Consumer Staples comprise of essential products like food, household goods, hygiene products, beverages, alcohol, tobacco etc. The products are non-cyclical and witness a year-round demand from consumers, regardless of the performance of the economy.

Let us have a look at the performance of few stocks in the sector-

Blackmores Limited

Blackmores Limited (ASX: BKL) develops and distributes health products for humans and animals including vitamin, mineral & nutritional supplements.

FY19 Results: The company reported full year revenue amounting to $610 million, up 1% on prior year. Reported net profit after tax for the year amounted to $53 million, down 24% in comparison to the previous year. Excluding one-off costs pertaining to work in relation to streamlining of business, the net profit after tax amounted to $55 million, down 19%. The company achieved domestic sales growth across all markets, excluding New Zealand where the sales went down at a rate of 1% in comparison to previous year.

FY19 Results (Source: Company Results)

Updates from Australia & New Zealand Market: In the Australian market, the company remains an ace brand for vitamin and dietary supplement with a market share of 15.9% along with a strong gap over its nearest domestic competitor. The company reported sales amounting to $267 million in Australia and New Zealand, which were slightly above the previous year comprising a modest gain in Australia and slight decline in New Zealand. The company completed the acquisition of Impromy in November 2018. Impromy is an evidence-based weight management program that supports the companyâs commitment to the health and wellness category.

Updates from Other Asia Markets: Excluding China, the company performed remarkably in the market in Asia. All the markets achieved a growth in revenue during FY19, which contributed 30% increase in sales to $107 million. Increased distribution and new product launches were major factors contributing to strong growth in both well-established and new markets. Sales in Vietnam increased by 157% and those in Korea went up by 28%. In Indonesia, sales witnessed a growth of 90%.

Sales in China: China witnessed a decline in sales due to the impact of changes in e-commerce laws. Sales in the segment amounted to $122 million, down 15% in comparison to previous year.

Sales for Bioceuticals Group: The BioCeuticals Group, comprising BioCeuticals, IsoWhey and Global Therpeuticsâ brands, went up by 4% in comparison to FY18.

Dividend: The Board declared a final dividend amounting to 70 cps, that resulted in full year fully franked dividend of 220 cps. The dividend will be paid to the shareholders on 12 September 2019.

The stock of the company is currently trading at a market price of $67.770, down 4.4% on 16 August 2019 (1:24 PM AEST) with a market capitalisation of $1.23 billion.

Synlait Milk Limited

Synlait Milk Limited (ASX: SM1) is engaged in production and sale of dairy products.

Acquisition: The company recently completed the acquisition of selected assets of Talbot Forest Cheese. As part of the acquisition, the company has taken over the consumer cheese brand, Talbot Forest Cheese and the property, plant and equipment of the Temuka site. The company has also assumed the management and operational control of Talbot Forest Cheese. This deal is expected to help the company to manufacture a variety of cheese products with optimisation of its manufacturing assets and access to new profit tools.

Resignation of Director: The company recently notified regarding the resignation of Neil Betteridge, Director of Operations.

FY19 Results Release Date: In a recent announcement to the exchange, the company updated that it will release the financial results for FY19 on 12 September 2019.

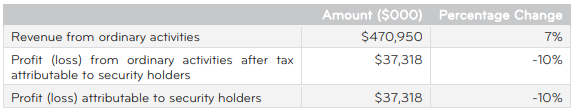

Half Year Results: During the six-months ended 31 January 2019, the company generated revenue from ordinary activities amounting to $470.95 million, up 7% in comparison to prior corresponding period. Profit attributable to security holders amounted to $37,318, down 10% in comparison to prior corresponding period.

Financial Summary (Source: Company Reports)

The stock of the company has generated returns of 3.37% and -5.93% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $8.980, down 2.4 % on 16 August 2019 (1:24 PM AEST) with a market capitalisation of $1.65 billion.

Costa Group Holdings Limited

Costa Group Holdings Limited (ASX: CGC) is engaged in marketing and packaging of fresh fruits and vegetables. The company provides its services to supermarket chains and some independent grocers.

Shareholding Update: The company recently updated that Commonwealth Bank of Australia ceased to be a substantial shareholder effective 12 August 2019. As per another update, Pendal Group Limited became a substantial shareholder with 5.02% of the voting power.

Announcement of Financial Results: In a recent announcement, the company notified that it will be releasing the financial results for the half year ended 30 June 2019, on 23 August 2019.

FY18 Financial Results: During the year, the company reported revenue amounting to $478 million, down 2.4% on prior corresponding period. Statutory net profit after tax for the period amounted to $4.3 million. EBITDA-S during the period amounted to $35.3 million, representing a decline of 42% on prior corresponding period. Leverage ratio was reported at 1.96x of EBITDA-S as at December 2018, with net debt amounting to $244.6 million. During the year, the company paid a fully franked dividend amounting to 5.0 cents per share. The shareholders received the dividend on 12 April 2019.

Product Segment: Revenue for the product segment witnessed a reduction of 4.3% on 1HFY18, largely due to lower biennial citrus production. Total transacted sales for the segment were reported at $615.7 million, as compared to $620.3 million in the first half of FY18.

In the Mushroom category, the business met its financial targets despite negative impact of variable compost quality on production volumes. Berry category was characterised by mixed performance in terms of strong production volumes from Corindi New South Wales farm and lower volumes from the end of Far North Queensland season. Contribution from the Citrus category was lower than the prior year due to off-year biennial fruit production cycle. Tomato category witnessed an overall lower price realisation due to weaker retail channel pull through. Majority of the produce was sold through wholesale markets.

CF&L Segment: Revenue for the Costa Farms and Logistics was reported at $2.9 million, up 3.8% in comparison to previous year, delivering a strong trading outcome.

Outlook: Considering the positive crop performance and weather conditions, the company is expecting NPAT-SL in CY2019 to report a growth of at least 30%.

The stock of the company has generated negative returns of 17.37% and 29.03% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $3.570, up 1.42% on 16 August 2019 (2:34 PM AEST) with a market capitalisation of $1.13 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.