Introduction of information technology into the healthcare industry has helped medical practitioners to diagnose and detect diseases promptly and accurately. Nowadays, technology has a significant impact in each industry. In the healthcare sector, technology is playing a pivotal role in saving peopleâs lives by detecting early symptoms of several chronic diseases. Implementation of Artificial Intelligence (AI) in medical equipment departments has given positive results. Moreover, advancement of technology has reduced human errors in detecting diseases.

Let us have a look at four stocks operating in the healthcare sector and listed on the Australian Stock Exchange.

Sonic Healthcare Limited

Sonic Healthcare Limited (ASX: SHL) is an Australia based (headquartered in Sydney) healthcare company, with presence across eight countries. The company provides specialised medical diagnostic services to clinicians, hospitals, medical centres and patients. SHL operates primarily in three segments viz. i) Laboratory ii) Imaging and iii) Others (includes clinical services and clinical trials).

Geographically, apart from Australia, SHL has sheer presence in the United States, Germany, United Kingdom, Switzerland, Belgium, Ireland and New Zealand. The company employs a staff of more than 36,000 people including pathologists, radiologists, medical scientists and technicians. Annually, the company serves more than 100 million people. The company got listed on the ASX in 1987.

Exiting from GLP Systems:

As per a market report on 27th June 2019, Sonic Healthcare Limited sold its entire stake of 85% in GLP Systems GmbH (headquartered in Hamburg, Germany) to Abbott (headquartered in the US). Owing to the stake divestment, the company would make a profit of around $ 48 million (after tax). During FY19, GLP generated a total revenue of $ 23 million.

GLP has developed a lab automated technology, which is extensively used by Sonic across its primary centres in the UK, Germany and Australia. GLPâs products are classified under the IVD equipment market and hence, varied from the core business of Sonic. Sonic would receive nearly $ 130 million from Abbot (buyer of GLP), comprising âproceeds from saleâ and âshareholders loan repaymentâ. The long-term relationship with GLP would continue, as Sonic will remain as a client of the former.

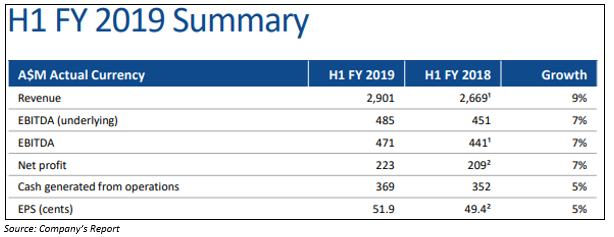

During H1 FY19, Sonic reported a revenue of $ 2.9 billion (up ~9% on a y-o-y basis) with a net profit of $ 223 million (up ~7% on y-o-y basis). As per the guidance provided by SHL, EBITDA would grow by 6-8% on constant currency terms. Earlier, in January 2019, Sonic completed the acquisition of 100% ownership in Aurora Diagnostics.

Stock Performance:

With a market cap of $ 13.07 billion and approximately 473.96 million outstanding shares, the SHL stock closed the dayâs trading at a price of $ 27.770 on 8 August 2019, up 0.725% from its previous closing price. It has given a return of 4.62% and 16.43% in the past three months and six months, respectively, while its annual dividend yield stands at 2.97%.

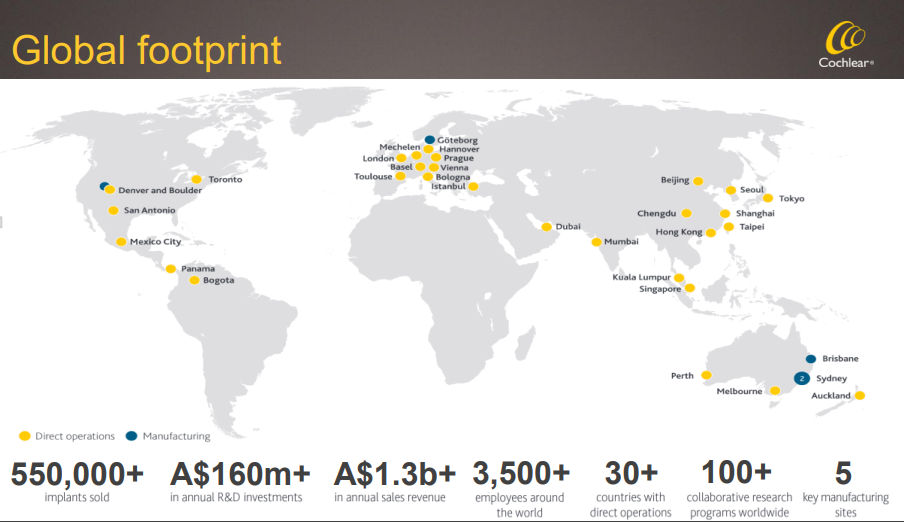

Cochlear Limited (ASX:COH) provides hearing implant services to hearing loss patients through products like Cochlear implants, bone conduction implants and middle-ear implants. Nowadays, hearing loss has emerged as one of the major disabilities among global population, with more than 466 million people suffering from this disability, globally, according to the WHO. COHâs headquarters is situated in New South Wales, Australia. The company got listed on the Australian Stock Exchange in 1995. Globally, products of Cochlear are sold across 100 countries along with direct presence in more than 30 countries.

Source: Companyâs Report

FDA Approval for Nucleus® ProfileTM Plus Series implant:

COH updated the market on 17th June 2019 regarding FDA approval for its Nucleus® ProfileTM Plus Series implant. As a result, the company would start an immediate roll out of the product in the United States. Earlier on 16th April 2019, the company had unveiled the launch of this product in Germany, with plans for further roll outs in other countries in the European region in the coming months.

Earlier, on 8th March 2019, the company announced that the National Institute for Health and Care Excellence (NICE), England, recognised COHâs recommendation of setting criteria for cochlear implants. The threshold eligibility for hearing implants has been reduced from 90dBHL to 80dB HL (equal or greater) for children and adults with hearing loss (severe or profound). The United Kingdom falls among the top 5 markets for COH and the above recognition is expected to leave a positive impact for the company.

Stock Performance:

On 8 August 2019, the share price of COH closed the dayâs trading at $ 209.970 with a P/E ratio of 46.37x. it has a market cap of $ 12.25 billion and approximately 57.72 million outstanding shares. The stock has given a return of 11.12% and 7.44% in the last three months and six months, respectively.

Nanosonics Limited

Nanosonics Limited (ASX: NAN) is engaged in R&D, manufacturing and marketing of trophon®, a device used for ensuring high level of safety to the patient by minimising the chances of infection. The EPR high level disinfection device is widely used across major hospitals in the United States and Europe. The product provides high level of disinfection (HLD) by the application of ultrasound probe disinfection practices. The company, which has its headquarters in Lane Cove, Australia, has a strategic collaboration with GE Healthcare for marketing trophon® across countries like Denmark, Finland, Spain and Portugal.

trophon® (Source: Company Report)

Appointment of Non-Executive Director:

On 17th July 2019, Nanosonics Limited unveiled to have appointed Geoff Wilson as a Non-Executive Director of Nanosonics. He would be entrusted for the position of Chair of the Audit and Risk Committee as current Chair of the Audit and Risk Committee, Richard England, would retire from the Board. Mr Geoff has wide experience starting from local and international executive leadership to director. He was associated with KPMG in Australia, Hong Kong and the United States. As per his qualification is concerned, Mr Geoff holds a Bachelor of Commerce from UNSW, as well as is a fellow of Chartered Accountants Australia and New Zealand.

Retirement of Non-Executive Director:

On 30th May 2019, the board confirmed the retirement of Non-Executive Director, Mr Richard England, after he shared his thoughts of not to stand for re-election at the 2019 Annual General Meeting. He served the company for nine years as a Non-Executive Director, Chair of the Audit and Risk Committee, Chair and member of the Remuneration Committee and a member of the Nomination Committee.

Stock Performance:

With a market cap of $ 1.5 billion and approximately 299.97 million outstanding shares, the NAN stock closed the dayâs trading at a price of $ 5.120 on 8 August 2019, up 2.195% from its previous closing price. It has given a return of 6.37% and 46.06% in the past three months and six months, respectively.

Pro Medicus Limited

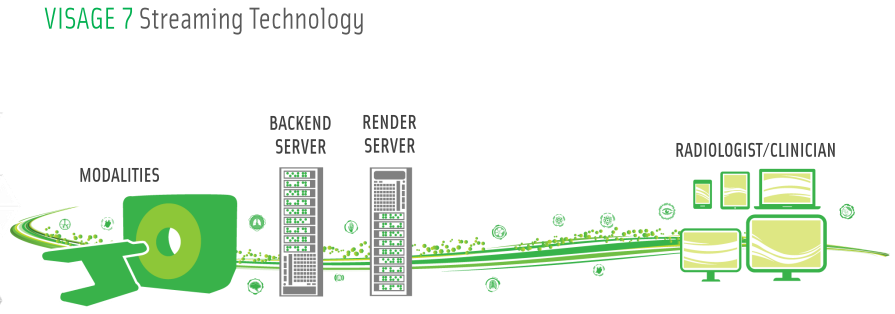

Pro Medicus Limited (ASX: PME) is engaged in providing software and IT solutions to healthcare providers. PME serves hospitals, imaging centres and healthcare groups across the globe by offering radiology IT software and services. In the first month of the year 2009, the company made an announcement regarding the acquisition of Visage Imaging. Visage is engaged in providing high-end imaging solutions to numerous clients across the world. Visage 7 is best known technology for delivering fast, multi-dimensional images streamed through an AI thin-client viewer. The company commenced its business in 1983 and is based out of Australia with its headquarters in Richmond.

Inclusion in S&P/ASX 200 Index:

On 31st July, S&P Dow Jones Indices announced that Pro Medicus Limited would be included in S&P/ASX 200, effective from 7 August 2019. The above scrip replaced DuluxGroup Limited (ASX:DLX) due to pending approval from the court regarding its acquisition by Nippon Paint Holdings Co Ltd.

PME Collaborates with Duke Health for 7 years:

On 24th April, PME collaborated with Duke Health, the biggest health system in the US state of North Carolina and best rated health care service providers in North America. The seven-year contract is for the implementation of the Visage 7 technology across the radiology departments of the North Carolina-based health system. The technology would also get integrated with the EHR of Duke Health.

Source: Companyâs Report

The management has clarified that the project would be implemented in 3 hospitals and twelve additional locations across Duke Health, including its flagship Duke University Hospital which has 957 beds. As per the management, the above deal would strengthen the companyâs product presence within the industry.

Stock Performance:

With a market cap of $ 2.69 billion and approximately 103.62 million outstanding shares, the PME stock closed the dayâs trading at a price of $ 27.260 on 8 August 2019, up 4.886% from its previous closing price. It has given a return of 25.72% and 97.81% in the past three months and six months, respectively. The stock has an annual dividend yield of 0.27%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.