Small-capitalisation Stocks

Small-cap stocks are those stocks which have market capitalisation of $300 million to $2 billion. The market cap of the company can be measured by a number of shares of outstanding times the price of each stock. During the expansion phase of the company, the stock price of small-cap companies generally go up, highlighting an advantage over the large-cap stocks. The companies categorised under small-cap stocks and less likely to pay a dividend because these companies re-invest their profit earned during the period as to grow their capital. The risk associated will these stocks are high when compared to the large to mid-cap stocks. These stocks may be ideal for those investors who have a long-term goal like saving for retirement or childrenâs education.

Why are Small-Cap stocks preferred by Investors?

Small-cap companies can be a good choice of investment when it comes to growth. The one who is investing in small-cap stocks gets a chance to get a foothold before the company explodes in size and stock price skyrockets. Therefore, if you can buy the stocks of small-cap companies at lower prices, there is a chance that you may earn a tidy profit later as the company grows and expand its operations.

Letâs look at following five Small-cap stocks that investors have been eying.

Simavita Limited (ASX: SVA)

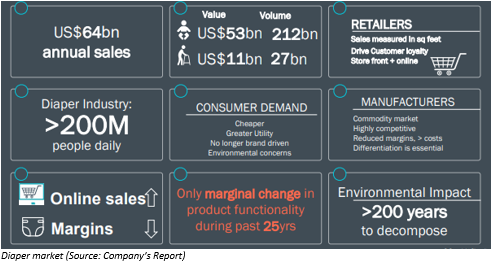

Simavita Limited is focussed on the development of disposable and wearable platform technologies for the healthcare market. Simavita is a MediaTech company which offers various products, which include SIM sensor, SIM pod, SIM assist application, SIM Wireless Fidelity enabling devices. Recently the company has announced the appointment of Dr John McBain as a Director.

CE Mark Approval for SmartzTM

On 25 November 2019, the company is pleased to announce that it has received CE Mark approval for Smartzâ¢. As a result, the Smartz⢠now meets those standards which enable the technology to be sold throughout the European Economic Area. Smartz⢠is an intuitive, easy to use technology, providing peace of mind to adults and infants. The Smartz⢠can deliver a significant competitive advantage to major retailers, distributors and global diaper manufacturers.

Simavita receives $683,621 under the R&D Tax Incentive Scheme

On 14 November 2019, the company has confirmed the receipt of $683,621 under the Australian Governmentâs Research and Development Tax Incentive Scheme. The companyâs net cash inflow after repayment of the Receivable Finance Facility and payment of fees is $379,663. Under the tax incentive scheme, the companies receive cash refunds for 43.5 per cent of eligible expenditure on R&D.

Stock Performance

On 29 November 2019 (AEST 12:54 PM), the stock was trading flat at $0.040.

Bougainville Copper Limited (ASX: BOC)

Bougainville Copper Limited, engaged in investment activities, is an independently managed company of Papua New Guinea. The company, via a release dated 25 October 2019, reported that there has been no production since 15 May 1989.

Revenue increased by 28.9 per cent during H1 2019

On 2 September 2019, the company has announced the half-yearly results for the period ended 30 June 2019, few highlights of the results are as follows:

- The companyâs revenue from ordinary activities has been increased by 28.7 per cent to K2.9 million compared to the previous year corresponding period.

- BOC has reported a net loss of K3.9 million.

- Bougainville Copper Limited has K0.731 million of cash in hand.

- Total current liabilities of the company reduced to K4.055 million from K4.219 million in prior corresponding period.

Stock Performance

On 29 November 2019 (AEST 12:55 PM), the stock was trading at $0.250, down by 3.846 per cent from the previous close.

Black Rock Mining Limited (ASX: BKT)

Black Rock Mining Limited, is listed on Australian Stock exchange, operates as a graphite producer. Black Rock Mining owns and operates graphite tenure in the Mahenge region of Tanzania.

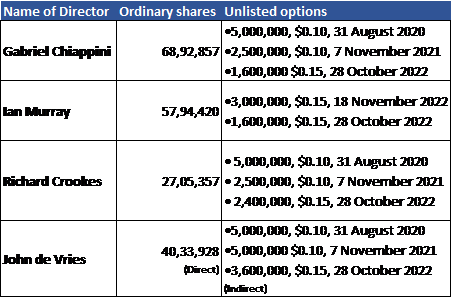

Change of Directors Interest

On 18 November 2019, the company has announced the change few of its directorâs interest. Below is the snapshot of the number of securities held after change by the directors:

September Quarterly Activities Report

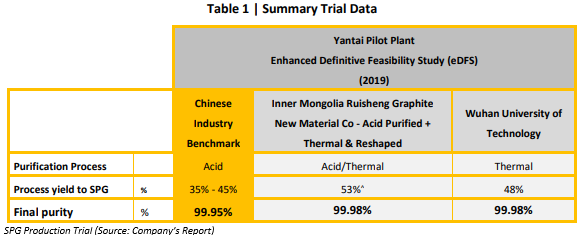

On 29 October 2019, the company is pleased to announce the September 2019 Quarterly Activities Report, a few highlights from the report are as follows:

- The companyâs financing activities are ongoing and managed through Black Rockâs debt advisors, ICA Partners (ICA).

- ICA continues to prepare documentation and protocols on a financing round which will commence in the coming months.

- The company looks forward to working with the Tanzanian Government on a framework for participation in the Mahenge Graphite Project.

- The trial demonstrated a yield to the final product of 48 per cent and 53 per cent, and the final purity of 99.98 per cent Total Graphite Content.

- In August 2019, Black Rock completed an equity placement to raise A$3 million via the issuance of 42,857,143 new shares at an issue price of A$0.07 per share.

- BKTâs Net cash used in operating activities was $1.08 million.

- The companyâs cash and cash equivalents stood at $2.774 million at the end of the quarter.

Stock Performance

The stock last traded at $0.050 on 27 November 2019.

KYCKR Limited (ASX: KYK)

KYCKR Limited is a provider of Know Your Customer and Know Your Bank services using legally compliant information. The company connects 200 registered corporates globally.

Results of Annual General Meeting

On 18 November 2019, the company has declared the results of the Annual General Meeting. Below are the resolutions which were passed during the AGM:

- Adoption of the Remuneration Report

- Re-election of Director â Ms Karina Kwan

- Re-election of Director â Ms Jacqueline Kilgour

- Approval of the issue of performance rights

- Grant of Options to Ms Karina Kwan

- Grant of Options to Ms Jacqueline Kilgour

- Approval of additional capacity to issue shares under ASX Listing Rule 7.1A

Stock Performance

On 29 November 2019 (AEST 12:57 PM), the stock was trading flat at $0.125.

Emerald Resources NL (ASX:EMR)

Emerald Resources NL headquartered in Perth, Western Australia, is a developer and explorer of gold projects. In 2016 the company acquired Renaissance Minerals Limited through an off-market takeover and is focussed on its Cambodian Gold Project in the eastern region of Cambodia.

Results of Annual General Meeting

On 26 November 2019, the company has declared the results of the Annual General Meeting. Below are the resolutions which were passed during the AGM:

- Adoption of the Remuneration Report

- Re-election of Mr Ross Stanley

- Approval of 10% Placement Facility

Mineral Investment Agreement Approved for the Okvau Gold Project

On 26 November 2019, the company announced the receipt of ministerial approval for the development of the Okvau Gold Project in Cambodia. A Sor Chor Nor, an official Government announcement letter, has been issued by the Council of Ministers approving the execution of the Mineral Investment Agreement by the relevant ministries.

Few highlights of the projects are as follows:

- The NPV went up to $488 million pre-tax and $345 million post-tax with a very high Internal Rate of Return (IRR) of 69% per annum pre-tax and 57% post-tax.

- The company is well-positioned to capitalise on a unique development opportunity with reduced fiscal risk.

- US$60M Project Facility with Sprott Private Resource Lending II L.P. for development of the Okvau Gold Project close to finalisation

Stock Performance

On 29 November 2019 (AEST 12:57 PM), the stock was trading flat at $0.043.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.