Crude oil is regarded as the worldâs most traded commodity, and its global supply and demand is catalyzed by economic conditions and geopolitical issues.

Recently, oil has been the hottest topic in the commodity market front across the globe, after the rising tensions in the middle east, trouble with supply levels at core oil farms and the possible renewal of sanctions from the US against Iran.

Moreover, the resource and energy commodity markets have been buffeted by US-China trade tensions amid a noticeable supply change and weaker than expected exchange rate.

In this article, we would acquaint ourselves to the recent updates on the oil front in Australia while combating the global terseness and understand the developments with Qantas Airways Limited (ASX:QAN).

Recent Oil Price Scenario

The world woke up startled on the Monday morning of 16 September 2019, after the news started doing the rounds regarding drone attacks on Abqaiq oil processing facility, a key oil infrastructure in Saudi Arabia which is the world's biggest crude exporter. This knocked out 6 per cent of the world's oil supply.

The price of global benchmark, Brent crude, represented a 15% uptick to $69 a barrel on Monday, its largest one-day climb since almost three decades.

Moreover, the fear of an accelerating global downturn loomed, partly due to the prolonged US-China trade war. Apparently, the attack was carried out with Iranian weapons which hinted about a probable global conflict involving the US and Iran.

Consequently, there were speculations of an instant surge in oil prices, which meant that the local petrol prices would jump, putting a pressure on the already fragile Australian economy, which is experiencing its slowest rate of growth in over a decade.

On this note, it is important to understand that in the March quarter 2019, Australian producers exported 330.3 million litres of condensate to the United Arab Emirates (part of the Middle Eastern realm) which was almost one-tenth of the total petroleum exports over the quarter.

The attacked region has been exclusively a source of imported crude oil from Australia and the second biggest source of refinery feedstock.

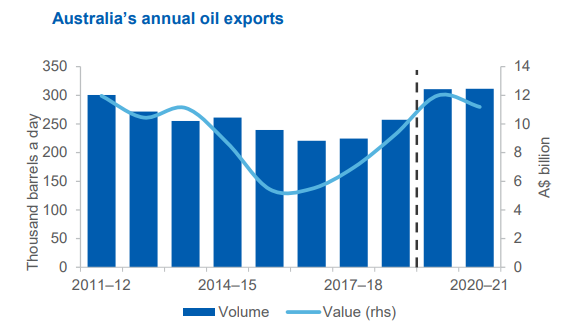

(Source: DIIS)

The Oil Outlook

2019 began with an oil price uptick for the first five months of the year, only to enter the volatility phase in June, driven by the uncertainty over global economic conditions and oil supply prospects.

According to the Department of Industry, Innovation and Science (DIIS), the earnings from oil exports are forecasted to continue their upward trend and rise from $9.3 billion in 2018â19 to $12 billion in 2019â20, acknowledging the expected volume growth, a higher expected oil price and the impact of a weak Australian dollar. However, this would eventually slump to $11.2 billion in 2020â21.

(Source: DIIS)

The Expert Opinion

Post the drone attacks, industry experts had warned that the Australian petrol prices could reach $2 per litre ($150 per barrel), if the tensions between the US and Iran escalate into a full-blown war, under a worst-case scenario.

This was likely to pose a significant problem for the Australian households (and the economy), pushing up the typical Australian familyâs weekly petrol bill, as rising petrol price crimps a consumerâs discretionary spending.

Moreover, the spike was expected to offset the recent income-tax refunds for low and middle-income households, and reduce the benefits of interest rate cuts, which would eventually pressurise the countryâs consumer spending.

Qantas Airways Limited

In this context, let us concentrate on the developments of Qantas Airways Limited (ASX:QAN), with investors keenly keeping a watch on the stock while the company is facing the heat of rising fuel costs due to prevalent oil price scenario.

On 16 September, QAN stock reported a dip of 4.53% with the potential threat to rising fuel costs associated with Saudi Arabâs oil facility attack. However, on 18 September 2019, QAN settled the dayâs trading session at A$6.280, up by 1.78 per cent with the oil price correction and optimistic update of output recovery by Saudiâs Energy Minister.

Qantas is Australiaâs largest domestic and international airline, and was founded in 1920 in Queensland. QANâs primary business is the transportation of customers through a couple of complementary airline brands, Jetstar and Qantas. QAN provides regional, domestic and international services, and was listed on the Australian Securities Exchange in 1995.

Dividend Payment

On 3 September 2019, QAN announced the payment of a fully franked dividend of A$0.13 per ordinary share, though the conduit foreign income was not declared. The dividend would be paid on 23 September 2019.

2019 Financial Stance

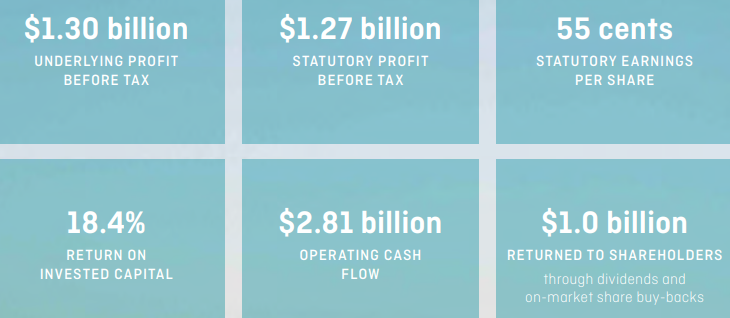

QAN did fall prey to the headwinds of higher fuel costs and the impact of a lower Australian dollar on its foreign currency expenses but was resilient enough to report strong results in financial year 2019. Below are the key highlights:

- The underlying profit before tax was reported to be $1,302 million while the Statutory profit before tax was $1,265 million.

- The Statutory earnings per share remained flat at 54.6 cents per share, though the return on invested capital was 18.4 per cent.

- The company delivered $452 million in transformation benefits and continued strong cash flow generation, with the net debt at $4.7 billion (as on 30 June 2019), below the net debt target range of $5.2 billion and $6.5 billion.

QANâs Financial Highlights for FY19 (Source: QANâs Annual Report)

Achievements as QAN heads towards its 100th year

- During 2019, the QAN shareholders received $1 billion in capital returns, and the company announced a further $200 million in dividends and around $400 million in an off-market buyback in August 2019.

- Post the latest buyback, it would have bought back almost a third of its shares since 2015, which is the most that any listed company has achieved on the ASX.

- Amid the tough wage landscape in Australia, the company provided 25,000 of our employees with a total of $32 million in staff travel bonuses.

- The company is investing in new fleet at Jetstar and another $25 million to strengthen the Frequent Flyer program.

- Moreover, $10 million has been invested in providing discounted fares for consumers hailing in remote regional cities on top of a $5 million regional grants program.

- The company has been investing in biofuel research and operates the worldâs largest airline carbon offset scheme.

Outlook

Chairman Richard Goyder AO vouches that by the end of 2020, QAN would have successfully shunned single use plastics by 100 million items and would be well-advanced to reduce their waste to landfill by 75 per cent by the end of 2021.

CEO Alan Joyce AC stated that aviation industry needed to adapt to a carbon constrained future, and players in the game should act responsibly to emissions, to guarantee long-term success. The company would be focussed on operational safety levels through 2020 and has signed up to industry-wide targets that will halve net emissions by 2050 based on 2005 levels.

Market found relief with the Brent Crude marking a rise of ~6.5% on Tuesday with Saudiâs Energy Minister, Prince Abdulaziz updating the market that the country is expecting to replenish its oil output to normal levels soon, with the production expected to return to 9.8 mn barrels by the month end.

However, market players are still closely monitoring the oil supply and price dynamics with some of them expecting the oil prices to remain above previous lows on increased worries about further attacks.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.