Xero Limited (ASX: XRO)

Born in the cloud, Xero Limited has stamped its name among the top performers of 2019 with the stock surging up 43.05% over the last six months. The investorsâ attention seems to set the theme right in the middle of the companyâs outstanding growth in delivering the easy-to-use platform for small businesses and their advisors.

Xero achieved 36% improvement in its operating revenue to $552.8 million that resulted in Annualised Monthly Recurring Revenue (AMRR) of $638.2 million, up 32%, for the fiscal year ended 31 March 2019. Its total subscribers increased by 31% to 1.818 million, which outlines the record performance of UK region and international net subscriber additions (239,000) exceeding those from ANZ (193,000).

The companyâs positive free cash flow stood at $6.5 million for the first time, equating to 1.2% of operating revenue of FY2019. Going forward, Xero plans to reinvest the cash generated to drive long-term shareholder value, wherein free cash flow in the Fiscal Year 2020 is expected to be a similar proportion of total operating revenue to that reported this year.

The strong progress in the companyâs fundaments led the increase of 42.88% in XROâs year-to-date return with an attractive upside of 24.31% recorded over the past three months. In a day trading session, XRO stock price has edged up by 3.103% to trade at $61.800 on 1 July 2019 (2:20 PM AEST). XRO closed at $61.220 on 1 July 2019.

Also Read: Xero Announces Initiatives That Will Enhance Its Accounting Partnerâs Efficiency In The UK

Nearmap Ltd (ASX: NEA)

Nearmap Ltd is a location data company that provides the high-resolution aerial imagery covering the majority of Australia, the United States and New Zealand region. The stock has witnessed a 146.25% growth in the past six months with as much as 228.70% improvement over the last one year.

On business front, the company reported 42% growth in its annualised contract value to $78.3 million with the continued record US growth and a strengthening market leadership in Australia during the 12 months ended 31 December 2018. Nearmap has launched a range of new product features that have been driving the companyâs capture systems to fly higher and faster.

Source: Company Presentation

Source: Company Presentation

Its ongoing program for sales and marketing enhancement coupled with the launch of 3D content visualisation through MapBrowser seems to drive the bright future of the company. This keeps Nearmap stay committed to scale for a global opportunity and become the worldâs leading provider of subscription-based location intelligence with the unique technology and business model.

NEA stock price rose 1.455% to trade at $3.855 on 1 July 2019 (AEST 3:36 PM AEST). The stock has mounted 5643.28% since its listing in December 2000 on the Australian Securities Exchange (ASX). NEA closed at $3.820 on 1 July 2019.

Also Read: A look at upward momentum of Nearmap

Afterpay Touch Group (ASX: APT)

Financial technology company, Afterpay Touch Group is one of the most talked about stock among investors for its ground-breaking payment platform that allows seamless transactions to customers. Over the period of one year, the stock price has soared 191.85% with year-to-date return of 108.92%.

Recently, the company raised $317.2 million through an institutional placement which got oversubscribed at the top end of the placement price range, i.e. $23.00 per share. The support outlines the investorsâ confidence in Afterpayâs global growth strategy, which remains the key highlight of the companyâs mid-term plan.

APT gained more attraction when co-founders Anthony Eisen and Nick Molnar confirmed their intention to sell no further shares during FY2020. The bossesâ cited this decision based on their belief in the potential of Afterpay Touch, an Australian listed global technology company, on delivering a trusted and valuable customer-centric services to a world-wide audience.

The stock last traded at $24.340 on 1 July 2019 with a market capitalisation of $6.33 billion. The stock has gained 106.51% in the past six months, reflecting an upside of 22.77% in the past three months.

Also Read: Afterpay Touch Group Updates on AUSTRAC And Its AML/CTF Program

Fortescue Metals Group Ltd (ASX: FMG)

Fortescue Metals Group started the month in green trading near to its 52-week high of $9.190. The stock settled the day session at 1.552% gains to close at $9.160 on 1 July 2019 with a price to earnings multiple of 22.810x and a market capitalisation of $27.77 billion.

The group is recognised for its production and supply of high-quality iron ore with mine sites located within the Pilbara region. Fortescue recently announced the completion of its fleet of towage and tugs infrastructure at its Heb Elliott Port in Port Hedland; this new facility has been named Judith Street Harbour. It outlines the companyâs target to build the worldâs most advanced vertically integrated fleet system to deliver bulk in addition to its core metallurgical, exploration and mining operations.

Founder and Chairman Andrew Forrest stated that Port of Port Hedland is the worldâs largest bulk export port that marks the Australiaâs economic and industrial gateway to Asia. He added that Boardâs decision to build and the subsequent completion of the Fortescueâs own fleet of ore carriers and self-operated towage capability underscores the final step in its initial journey.

Over the past 12 months, the stock has increased 119.01% with year-to-date return of 136.95% and an upside of 137.53% over the past six months.

Nanosonics Limited (ASX: NAN)

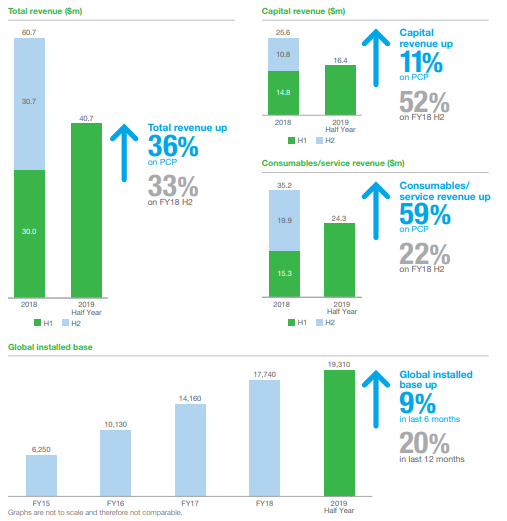

Nanosonics Limited, an ASX listed infection control company, delivered a record first half sales of $40.7 million, up 36%, on previous corresponding period. The success outlines the launch of companyâs flagship product trophon®2 in North America, Australia and Europe during the year ended 31 December 2018.

NAN 2019 Half Year Highlights (Source: Company Presentation)

The company also extended its distribution agreement with GE Healthcare with the objective to expand its geographic footprints in Denmark, Finland, Spain and Portugal. This comes in addition to Nanosonics existing agreement with GE for Sweden and Norway. Moreover, the company has planned to transform its USA distribution agreement with GE into a Capital Reseller model that can reportedly result in material increase during FY20 in both margin from consumables and sales in North America.

NAN stock price has increased by 78.41% over the past 12 months including a positive price change of 30.39% in the past three months. The market capitalisation of the company stands at $1.69 billion with shares outstanding 299.97 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.