Oil will continue to catch a significant chunk of energy till next 20 years says BP, one of the world's largest oil producer. The report offers clue to the company's strategy to tackle reduce the carbon emissions with in-line as per the goals of the Paris climate accord. As per the BP annual energy outlook of 2019, oil demand will be strong for the next 20 years even if the ambitious targets set in the Paris Climate Change accord are met and adopted. In a rapid change in economies from fossil energy to renewable energy the oil demand will drop only 20% by 2040 even with the use of renewable energy and electrification of transport by various industries and yet if the bold actions were made to curb the carbon emission oil will still meet half of the world's energy demand. In the rapid transaction to a low carbon world, the carbon dioxide emissions would drop to 45% by 2040, but this would require a revolution in technology for carbon capture, usage, and storage.Â

Source: BP Energy Outlook 2019

The primary energy consumption will mark a steady increase in oil and an exponential increase in renewable energy. The transaction to a lower-carbon energy system would continue with natural gas and renewable gaining grounds relative to oil and coal. As per the forecast by BP the renewable and natural gas would account for almost 85% of the growth in the primary energy segment and oil increases during the first half of the outlook albeit at a much slower pace than in the past before spiking again in the 2030s. The coal consumption is broadly flat with its importance declining in the global energy system.

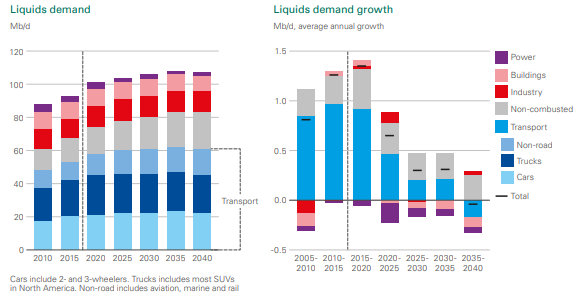

As per the outlook, the consumption of liquid fuels grows over the next decade, before broadly plateauing in the 2030s.

Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Source: BP Energy Outlook 2019

Source: BP Energy Outlook 2019

The demand for liquid fuels looks set to expand with an increase of 10Mb/d and reach 108Mb/d from 98Mb/d with majority of the growth happening over the next ten year, and the demand continues to expand from the transport sector which is to remain around 55%. The transport demand for liquid fuels is expected to increase from 56 Mb/d to 61Mb/d (steady) by 2040, and the demand from transport sector eventually is fading over the outlook amid improvement expectations in vehicle efficiency. The demand for Non-Combusted liquid fuel show gains, especially as a feedstock in petrochemicals and the demand grows over the outlook by 7Mb/d to 22Mb/d by 2040.

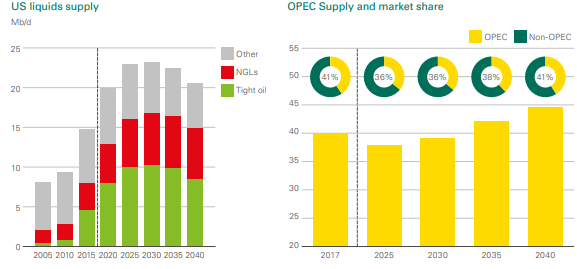

On the supply side, the growth in liquid supply is initially dominated by U.S. tight oil(shale oil), with OPEC production increasing only after U.S. tight oil declines.

Source: BP Energy Outlook 2019

As U.S. tight oil declines, this space is filled by OPEC production which is aided by OPEC members responding to the increase in global oil resources and the action taken to reform OPEC members economies and reducing the dependency on oil that will gradually allow them to adopt a more competitive strategy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.