 37 years in finance, audit and risk management.

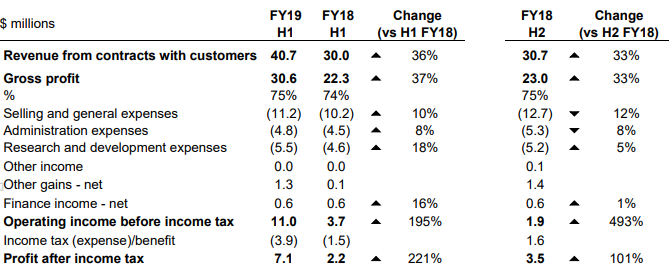

1HFY19 Highlights: During the first half ended 31 December 2018, the company reported sales amounting to $40.7 million, up 36% on pcp and 33% on the prior half. Operating PBT was reported at $11.0 million, up 195% on pcp. The period was marked by successful launch of trophon®2 in Europe, Australia and North America. NAN reported capital sales of $16.4 million, up 11% on pcp. The company expanded its distribution agreement with GE Healthcare to cover a Finland, Spain, Portugal and Denmark.

1HFY19 Financial Results (Source: Company Reports)

Revenue from consumables and service was reported at $24.3 million, up 59% in comparison to pcp. Operating expenses for the first half were reported at $21.5 million, that included research and development expenditure of $5.5 million, up 18% on pcp. At the end of the period, the company had a cash balance of $71.3 million, representing a strong balance sheet position to support the companyâs long-term growth strategy.

FY19 Guidance: Operating expenses for FY19 are expected to be approximately $50 million, including $12 million spent on research and development. Majority of the R&D expenditure during the year would pertain to new product development. Beyond FY19, the company aims to further expand into new markets. Through continued investment in R&D, it is continuously engaged in building a pipeline of new potential product opportunities.

As on 23 August 2019, NANâs stock generated returns of 38.02% over a period of 6 months and quoted A$4.920, down 1.76%.

Summerset Group Holdings Limited

Summerset Group Holdings Limited (ASX: SNZ) operates a retirement village in NZ.

Change of Company Secretary: The company recently appointed Robyn Heyman as Head of Legal and Company Secretary, in place of Deputy CFO and Company Secretary, Leanne Walker.

Dividend: The company notified that it will be paying dividend amounting to NZD 0.064 per ordinary share on 09 September 2019 to its shareholders.

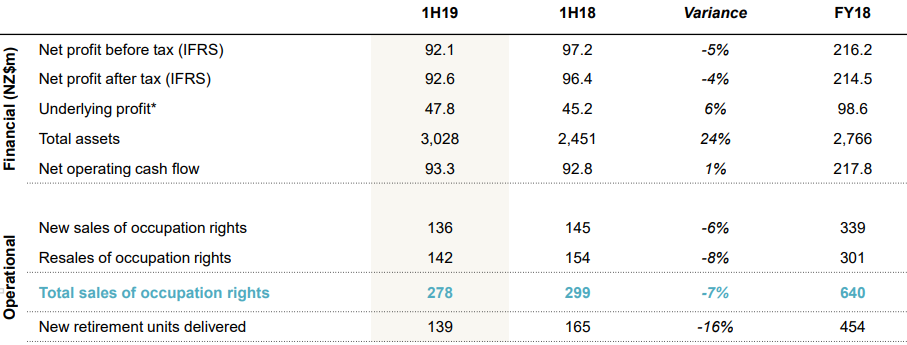

1HFY19 Results: During the first half ended 30 June 2019, the company reported underlying profit amounting to NZ$47.8 million, up 6% on pcp. Reported PAT for the period amounted to NZ$92.6 million, down 4% on pcp. Total assets for the period stood at NZ$3.0 million, up 24% in comparison to pcp. The company also declared an interim dividend amounting to NZ 6.4 cps.

1HFY19 Results (Source: Company Reports)

During the start of the year, the company purchased six new sites in Waikanae, Milldale, Whangarei, Cambridge, Blenheim and Rangiora, increasing its land bank to around 5,000 retirement units. The company delivered 139 new homes in the first half and expects to deliver a total of 350 homes by the end of the year. In FY20 first half, the company expects to establish 150 retirement units in the main buildings at Rototuna and Casebrook.

SNZ reported a development margin of 28.4% for the period, down from 33% on pcp. Over the medium to long term, the company expects the development margins to be in the range of 20% - 25%.

Post close of the market on 23 August 2019, the SNZ stock generated returns of 3.66% and 6.38% over a period of 1 month and 3 months, respectively. The stock traded flat at A$5.670, with a market cap of A$1.28 billion.

Pro Medicus Limited

Pro Medicus Limited (ASX: PME) is engaged in supply of healthcare imaging software and services to hospitals and other health related entities.

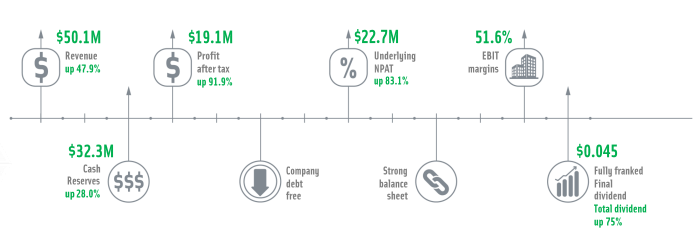

FY19 Performance: During the year ended 30 June 2019, the company generated revenue amounting to $50.1 million, up 47.9% on pcp. PAT was reported at $19.1 million, up 91.9% on pcp. The underlying PAT stood at $22.7 million, soared by 83.1% on pcp. The cash reserves of the company went up by 28% to $32.3 million. EBIT margins during the period increased to 51.6%. PME declared a fully franked dividend of 4.5 cps, taking the total dividend for FY19 up by 75% on FY18.

FY19 Key Metrics (Source: Company Presentation)

The period was marked by revenue growth in all the jurisdictions. North America reported a rise of 42.2% in revenue. Revenue in Europe increased by 102.3% and that in Australia witnessed a rise of 30.2%.

Contract Wins: During the period, the company announced three contract wins. In April 2019, the company signed a 7-year contract with Duke Health for a total value of $14 million. Under the contract, PMEâs systems were established across three hospitals and numerous additional locations. In November 2018, the company signed a 7-year contract with Partners Healthcare for Brigham and Womenâs Hospitals & Massachusetts General Hospital. The contract with Partners Healthcare was valued at $27.0 million. In December 2018, an extension to this contract was undertaken with a German Govt. hospital network, which was valued at $3 million.

The stock of the company generated returns of 113.15% over a period of 6 months, after the close of business hours on ASX on 23 August 2019, quoting A$30.090, down 1.60% relative to its last trade.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.