Australiaâs expansive geography and the presence of distinct soils and growing climates allow the farmers to produce distinct varieties of grains, oilseeds and pulses, which together constitute one of the most efficient and profitable sectors of the Australian agriculture industry, comprising 27 % of total agricultural exports income in 2016-17 (as per ABARES).

Lately, according to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the wheat exports from Australia fell way below the five-year average, at ~ 9.7 million tonnes during 2018-19 primarily due to high domestic prices in eastern states and severe droughts. Many grazing reasons across the country have also remained dry leading to a rising domestic demand for grain as animal feed amidst surging prices for sheep and cattle at home and abroad.

Also, at a time when drought elevated the Cattle slaughter throughout the start of 2019 as producers grappled with limited feed and water, the global demand for Australian beef and sheep meat has consistently been strong, supported further by a softer Australian Dollar and new year tariff reductions in some international markets. The trend is expected to continue this year and benefit the grain growers as the harvest season kicks off in October 2019.

Going forth in 2019â20, the wheat exports are projected to recover and increase both in volume and value as the production ramps up, domestic demand stabilises, and the drought conditions ease.

Letâs look at some of the ASX-listed agribusinesses in Australia -

GrainCorp Limited

GrainCorp Limited (ASX:GNC), based in Sydney, Australia, operates as a food ingredients and agribusiness company engaged in processing and distribution of wheat, barley, and canola, as well as provision of different malt products and services to brewers and distillers. The company also refines and supplies edible oil. With a market capitalisation of around AUD 1.81 billion and approximately 228.86 million shares outstanding, the GNC stock is trading at AUD 7.655 (AEST 1:26 PM), up 1.391% by AUD 0.105, with ~ 282,004 shares traded on 7 August 2019.

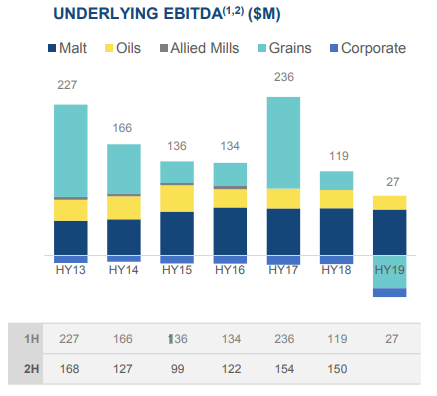

FY19 Earnings Guidance Update- Recently on 02 August 2019, GrainCorp updated the market that the company was estimating its underlying EBITDA for the financial year 2019 (FY19) to be in the range of $ 65-85 million with the underlying net loss after tax expected to be in the range of $ 70-90 million. The company also mentioned that the full-year negative EBITDA impact of the current disruption of grain esports and Australian wheat markets is expected to increase in the range $ 60-70 million from $ 40 million, earlier announced in April 2019. The companyâs Underlying EBITDA trend in the last seven years until the first half of 2019 is charted below.

Source: Investor Presentation- Half Year Ended 31 March 2019

Also, GrainCorp is anticipating that the new crop trading opportunities in the last quarter of FY19 would not likely materialise due to the unwillingness of the foreign market participants to consider new season contracts.

Earlier in June 2019, GrainCorp reached a 10-year contract, to manage eastern Australian grain production risk, effective FY20 onwards and will have material benefits to the company such as reduced cash flow volatility and earnings during seasons of lower production. The company also mentioned that the trading conditions of its other businesses, including Malt, were so far consistent with expectations.

Costa Group Holdings Limited

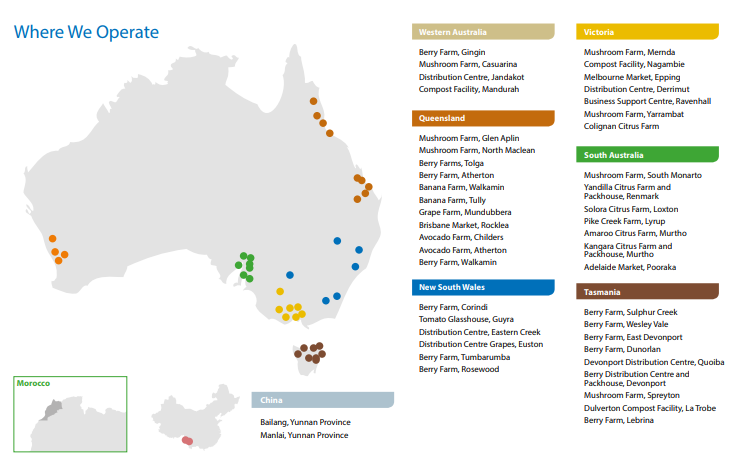

Costa Group Holdings Limited (ASX:CGC), based in Victoria, is one of Australia's leading horticultural company and a major supplier of produce to food retailers, including supermarket chains and independent grocers. It operates in five key categories including mushrooms, glasshouse tomatoes, berries, citrus and avocados; and has ~ 4,500 ha of planted farmland with 30 ha of glasshouse facilities along with 7 mushroom growing facilities, all located across the country.

A snapshot of the companyâs operations is given below.

Source: Annual Report 2018

The Groupâs market capitalisation stands at around AUD 1.2 billion with approximately 320.55 million shares outstanding. On 7 August 2019, the CGC stock was trading at AUD 3.690, down 1.6% by AUD 0.060 with ~ 2.57 million shares traded (AEST: 1:47 PM).

On 12 July 2019, Costa Group Holdings informed the stakeholders that it would be announcing its results for the half year ended 30 June 2019 (1H CY2019) on Friday 23 August 2019, followed by an investor briefing.

Earlier on 5 July 2019, Frank Costa announced his retirement as a non-executive director of Costa Group, effective 4 July 2019 while he would continue his involvement with the company as an advisor to the Board.

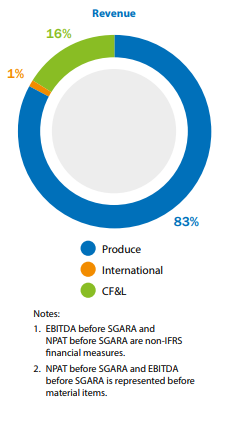

Annual Report Highlights â The financial period from July 2018 to December 2018 (FP2018) saw Costa deliver a $ 8.5 million underlying Net Profit After Tax before SGARA (NPAT-S) and the revenue was slightly down by 2.4% on the previous corresponding period to $ 478 million. Costaâs revenue by segment for the six-month fiscal period 2018 is illustrated below-

Source: Annual Report

The Board declared a fully franked dividend of 5.0 cents per share for FP2018.

Ridley Corporation Limited

Ridley Corporation Limited (ASX:RIC), based in Melbourne, Australia operates stock feed mills, which produce and distribute animal feed products for the beef, dairy, pig and poultry industries.

Source: Companyâs Website

Besides, the company also runs salt refineries and produces crude salt along with providing rural products and services. With a market capitalisation of around AUD 326.82 million and approximately 311.26 million shares outstanding, on 7 August 2019, RIC was trading at AUD 1.020, down 2.857% by AUD 0.030 with ~ 90,588 shares traded (AEST: 1:47 PM).

Westbury facility Opened - Recently on 24 July 2019, the company announced that its new state-of-the-art extrusion plant in Westbury, Tasmania had officially been opened. The facility has an initial manufacturing capacity of 50,000 tonnes of extruded feeds, including both aquaculture and pet food, with a potential to expand as required. The Tasmanian Government had granted the company a funding of $ 2 million to support the project, with the construction of the facility utilising ~550 contractors and sub-contractors, including engineering consultants, civil, structural and electrical services.

Roots Sustainable Agricultural Technologies Ltd

Roots Sustainable Agricultural Technologies Ltd (ASX: ROO), based in Israel, is engaged in the development and commercialisation of disruptive, modular, cutting-edge technologies to solve the ongoing issues concerning agriculture such as plant climate management and water shortage for cultivation. With a market capitalisation of around AUD 5.31 million and approximately 87.03 million shares outstanding, on 7 August 2019, ROO was trading at AUD 0.059, down 3.279% by AUD 0.002 with ~ 19,233 shares traded (AEST: 1:55 PM).

Recently on 1 August 2019, Roots Sustainable Agricultural Technologies informed the stakeholders that through the use of its Root Zone Temperature Optimization (RZTO) technology, the company had successfully increased the harvest yield of cannabis flower by 40% while also enhancing the quality output and quantity of harvests from two to three per year. The results were observed and demonstrated at Tim Blakeâs leased property located in Laytonville, CA that encompasses the cultivation farm Little Hawk Collective, Inc. following its initial sale and installation in March 2019.

The encouraging results with Little Hawk Collective, Inc. further underpin the companyâs strategic focus on the high-value North American cannabis cultivation market.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.