About the Company:

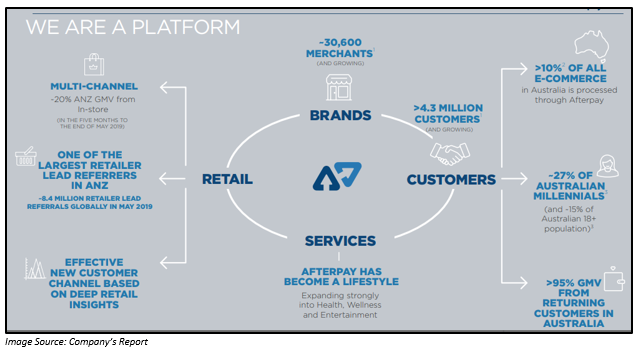

Afterpay Touch Group Limited (ASX:APT) is a technology-driven payments company from the information technology sector which aims to make the purchasing experience of its global customer great. The company allows leading retailers to offer their customer with the service of âbuy now, receive now, pay laterâ. Thus, the end customers are not required to enter any loan or make an upfront fee or interest to the company. The company has over four million active customers and upwards of 30,000 active retail merchants are on its platform.

Recent update/s:

On 13 June 2019, the company provided an update related to the important developments with respect to AUSTRAC as well as its Anti-Money Laundering/Counter Terrorism Financing (AML/CTF) program.

About Anti-Money Laundering and Counter Terrorism Financing:

Anti-Money Laundering is the set of rules and regulations that are set in order to prevent criminals from hiding the funds obtained from the illegal sources as genuine income.

Counter Terrorism Financing: Under Counter Terrorism Financing, the financial institution fulfils strict requirements with respect to monitoring the transaction of the customers, their behavior. The institutions are also expected to conduct proper due diligence of its customers.

On 12 June 2019, Afterpay Pty Limited, the subsidiary company of Afterpay Touch Group Limited, received a notice from AUSTRAC (Australian Transaction Reports and Analysis Centre) during the evening that it needs to appoint an external auditor who would be authorized by AUSTRAC for carrying out an audit in respect of its Anti-Money Laundering/ Counter-Terrorism Financing (AML/CTF) compliance.

The notice issued by AUSTRAC to Afterpay Pty Limited is as per section 162(2) of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth). Under this act, the external auditor would be focusing on key areas on over the period from 19/1/ 2015 to date in preparing the audit report. The notice also provides a guideline on timeframe within which the audit process is to be concluded. The completed version of the audit report is expected to be provided to the regulator â AUSTRAC within 120 days upon the appointment of the external auditor.

The company was engaged with AUSTRAC regarding its AML/CTF compliance for a number of months along with this recent engagement. The company stated that it would continue to work closely and in a constructive manner with AUSTRAC to ensure that the AML/CTF compliance of the company is strong.

Further the company stated that it is firm on meeting the expectations of its retail partners and customers. Since inception the company has gained the trust of millions of customers to transact on its platform.

Also, the company stated that the âBuy Now Pay Laterâ segment is catching the attention of not only the customers but regulators as well. The company would be working with the regulator to formulate a leading compliance scheme that would be specific to APTâs business. Other than this, the company has taken measures to put a check on money laundering as well as terrorism financing risk. Other than this, the model also has a maximum per transaction limit of $1,500.

Multiple steps have already been taken by the company to reinforce its Anti-Money Laundering/ Counter-Terrorism Financing framework, which includes the focus areas as mentioned in the notice.

The notice provided by AUSTRAC to Afterpay, includes:

- Within a period of 14 days, Afterpay needs to identify three or more individuals which it considers appropriate to be authorized as external auditors.

- Afterpay must have each of the Nominated Individuals complete or provide documents in support of their application to be authorized as an external auditor. These documents include Completed âCapability statementâ along with signed statutory declaration along with the resume of the nominated individual which will provide a summary of the employment and education history and any other information of the nominated individual.

- The capability statement and along with the resume of the nominated candidate must be sent by email.

Afterpay would continue to invest in the enhancement of the AML/CTF compliance.

On 12 June 2019, the company also released an announcement where it provided an update related to its capital raising. The company has raised $317.2 million through fully underwritten institutional placement. The placement received strong support from the existing as well as new shareholders. A total of 13.8 million ordinary shares were placed at $23 per share. Shareholder approval is not required for this share placement and the company notified that the settlement of the placement is planned to occur on 14 June 2019, with the shares to go on trade on 17 June 2019.

Other than this, the company would also be providing an opportunity to the existing shareholder to purchase new shares in Afterpay under the share purchase plan (SPP) which will be issued at the lower of $23 which was the placement price and also 5-day VWAP of Afterpay shares up to the closing date of the share purchase plan. The company via the SPP aims to raise approximately $30M.

As part of its secondary sell down plan, the company announced that Anthony Eisen, David Hancock and Nicholas Molnar have sold 2.05m,0.40m and 2.05m respectively to two US investors Woodson Capital and Tiger Management at $23.00 per share. The three investors have confirmed that they do not have further intention to sell their remaining shares at least for the next 120 days from the announcement of the placement.

In the recent Investor presentation release of the company on 11 June 2019, the company provided a global business update highlight.

Group:

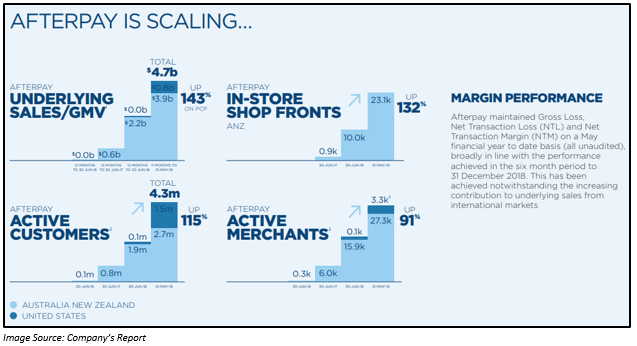

The underlying sales were ~$4.7 billion in 11 months to 31/05/2019, which was up by 143% as compared to the prior comparable period. There were more than 4.3 million active customers and ~ 30,600 active merchants by 31 May 2019.

US: In the US, the company continues to grow strong. There were more than 1.5 million active customers and ~ 3,300 active merchants along with further 1,100 integrating merchants as at 31 May 2019.

UK: The company completed a âsoft testâ in the UK market which is now live under the name Clearpay.

Stock Performance:

The shares of APT has generated an excellent YTD return of 113.67% and it has been in a good upward momentum in the past 3 months with a returns of 23.57%.

At market close on 13 June 2019, the price of the shares of APT were last traded at A$22.550, down by 12.051%. APT holds a market capitalization of A$6.12 billion and approximately 238.84 million outstanding shares. The 52-week high and 52-week low price are at A$28.700 and A$8.375, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.