Small Business

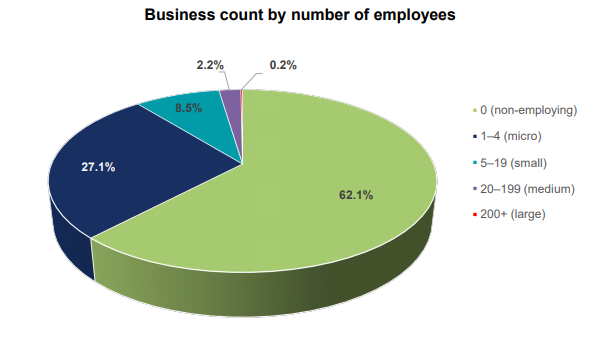

Small Businesses dominate the Australian economy. Besides, small businesses are very prosperous for the country, as they contribute 33% to the countryâs GDP while employing 44% of the countryâs workforce, as per the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) - Small Business Counts 2019.

In Australia, a business with less than twenty employees is considered as a small business. A medium business should have employees in the range of 20 to 199. Meanwhile, any business with over 200 employees is considered a large business.

Source: Australian Small Business and Family Enterprise Ombudsman - Small Business Counts 2019

Source: Australian Small Business and Family Enterprise Ombudsman - Small Business Counts 2019

Every business is small in the beginning with a potential to grow as large as it could become, depending on the value posed by such businesses, and a strong management team to steer the business.

Blue Chip

Blue-Chip companies are fully mature businesses powerhouse with an extended presence in a particular jurisdiction. These companies have moderate growth, decent earnings history, large-scale operations, well capitalised, brand name and give consistent performances.

These companies are often said to be less volatile. Blue chip stocks are large companies, and they provide a decent dividend returns, stable earnings, diversification, and long-term returns.

At the same time, the returns from blue chips are moderate as well, implying lower volatility. Also, the prices of blue-chip stocks are relatively higher than the other stocks.

Small Cap

Small cap stocks have a relatively lower market capitalisation. Mostly, companies with a market capitalisation of less than $2 billion dollars are considered in the small cap space.

Investors should look for the companies that can grow into a big company. Not every company could grow and become a blue-chip company. However, quality businesses have better chances of delivering shareholder value. Besides, diversification allows an investor to get a cover from the volatile nature of small cap stocks. It exposes the investor towards other opportunities as well.

Small companies offer an attractive growth potential relative to the larger companies. As a growing company, sustaining the growth attributes leads to a larger size, better market share, and ultimately a large company.

We would now discuss such relatively small businesses that have been in the limelight for the past few months.

Perth Basin Gas Players

Warrego Energy Limited (ASX: WGO) & Strike Energy Limited (ASX: STX)

Joint Venture

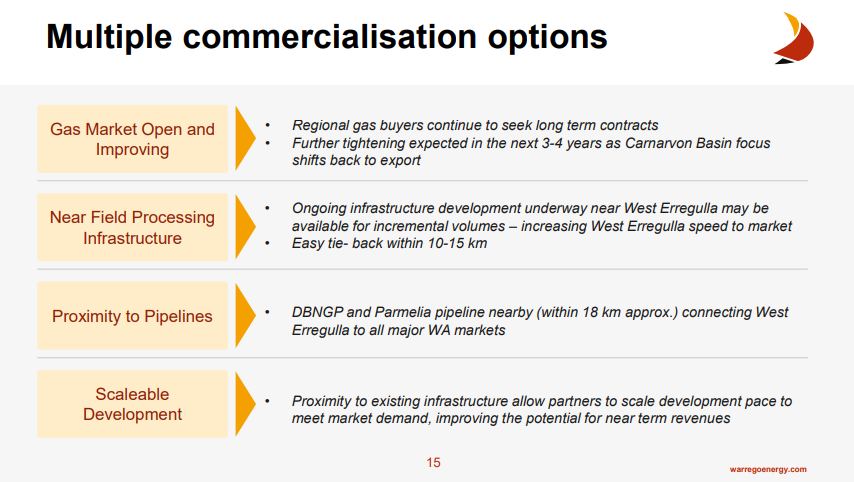

Lately, these two small players in the oil & gas segment have caught the investorsâ eyes. The companies are being benefitted by the developments occurring in a 50-50 Joint Venture by Warrego Energy and Strike Energy at the West Erregulla-2 in EP 469.

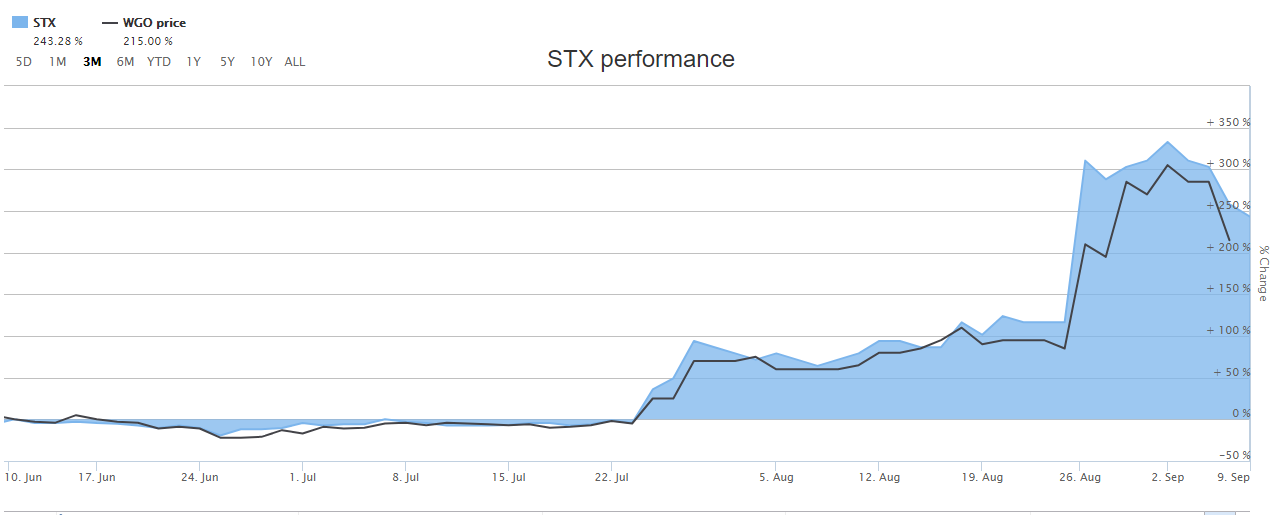

STX & WGO price movement in the last 3 months (Source: ASX)

STX & WGO price movement in the last 3 months (Source: ASX)

Price Movement

On the price movement front, both the stocks have performed similarly in the last three months to 9 September 2019. Meanwhile, the development at the EP 469 has been very favourable to both the companies.

West Erregulla-2

Situated in onshore Perth Basin, West Erregulla-2 is a long-term gas production region in WA. According to reports, the drilling was commenced in June this year. The region has emerged as one of the most exciting areas in the country for gas exploration, following the Waitsia discovery.

Reportedly, one of the major conventional gas discoveries is Kingia sandstone, which was intersected close to prognosis. Kingia has an excellent reservoir quality with high gas saturation and porosities up to 19% (average 14.3%). Subsequent drilling intercepted the High Cliff sandstones, and extended drilling breaks were observed through the high cliff with elevated gas readings.

Further, a net pay of 10m in a gross High Cliff gas column of at least 22m was observed, in line with pre-drilling expectations and Waitsia analogues. Besides, the third major discovery is Wagina, which observed a net reservoir of 10.2m in a gross Wagina gas column of 79m. Porosities of up to 14% and reservoir pressure in excess of 6,800 psia were also noticed at the Wagina discovery.

Commercialisation Options (Source: Warrego Energy Presentation, August 2019)

Commercialisation Options (Source: Warrego Energy Presentation, August 2019)

On 11 September 2019, WGOâs stock was trading at A$0.325, up by 6.557% (at AEST 12:22 AM). Over the year-to-date period, the stock of the company has returned +510%. In the last three months, the return of the stock is +205.00%.

Concurrently, STX stock was trading at A$0.27, up by 5.882% 9 at (AEST 12: 25). The stock has returned +200.00% in the year-to-date period. Besides, the return of the stock has been +280.60% in the last three months period.

Technology Going Private

Dreamscape Networks Limited (ASX: DN8)

Dreamscape Networks provide domain name and hosting solutions in Australia. Over the year-to-date period, the return of the stock has been +227.16%. In the last three months, the stock has returned +96.3%.

Acquisition

In July this year, the company entered into a Scheme Implementation Deed (SID) with Web.com Group, Incorporated, which would see Web.com acquiring all the issued capital of the company for a cash consideration of A$0.27 per DN8 Scheme Consideration or ordinary share. Besides, Web.com is an affiliate of a private equity firm based in New York.

Meanwhile, the Scheme Consideration represents a 32% premium to the closing price on 19 July 2019, and a 68% premium to the 30-day VWAP. The board of the company recommended voting in favour of the Scheme.

Further, the report by the independent expert asserted that the Scheme is reasonable and fair. Considering no superior proposal, the Scheme is also in the best interests of shareholders of the company. The company is set to host the scheme meeting on 7 October 2019 to consider a vote on the proposed transaction.

Full Year Results

Late last month, the company released preliminary final report for the year ended 30 June 2019. Accordingly, the revenue witnessed a growth of 21% to $74.26 million in FY2019 compared to revenue of $61.56 million in FY2018.

Meanwhile, net profit after tax of the company more than doubled, during the year at $5.64 million compared to $2.73 million in FY2019.

On 11 September 2019, DN8âs stock was trading flat at A$0.265 (at AEST 12:36 PM).

Healthcare

Opthea Limited (ASX: OPT)

Clinical biopharmaceutical company, Opthea Limited is focused on the development of drugs to cure retinal diseases.

In August, the company broke the news regarding the positive developments related to its drug candidate OPT -302. The drug is for the treatment in naïve patients with wet age-related macular degeneration (AMD).

Full-Year Results

According to the Preliminary Report for the year ended 30 June 2019, the revenue of the company was down by 20% to $914k compared to revenue of $1.14 million in the previous year. The loss after tax stood at $20.91 million, which was an increase of 23.7% from the previous corresponding period.

On 11 September 2019, OPTâs stock was trading at A$3.53, down by 1.397% 9 (at AEST 12:41 PM). Over the year-to-date period, the return of the stock is +528.07%. In the past three months, the return has been +411.43%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.