In this article, we would discuss five stocks from the food industry. On 26 August 2019, the Australian benchmark index was trading at 6,428.6, down by 1.5% or 94.5 points (at AEST 12:38 PM).

Costa Group Holdings Limited (ASX: CGC)

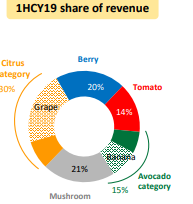

On 23 August 2019, the company reported results for the half-year ended 30 June 2019. Accordingly, the revenue of the company was recorded at $573 million in HY2019, up by 11.8% on $512 million in HY2018. The statutory NPAT was $41.1 million for the half year period compared with $40.6 million in the previous corresponding period.

Meanwhile, the company has announced a fully-franked dividend of 3.5 cents payable on 3 October 2019, and the record date of the dividend is 12 September 2019.

Product Growth Plan Update

Berry Category: Reportedly, the 2019 berry program emphasises on additional optimisation of the existing footprint. CGC has been undertaking the growth of premium planting, and an additional thirty hectares of Arana was sown with total plantings now at eighty-nine hectares throughout the three zones.

Meanwhile, in China, the plantings have been accommodated in 174 hectares consisting of 144 hectares of blueberry, and 22 hectares of raspberries and 8 hectares of blackberries. The 2020 planting would include of sixty-two hectares of blueberries in Guangmen region. Besides, the total capital investment by the JV would be approximately A$55 million by the end of CY2019.

As per the release, in Morocco, the expansion of 45 hectares was completed, and the total footprint is now 314 hectares. The guidance for African blue is positive, and the total footprint in Agadir is presently sixty-six hectares. Besides, another 2.67 percent share procurement of African Blue is planned for late 2019 and 2020, which would take the companyâs ownership to 90 percent.

Mushroom Category: Reportedly, the companyâs production network was rebalanced, all growing rooms at the expanded Monarto facility are now operational. Besides, the company is bringing in additional labour, including technical support, and training programs have been progressing.

Meanwhile, phase 2 & 3 compost plant was issued with a certificate of occupancy, and growing rooms and office/staff amenities were completed.

Tomato Category: Reportedly, the new ten hectares hi-tech glasshouse project consists of an extended nursery facility and improved packing and after harvest facilities. The new 10 hectares project would allow to grow the companyâs snacking/specialty tomato offering. Besides, the construction tenders were awarded, and the 2.5 hectares nursery pad along with five hectares glasshouse pad have been concluded while the overall program is as per the plan.

Source: Companyâs Report

Outlook: Reportedly, the challenges and uncertainties remain attributing to continued lower than expected of mushrooms, raspberry crumble. Besides, the company expects blueberry pricing pressure backed by the higher than estimated NNSW blueberry industry crop.

Meanwhile, the outcomes have been in line with the latest outlook; the trading and prediction continue to be difficult with possible snag risk.

On 24 August 2019, CGCâs stock was trading at A$2.98, down by 5.994% (at AEST 1:41 PM).

Synlait Milk Limited (ASX: SM1)

On 16 August 2019, the company had notified to declare the results for the year ended 31 July 2019 on 12 September 2019. Recently, the company announced that it had completed the acquisition of selected Talbot Forest Cheese assets.

Source: Companyâs Report

Reportedly, the acquisition included property, plant & equipment of Temuka site, and the consumer cheese brand (Talbot Forest Cheese) while the current customer relationship would continue. Synlait has been controlling the management & operations of Talbot. Meanwhile, there were assets that were not part of the sale agreement, which included a factory in Geraldine and Deli shop.

Leon Clement, CEO of Synlait, stated that the deal allows the company to produce a range of cheese products, and it helps to optimise the companyâs manufacturing assets. He said that the deal would access a new pool of profits with a flexible manufacturing plant to customise the product as per the customer needs.

On 24 August 2019, SM1âs stock was trading at A$8.705, down by 0.854% (at AEST 1:47 PM). Over the past one year, the stock has generated a negative return of 15.17%. However, the stock has provided a return of 2.81% over the last year-to-date period.

Inghams Group Limited (ASX: ING)

On 5 August 2019, ING had notified on the release of the full-year results for FY2019 on 27 August 2019. Also, recently, the companyâs Chairman has re-joined, following the recovery from the illness.

Source: Companyâs Report

In 28 February this year, the company had released the half-year results for the period ended 29 December 2018. Accordingly, the companyâs core poultry volumes grew by 3% across the group, and the gross profit was up by 2.9% to $250.2 million, which was backed by automation, labour productivity, procurement and network rationalisation.

Reportedly, the half-year period had seen cost increased on the fleet driven by the drought conditions in Australia. The underlying EBITDA was up 3.6% to $109.6 million for the period, and EBITDA increased 30.8% over the pcp, which included favourable effect from profits on sale and restructuring changes.

Meanwhile, the underlying NPAT was down by 5.3% to $55.4 million attributed to change in tax legislation, and NPAT increased to 28.5% to $84.4 million due to sale on profits and restructuring changes.

Besides, the volume in the third party feed business was down due to the exit of Red Lea from the industry, and the sale of Mitavite. The sale of horse feed business was completed and of $59.5 million in 2018. The cash flows were strong during the first half due to an improvement in working capital supported by the sale of assets.

On 24 August 2019, ING was trading at A$4.01, down by 1.716% (at AEST 1:58 PM). Over the last one year, the stock gave a return of 16.68%. Meanwhile, the stock has given a negative return of 9.13% in the last three months period.

Blackmores Limited (ASX: BKL)

Recently, the company had released results for the year ended 30 June 2019. Accordingly, the revenue of the company was slightly up by 1% to $610 million in FY2019 compared with $601 million in the previous year.

Source: Companyâs Report

Reportedly, the company recorded EBIT of $80.5 million in FY2019 compared with $101.61 million in FY2018. The reported NPAT was $53.4 million in FY2019 compared with $69.22 million in FY2018. Besides, the company achieved domestic sales in all markets except New Zealand, which was down 1% in the previous year.

Meanwhile, the sales in Australia & New Zealand regions stood at $267 million, marginally up on the prior year with small increase in Australia region and fall in New Zealand region. In 2018, the company concluded the procurmeent of Impromy.

As per the release, the business in Asia (excluding China) contributed to a total 30% increase in sales to $107 million, and all markets achieved growth. The growth in Vietnam was 157%, Korea was 28% and Indonesia was up 90%.

Meanwhile, in China, the results were impacted by the changes to e-commerce laws, which came into effect from January 2019. The sales in China were down by 15% to $122 million compared to previous corresponding year.

On 24 August 2019, BKLâs stock was trading at A$68.09, up by 0.65% (at AEST 2:04 PM). Also, over the past one year, the stock has given a negative return of by 55.22%.

Freedom Foods Group Limited (ASX: FNP)

In June this year, FNP completed equity raising, which included Retail Entitlement Offer and Shortfall Placement. Accordingly, the share activity was offered at a price of $4.8 per new share, to raise approximately $130 million shares.

Reportedly, the company issued ~24 million new shares on 30 May 2019 and issued ~2.33 million shares on 19 June 2019 related to component of e Entitlement Offer.

Besides, ~1.48 million shares were issued to eligible investors, and ~843k shares were placed by Veritas Securities and UBS AG, which were related to shortfall placement. Meanwhile, ~6k new shares were issued to a nominee for the ineligible shareholders.

Subsequently, the total shares on issue totalled to ~272.90 million.

On 24 August 2019, FNPâs stock was trading at A$4.23, down by 2.982% (at AEST 2: 09). Over the last one year, the stock has provided a negative return of 27.81 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.