- Faster growth in key numbers

- Premium Valuation

- No dividends issued

- They have a low price-to-book ratio and/or a low price-to-earnings ratio.

- They include a high dividend yield

- Growth stocks are linked with high-quality and successful companies. They typically have high price-to-earnings ratios and high price-to-book ratios. Value Stocks, on the other hand, have low PE ratios and low PB ratios.

- Investors who invest in the growth stocks derive returns from capital appreciation and not on dividends. When it comes to value stocks, investors expect that the stocks would increase in value with time when the wider market identifies their full potential, or business turn arounds, or via take over resulting in rising share prices.

- Growth stocks tend to be perceived as puffed up and overvalued.

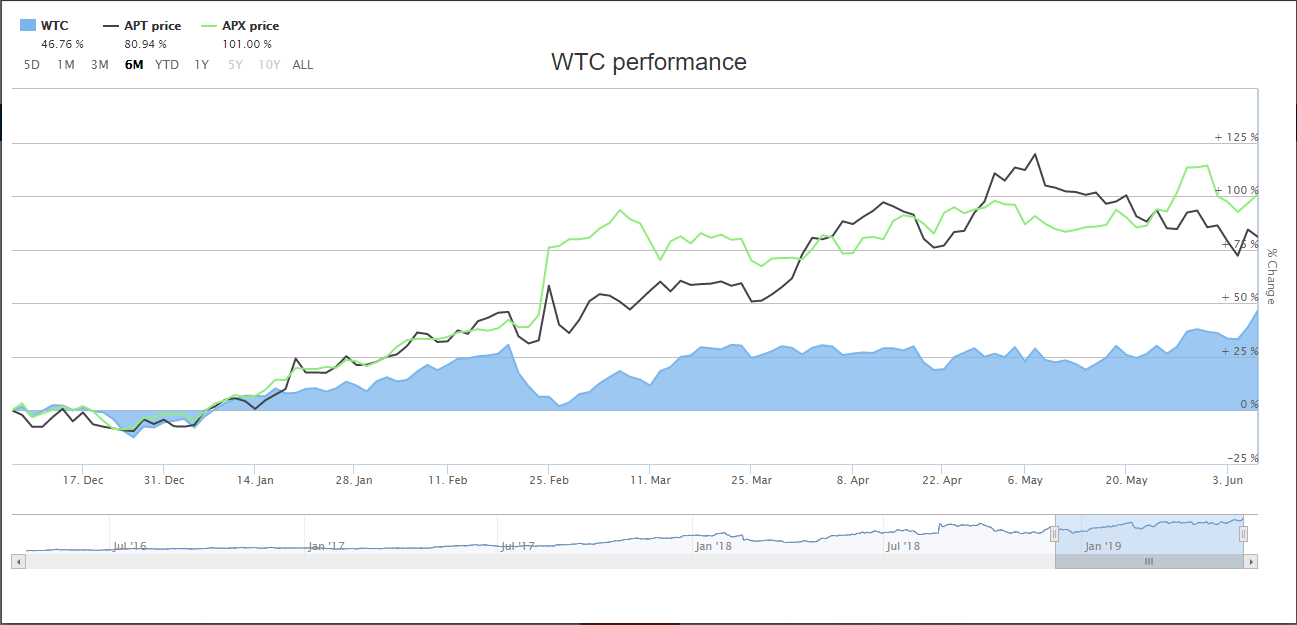

(Source: ASX)

Wisetech Global Limited

An innovative logistics global developer of cloud-based software solutions, WiseTech Global (ASX: WTC). Its first flagship product is CargoWise One which provides an end-to-end logistics solution. The company has been in the market for over 25 years and is based out of Sydney. It has offices across the globe in Europe, the Americas and Australasia.

(Source: ASX)

Wisetech Global Limited

An innovative logistics global developer of cloud-based software solutions, WiseTech Global (ASX: WTC). Its first flagship product is CargoWise One which provides an end-to-end logistics solution. The company has been in the market for over 25 years and is based out of Sydney. It has offices across the globe in Europe, the Americas and Australasia.

Global spread-out (Source: Companyâs report)

On 6th June 2019, the company provided the briefing materials used by the company while conducting investor conferences and briefings. It stated that 38 out of the top 50 global 3rd party logistics providers used the companyâs solutions across almost 130 countries whereas all 25 of the top 25 global freight forwarders made use of these solutions.

The company is underway in the development of a new TMS system which would be known as CargoWise. This tool is anticipated to replace all of WTCâs existing TMS softwares.

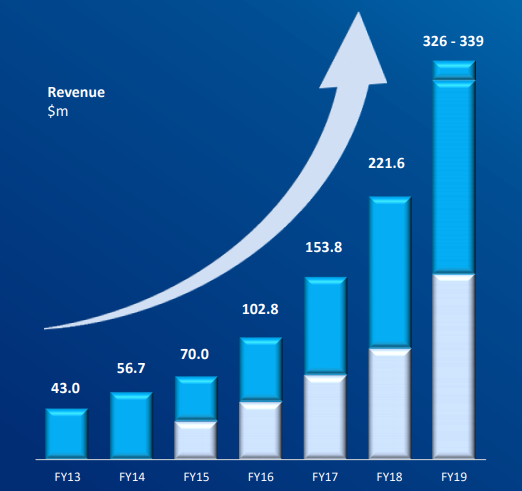

The companyâs outlook for FY19 is to generate a revenue ranging between $326 million and $339 million. The FY18 revenue was $221.6 million. This would be 47% - 53% growth on pcp. The FY19 EBITDA is expected to be in a range of $100 million and $105 million, which would be a 28% - 35% rise on pcp. The FY18 EBITDA was $78.0 million.

Global spread-out (Source: Companyâs report)

On 6th June 2019, the company provided the briefing materials used by the company while conducting investor conferences and briefings. It stated that 38 out of the top 50 global 3rd party logistics providers used the companyâs solutions across almost 130 countries whereas all 25 of the top 25 global freight forwarders made use of these solutions.

The company is underway in the development of a new TMS system which would be known as CargoWise. This tool is anticipated to replace all of WTCâs existing TMS softwares.

The companyâs outlook for FY19 is to generate a revenue ranging between $326 million and $339 million. The FY18 revenue was $221.6 million. This would be 47% - 53% growth on pcp. The FY19 EBITDA is expected to be in a range of $100 million and $105 million, which would be a 28% - 35% rise on pcp. The FY18 EBITDA was $78.0 million.

Revenue over the years (Source: Companyâs report)

The company acquired Xware, which is a market leader in Spain and is a messaging integration solutions provider. The purchase cost was of almost $12.0 million upfront and had an expected multi-year earn-out potential of approximately $11.2 million in relation to revenue performance, business integration and strategic objectives. Many growth companies use Merger and Acquisition to increase the companyâs reach and in-turn generate higher income growth. WiseTech Globalâs Xware acquisition fits this bill.

At the time of writing on 7th May 2019, the stock continues to trade towards its 52- week high of A$27.070 and is trading at A$26.920, up by 1.78%. In the past year, it has generated a YTD return of 65.53%.

Appen Limited

An information technology company, Appen Limited (ASX:APX) partners up with tech, automotive, government and e-commerce players with the aim to help them in data security. This data is used to create innovative products and services, relying on machine learning and natural language. The companyâs corporate headquarters are in NSW. The company operates across 130 countries and has expertise in over 180 languages and dialects.

The company focusses on three main data types- relevance, speech and natural language and image and video.

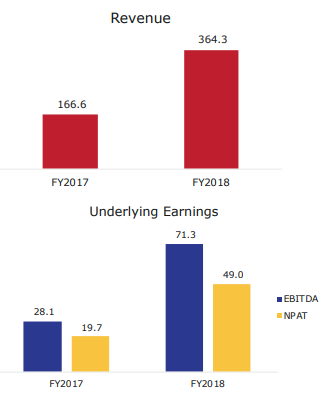

The company conducted its Annual General Meeting on 31st May 2019. On the financial end, the companyâs revenue was up by 119% to $364.3 million. The Underlying EBITDA was recorded at $71.3 million which was up by 153%. The Underlying NPAT amounted to $49.0 million, up by 148%. The full year dividend was 8.0 cps, up by 33% on 2018. This kind of financial performance is typical of a growth stock, with growth in both the top-line and bottom-line figures.

Revenue over the years (Source: Companyâs report)

The company acquired Xware, which is a market leader in Spain and is a messaging integration solutions provider. The purchase cost was of almost $12.0 million upfront and had an expected multi-year earn-out potential of approximately $11.2 million in relation to revenue performance, business integration and strategic objectives. Many growth companies use Merger and Acquisition to increase the companyâs reach and in-turn generate higher income growth. WiseTech Globalâs Xware acquisition fits this bill.

At the time of writing on 7th May 2019, the stock continues to trade towards its 52- week high of A$27.070 and is trading at A$26.920, up by 1.78%. In the past year, it has generated a YTD return of 65.53%.

Appen Limited

An information technology company, Appen Limited (ASX:APX) partners up with tech, automotive, government and e-commerce players with the aim to help them in data security. This data is used to create innovative products and services, relying on machine learning and natural language. The companyâs corporate headquarters are in NSW. The company operates across 130 countries and has expertise in over 180 languages and dialects.

The company focusses on three main data types- relevance, speech and natural language and image and video.

The company conducted its Annual General Meeting on 31st May 2019. On the financial end, the companyâs revenue was up by 119% to $364.3 million. The Underlying EBITDA was recorded at $71.3 million which was up by 153%. The Underlying NPAT amounted to $49.0 million, up by 148%. The full year dividend was 8.0 cps, up by 33% on 2018. This kind of financial performance is typical of a growth stock, with growth in both the top-line and bottom-line figures.

Financial overview (Source: Companyâs report)

The company witnessed growth in New and existing customers with its multiple projects, depicting the consistency in its data and quality. The company received few certifications as well- Manila facility ISO 27001, Exeter facility ISO 27001 and ISO 9001.

The company had also completed the virtual integration of its platform- Leapforce. Efficiency savings worth $6 million are expected in 2019 from this activity.

Chairman, Mr Chris Vonwiller addressed the meeting and stated that the company had a presence in China, including software development professionals and operational staff. He also highlighted that the company has braced up to take part in the growth of AI and machine learning adoption in China. Further, the office too is structurally separate from the companyâs global business to aid in reacting to the local market conditions and protecting data privacy.

At the close of trade on 7th May 2019, the stock traded close to its 52-week high of A$29.700 at A$26.650, up by 1.91%. In the past year, it has generated a YTD return of 136.65%.

Afterpay Touch Group Limited

A technology-driven payments company, Afterpay Touch Group Limited (ASX:APT) enables leading retailers to provide a âbuy now, receive now, pay laterâ service. The end consumers are therefore not required to enter a traditional loan or pay any fees or interest to the company.

Financial overview (Source: Companyâs report)

The company witnessed growth in New and existing customers with its multiple projects, depicting the consistency in its data and quality. The company received few certifications as well- Manila facility ISO 27001, Exeter facility ISO 27001 and ISO 9001.

The company had also completed the virtual integration of its platform- Leapforce. Efficiency savings worth $6 million are expected in 2019 from this activity.

Chairman, Mr Chris Vonwiller addressed the meeting and stated that the company had a presence in China, including software development professionals and operational staff. He also highlighted that the company has braced up to take part in the growth of AI and machine learning adoption in China. Further, the office too is structurally separate from the companyâs global business to aid in reacting to the local market conditions and protecting data privacy.

At the close of trade on 7th May 2019, the stock traded close to its 52-week high of A$29.700 at A$26.650, up by 1.91%. In the past year, it has generated a YTD return of 136.65%.

Afterpay Touch Group Limited

A technology-driven payments company, Afterpay Touch Group Limited (ASX:APT) enables leading retailers to provide a âbuy now, receive now, pay laterâ service. The end consumers are therefore not required to enter a traditional loan or pay any fees or interest to the company.

Few company customers (Source: Company website)

The company provided an update on the key business and regulatory developments on 6th June 2019. The Underlying sales were almost $4.7 billion in the 11 months ending 31st May 2019, up by 143% on the pcp. As on the data from end of May, the company had more than 4.3 million active customers. The company partnered up with almost 30,600 active merchants, which is 32% more than the statistics of 31st December 2018.

The company received two awards recently. On 16th May 2019, At the World Retail Congress in Amsterdam, it was granted the âRetail Technology Game Changer of the Yearâ. On 22nd May 2019 at the Australian Banking & Innovation Awards in Sydney, it was awarded the âBest Fintech Innovatorâ. The awards help the growth companies to be in the reckoning of the investors and aid in perception building and in turn might lead to valuation premium.

The company recently signed a deal with Citi worth $300 million receivables funding facility with the purpose of aiding the expansion of its US business. The term for this new US facility is twenty-four months.

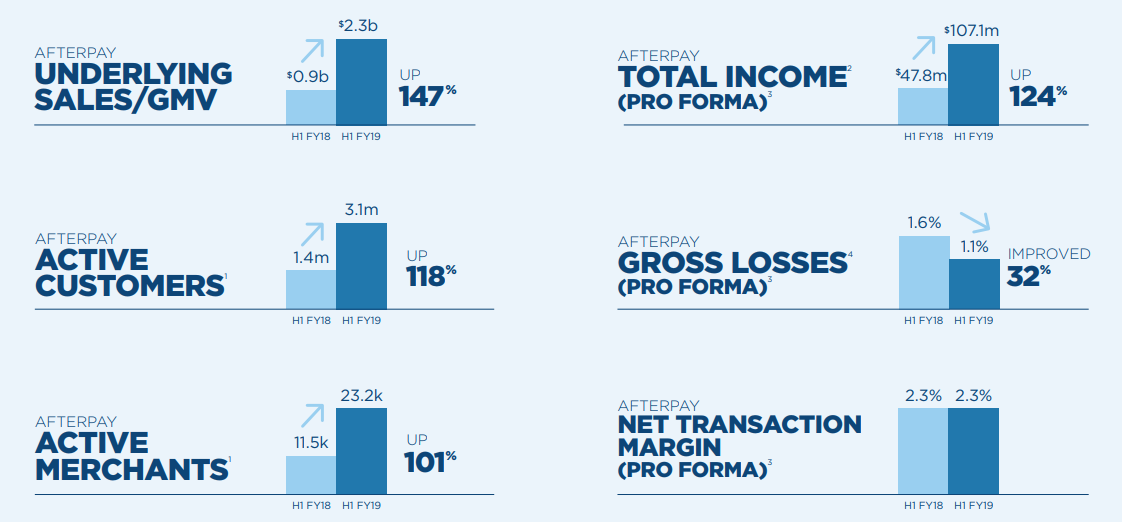

The company had released its H1 FY19 results earlier this year in February. Below is a snapshot of its highlights:

Few company customers (Source: Company website)

The company provided an update on the key business and regulatory developments on 6th June 2019. The Underlying sales were almost $4.7 billion in the 11 months ending 31st May 2019, up by 143% on the pcp. As on the data from end of May, the company had more than 4.3 million active customers. The company partnered up with almost 30,600 active merchants, which is 32% more than the statistics of 31st December 2018.

The company received two awards recently. On 16th May 2019, At the World Retail Congress in Amsterdam, it was granted the âRetail Technology Game Changer of the Yearâ. On 22nd May 2019 at the Australian Banking & Innovation Awards in Sydney, it was awarded the âBest Fintech Innovatorâ. The awards help the growth companies to be in the reckoning of the investors and aid in perception building and in turn might lead to valuation premium.

The company recently signed a deal with Citi worth $300 million receivables funding facility with the purpose of aiding the expansion of its US business. The term for this new US facility is twenty-four months.

The company had released its H1 FY19 results earlier this year in February. Below is a snapshot of its highlights:

(Source: Companyâs report)

At the close of trade on 7th May 2019, the stock was priced at A$24.150 up by 2.98%. In the past year, it has generated a YTD return of 187.73%.

(Source: Companyâs report)

At the close of trade on 7th May 2019, the stock was priced at A$24.150 up by 2.98%. In the past year, it has generated a YTD return of 187.73%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.