Technology sector is an important determinant of economic growth, as most of the industries in some or the other way depend on technologies, enabling them to enhance their productivity, quality and profitability. Technology sector basically provides products and services to other industries, such as hardware, software, semiconductors and consulting services.

The technology sector is considered as one of the most volatile sectors. It is also among the largest sectors in terms of market cap, as well as diverse range of companies and industries. The best part of the technology sector is that there is always an exposure to growth with the rise of new technology. At present, cloud computing, big data, AI and mobile computing are some of the popular technologies.

How Tech Stocks Can Increase Your Profit?

Stocks of technology companies are considered as the most attractive space for investors, as they act as an umbrella to the portfolio of investors.

Features of Technology Stocks:

- Future Facing: Since the technology stocks provide the market with an opportunity to invest in businesses that keep focus on the future needs. As a result, there is always a possibility for investments in breakthrough technology and benefit from the growth in the future.

- Immense Opportunities: These businesses can cater to across sectors, owing to the fact that technologies are used by most of the sectors.

- M&A Activities: Due to high prospects, there are always better chances of mergers and acquisitions in the sector. Growth in consumer confidence results in tech M&A deals.

Points to Note While Choosing Technology Stocks:

- Good Current and Expected Profitability: Investors before injecting their funds in technology stocks must do their homework with respect to the financial fundamentals of these companies. Financial fundamentals cover earnings after tax, operating margins as well as cash flows of the companies. These parameters would give an idea on how likely the selected stock would generate profit in the near future.

- Intrinsic Value: Investors should also find the intrinsic value of the company before investing, as this value helps in knowing the real value of the stock.

- Capital Structure: Another important criterion to select tech stocks before investing in them is to have a look at the capital structure of the company, which helps the investors in knowing how the company is funding its business, i.e. debt or equity. It also unveils how the company manages its capital to create short-term liquidity to cover operating costs and at the same time, reserves enough capital to fund expansion or growth program without increasing debt.

- Earnings momentum: Investors should also have a look at the earnings momentum of the company, as it gives a picture of whether the companyâs earnings are increasing or not. The stocks with high earnings acceleration are generally seen trading at a higher P/E ratio, owing to the fact that the investors invest in the stock in anticipation of a better return.

- Asset Utilisation: Investors should also consider the asset utilisation of the company. By asset utilisation, we mean that how much the company is earning against each dollar of the asset it owns. This could be measured using the asset utilisation ratio.

Seven ASX-listed Profit-Making Technology Stocks:

-

WiseTech Global Limited

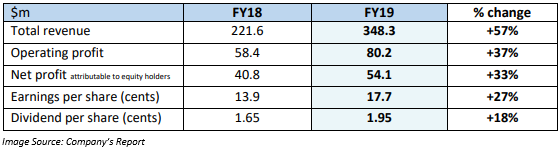

(ASX: WTC), a provider of software solutions to the logistics industry, globally, unveiled strong growth in revenue and net profit, as it updated the market with its FY2019 results for the year ended 30 June 2019. WTCâs revenue reported an increase of 57% to $348.3 million, while the companyâs net profit grew by 33% to $54.1 million.

-

Computershare Limited

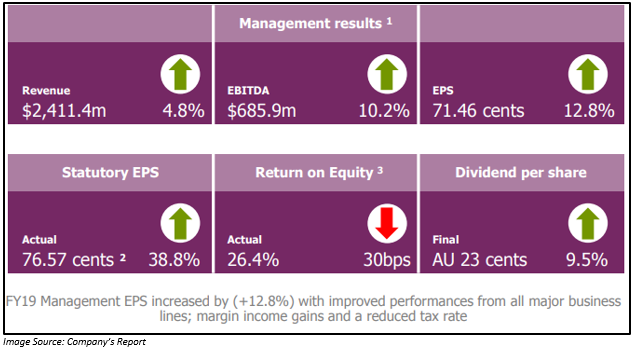

(ASX: CPU), an IT sector player engaged in the operation of a computer bureau, operation of share registries and the provision of software, reported a 38.5% increase in its net profit after tax to $415.73 million in FY2019. The companyâs revenue from continuing operations increased by 2.5% to $2.35 billion. The final dividend of CPU for the financial year 2019 was $23 cents per share.

-

Iress Limited

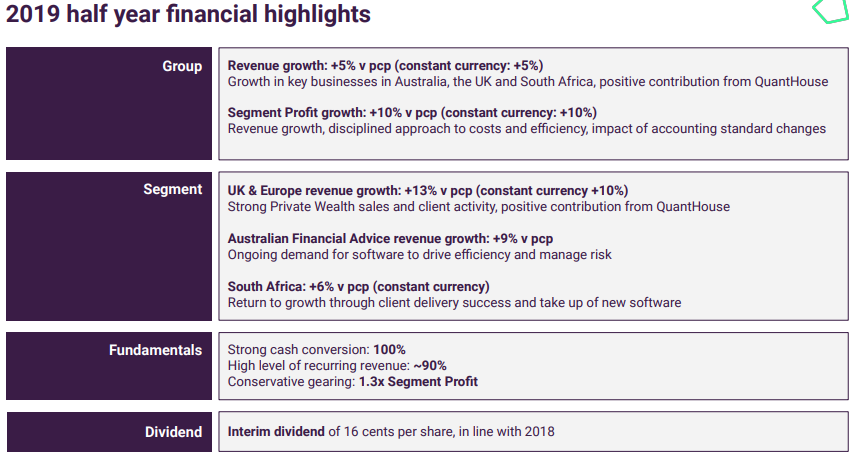

(ASX: IRE), a provider of IT solutions, reported a 10% growth in the segment profit to $30.4 million on pcp in 1H FY2019 The company registered operating revenue of $ 241.8 million in the first half. The company caters to financial market participants and wealth managers.

Source: Companyâs Report

-

Altium Limited

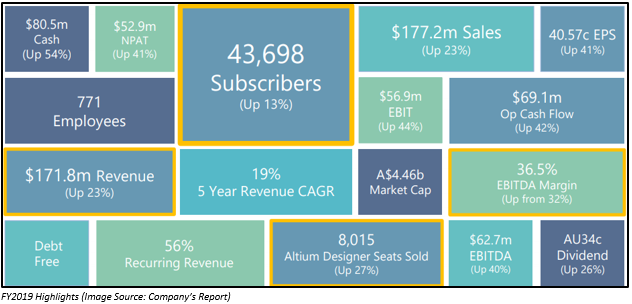

(ASX: ALU), a company catering to its clients by developing and selling computer software for the design of electronic products, reported an outstanding result for FY2019 ended 30 June 2019. The net profit after tax of the company reported an year-on-year increase of 41% to US$52.9 million. Meanwhile, earnings per share went up by 41%.

-

Appen Limited

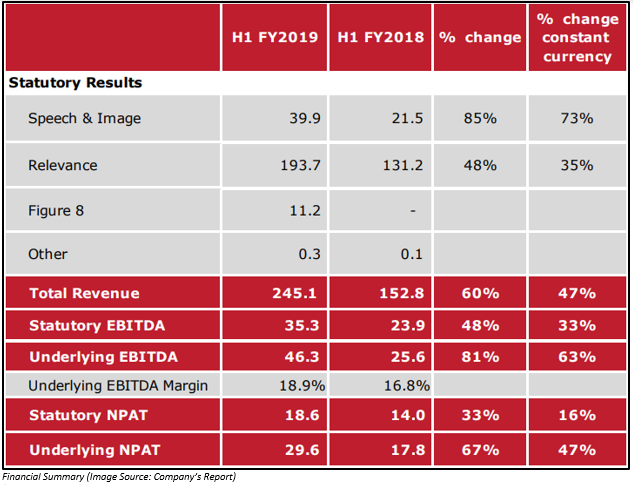

(ASX: APX), a provider of linguistics services, reported a 60% growth in its revenue to $245.1 million in the year ended 30 June 2019. Underlying EBITDA increased by 81% to $46.3 million and underlying NPAT went up by 67% to $29.6 million.

-

Link Administration Holdings Limited

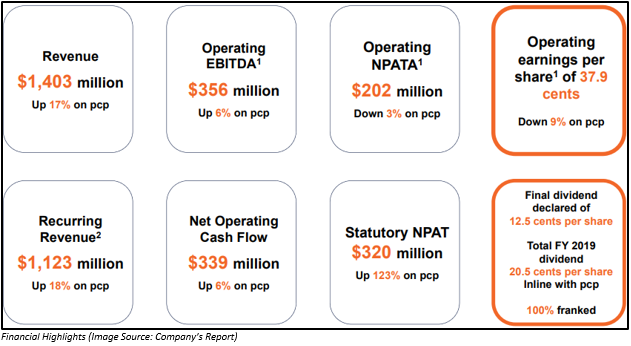

(ASX: LNK), a provider of services in Australia's superannuation fund administration industry, reported a 17% increase in its revenue to $1,403 million on pcp. Its recurring revenue increased by 18% to $1,123 million and statutory NPAT went up by 123% to $320 million. The total dividend for FY2019 stands at 20.5 cents per share.

-

Technology One Limited

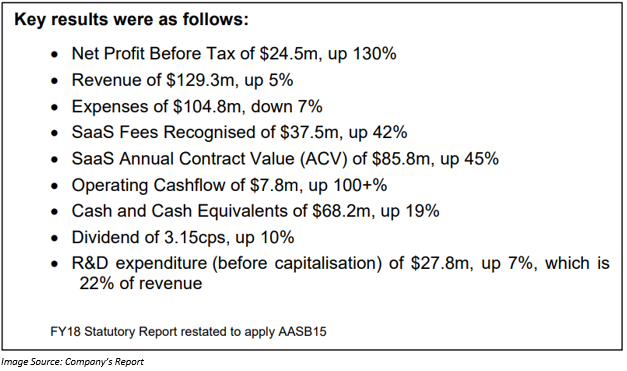

(ASX:TNE) reported a 130% growth in its net profit before tax to $24.5 million in its half yearly results for the period ended 31 March 2019. The expenses of TNE, which is Australiaâs largest enterprise SaaS company, declined by 7% to $104.8 million and revenue increased by 5% to $129.3 million.

Outlook of Technology Sector in Australia by 2030:

Around the world, economies are making huge investments to get benefit from the economic and social

opportunities of the digital economy. In Australia, economic success of the country would rely on the countryâs ability to harness technological advances to give a boost to existing businesses and improve daily life, as well as create new products and markets.

According to a market report, in the next 10 years, with improvement in the existing industries and growth of new industries, the technology sector in Australia would be contributing more than $300 billion to the Australian economy.

Key areas such as people, services, digital assets and the environment would be the deciding factors for the technology future in Australia. Each category in this journey would be moving towards developing its digital skills.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.