Crude oil prices took a jab in the international market amid a drastic increase in the United States Crude Oil Inventory. The benchmark Brent Crude Oil Spot dropped from the level of US$ 73.60 (Dayâs high on 20th May 2019) to the present level of US$ 70.44 (as on 23rd May 2019 AEST 4:12 PM).

The prices previously rose in the international market over the concern of supply disruption caused by the attack on Saudiâs oil tanker and middle east angst.

However, the United States- a contributor to the recent oil spill has built its inventory sharply, which in turn is exerting pressure on crude oil prices.

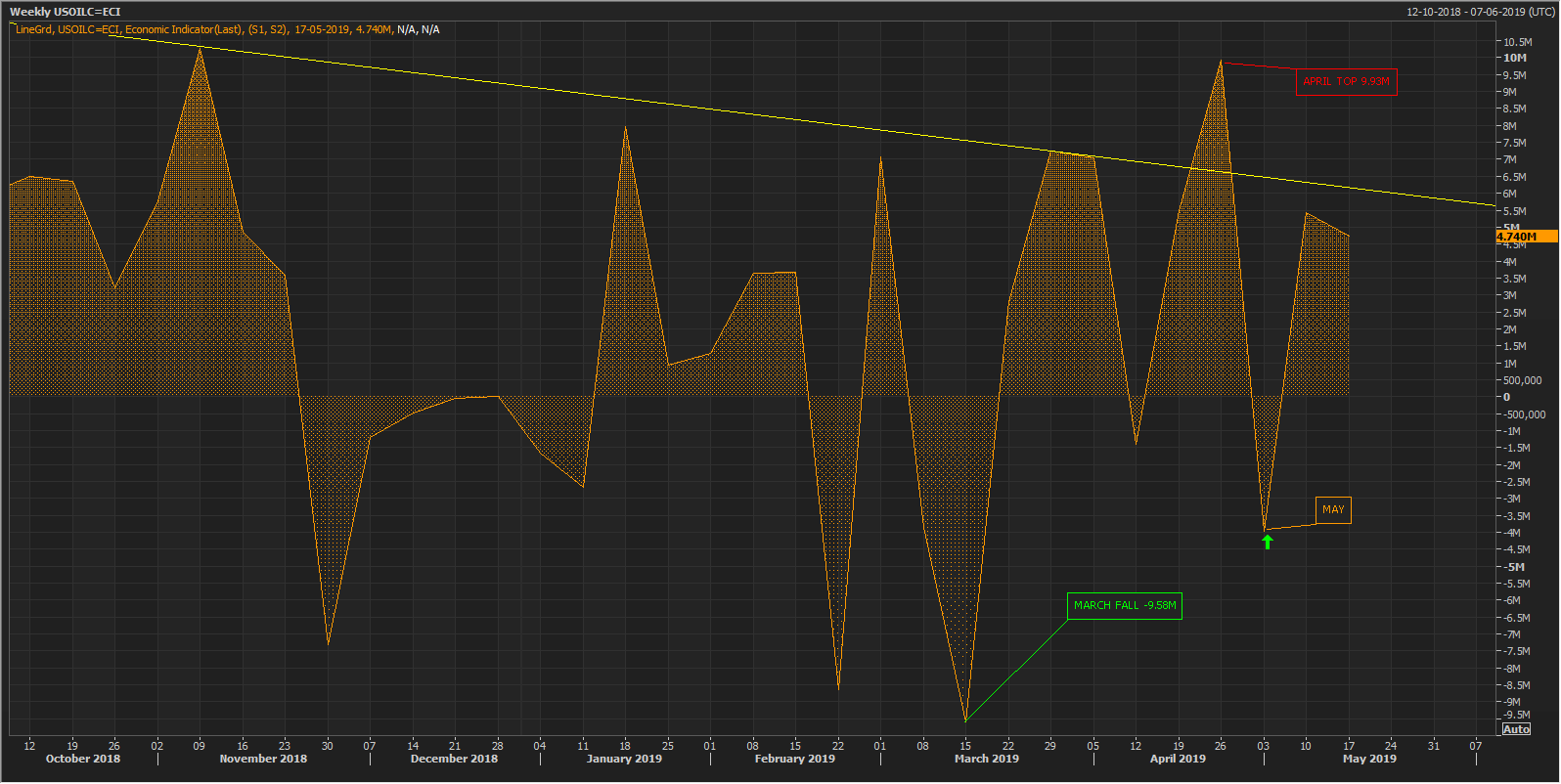

As per the official data, the United States Weekly Crude Oil Inventory stood at 4.7 million barrels for the week ended 17th May 2019, significantly up against the market expectation of a decline to -1.2 million barrels. Albeit, the crude oil inventory rose in the United States, but the refinery capacity is expected by the market participants to improve. The expectation is in line with the previous inventory level which stood at 5.4 million tonnes (for the week ended 10th May). And, the inventory for the week ended 17th May stood at 4.7 million, which in turn denotes an improvement in the refinery process in the United States.

Inventory Analysis:

Source: Thomson Reuters (U.S. Weekly Crude Oil Inventory)

Source: Thomson Reuters (U.S. Weekly Crude Oil Inventory)

The overall inventory in the United States in March dropped till -9.58M barrels, which in turn, coupled with voluntary production cut from OPEC, raised the supply concerns in the global market and supported the prices.

April end marked the highest gain in inventory in the year 2019; the inventory rose till 9.93M (for the week ended 26th April 2019). The sudden increase in inventory exerted pressure on crude oil prices.

Although the crude oil inventory levels are well below Aprilâs top of 9.93M barrels (denoting improvement in that the refinery processing in the US), but the inventory levels are picking up progressively in the United States since beginning of May, which could further exert pressure on crude oil prices.

Apart from a rise in the inventory, another factor which should be taken into consideration by the market participants is the changing energy trend. The global economies are becoming more carbon resilient following the Euro-6 emission standards, which, in turn, is marking an inclination of the energy sector towards renewable energy.

Many international oil behemoths such as Total (France) and ENI (Italy) already included renewable energy projects under their portfolio. The major giants such as BP are burning extensive capitals on a renewable energy project. Such a divergence could signify that these significant oil mammoths are assessing the global oil scenario less optimistically. BP, in its outlook of oil, also mentioned that the global oil scenario is likely to mark an average demand in the long run, post a short-term demand boost.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.