Considered as non-cyclical, products that are categorised as essential are consumer staples. Some of the examples of consumer staples include food items, beverages, personal products and pharmaceutical drugs. However, products like alcohol and tobacco, which are not essentially important, are also part of this sector, as they witness demand year-round.

There are varied characteristics that make stocks in this category (also referred as "defensive," or "recession-proofâ) attractive for investments. Investors get attracted to consumer staple stocks, the manufacturers of these products, as well as distributors and retailing chains that aid their business, factoring in stable income, opportunity for capital gain and consistent dividends. It is no surprise that majority of the brands that are considered valuable come under the consumer staples sector.

Though consumer staples are considered as safe haven during the periods of market volatility or economic slump, it seems that 2019 is not the year for the consumer staples sector. Several key names in the Australian consumer staples market have witnessed their shares hammered in the recent months. Factors like fluctuations in oil prices and escalating trade tensions between the United States and China seem weighing on consumer staple stocks.

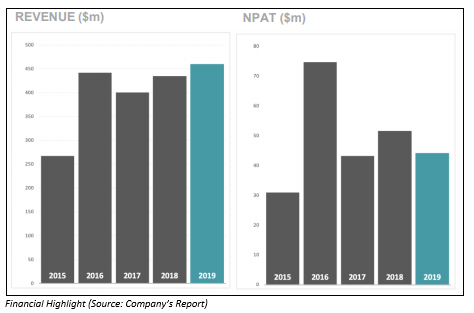

In this article, we would discuss three players in the consumer staples market that are experiencing challenging market conditions. Over the last six months, consumer staple players Costa Group Holdings Limited, Blackmores Limited and Bega Cheese Limited reported negative returns of 23.67%, 31.74% and 18.26%, respectively. The drag in their stock prices highlights weak results related to their earnings as well as revised guidance for near term growth.

Let us have a look at the developments of these companies, in addition to their stock performance on the Australian Securities Exchange.

Costa Group Holdings Limited

About the Company:

A specialist in growing, packaging and marketing premium quality fruits and vegetables including table grapes, avocados, berries, tomatoes and mushrooms, Costa Group Holdings Limited (ASX:CGC) exports its produce to regions like Asia, North America and Europe. The company caters to supermarket chains in Australia, independent grocers, wholesalers, retailers and other food industry stakeholders.

Costa Group Holdings is scheduled to release its results for the half year ended 30 June 2019 on 23 August 2019.

July Month Market Updates:

- Market announcement on 26 July 2019 â Unveiled that Pendal Group Limited (ASX:PDL) & its Associates, Pendal Fund Services Limited, Pendal Institutional Limited ceased to be a substantial holder in CGC.

- 19 July 2019 Market Update â Announced that Bennelong Australian Equity Partners Ltd ceased to be a substantial holder in CGC. Bennelong sold 4,032,390 ordinary shares on market.

- In a market update on 5 July 2019, Costa Group Holdings announced that Mr Frank Costa had decided to retire from the companyâs Board. His retirement from the position of a non-executive director was effective from 4 July 2019. However, Mr Frank announced that he would continue serving the company as an advisor to the Board. Post this development, Mr Francisâ indirect interest in the company via Costa AFR Pty Ltd also ceased.

- New issue announcement on 4 July 2019 â Unveiled the issue of 483,378 options under the companyâs CY19 long term incentive plan. However, these options are subject to vesting conditions that are dependent on performance against defined criteria for the companyâs performance during FY19 - FY21. Of the total options, 25% are growth target options and are subject to a performance hurdle based on geographic and category diversification. Moreover, these options are subject to growth aimed towards aiding sustainable long-term value creation linked to return on capital, while the remaining 75% options are EPS options. These earnings per share options are subject to a performance hurdle based on CGCâs basic EPS CAGR over the performance period.

- Market Update on 4 July 2019, under which the company announced a change in the interest of Director Harry George Debney.

Stock Performance:

After the close of business on 9 August 2019, CGCâs stock was valued at A$3.830, up by 2.4 per cent, with a market cap of A$1.2 billion and ~ 320 million outstanding shares. With a P/E ratio of 10.380x and an annual dividend yield of 3.61 per cent, the YTD return of the stock is negative 47.91 per cent. In the last one, three and six months, it has delivered negative returns of 11.37 per cent, 29.57 per cent and 26.67 per cent, respectively.

Blackmores Limited

About the Company:

Catering to around 17 markets across the globe with its natural healthcare products and services, Blackmores Limited (ASX:BKL) is focused on highest quality standards. The company is a provider of various vitamin, minerals, herbal and nutritional supplements. Additionally, thousands of people use the companyâs Naturopathic Advisory Service, part of BKLâs innovative educational services. It has an employee base of around 1,200 people in Australia, New Zealand as well as Asia.

Management Changes:

On 6 August 2019, the company updated the market regarding the resignation of Non-Executive Directors Ms Helen Nash and Ms Jackie McArthur. The board is set to start the process of making new appointments to fill the vacancies.

Blackmores Limited unveiled the appointment of its new Chief Executive Officer and Managing Director during early July 2019. Mr Alastair Symington, who would join the company on 1 October 2019, holds more than 20 years of experience in beauty, health, and grooming. He has worked with well-known companies including Nestlé and The Procter & Gamble Company. Mr Alastair is currently serving as a Senior Vice President of Consumer Beauty for consumer products manufacturer and retailer Coty. His current role is focused on the ALMEA region - Asia, Latin America, the Middle East, Africa and Australia.

Q3 FY19 Financial Update:

During the third quarter of the financial year 2019, BKL reported $ 460.1 million in revenue, up from $ 434.4 million in the same period a year ago. The companyâs EBIT for the reported quarter stood at $ 65.5 million, compared with $ 74.5 million in the year-ago period. It reported a fall in NPAT during Q3 FY19 to $ 44.2 million from $ 51.6 million in the third quarter of FY18.

For the financial year 2019, the company expects modest revenue growth, continued focus on lowering excess stock in channels to the Asian country, China, and speeding up its plan aimed to streamline business and achieve savings worth $ 60 million over a 3-year period.

Stock Performance:

After the close of business on 9 August 2019, BKLâs stock was valued at A$83.650 , down by 0.04 per cent, with a market cap of A$1.45 billion and ~17 million outstanding shares. With a P/E ratio of 20.570x and an annual dividend yield of 3.64 per cent, the YTD return of the stock is negative 33.19 per cent. In the last one, three and six months, it has delivered negative returns of 8.54 per cent, 8.10 per cent and 33.64 per cent, respectively.

Bega Cheese Limited

About the Company:

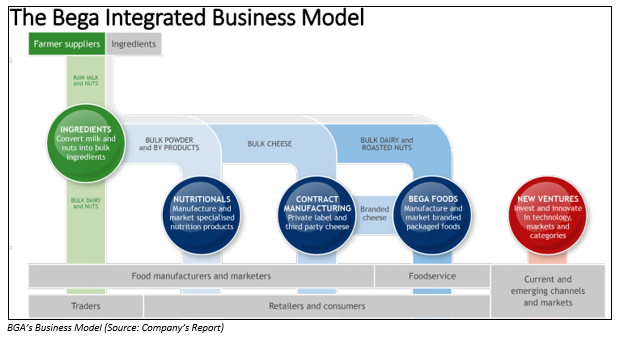

An iconic Australian brand with cheese products, Bega Cheese Limited (ASX: BGA) is engaged in the production of food brands and products. The company operates manufacturing plants across New South Wales and Victoria. Additionally, BGA is engaged in exporting its extensive range of retail cheese products to regions, including the Middle East, North Asia, Southeast Asia, South America, Central America and the Pacific Islands.

Market Update:

The company, in a market update on 2 August 2019, announced a revised guidance for normalised earnings before interest, tax, depreciation and amortization (EBITDA) for the financial year ended 30 June 2019. The company updated normalised EBITDA guidance range to $ 113 - $ 117 million from the earlier guidance range of $ 123- $ 130 million (unveiled as part of the companyâs announcement related to interim results for the first half of FY2019). The revised guidance follows assessment of the full year result, which is subject to the final statutory audit. As a result of the reduced guidance, the company lowered gearing in the second half of FY2019. BGA expects to report $ 300 million in net debt, with sound leverage cover at end-FY19.

In FY2019, the company registered a 41% year-on-year increase in milk intake, which stood at 1.06 billion litres. Moreover, Bega Cheese boosted its share from 8.1% to 12.4% in the milk pool market in Australia. However, the company experienced strong competitive pressure from processors in the last quarter of FY2019, as well as in establishing the milk price from 1 July 2019 for the financial year 2020.

Bega Cheese is scheduled to release its results for FY19 in late August 2019.

Stock Performance:

After the close of business on 9 August 2019, BGAâs stock was valued at A$4.000, up by 1.52 per cent, with a market cap of A$ 842.11 million and ~213 million outstanding shares. With a P/E ratio of 57.100x and an annual dividend yield of 2.79 per cent, the YTD return of the stock is negative 20.24 per cent. In the last one, three and six months, it has delivered negative returns of 13.60 per cent, 24.08 per cent and 19.26 per cent, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.