Negative shareholder returns, low dividends, lopsided trading, legal accusations and inconsistent business performance are all bane for active companies. The harsh part is the fact that these phases are unlikely to be avoided and befall with almost every operational business. Economic conditions, global trade relations and domestic barriers can lead to adversities and have a direct impact on the companyâs health. Presently, we are in the revolutionary times where technological advancements in the form of Artificial Intelligence, Cultured Meat, Electric Vehicles and Virtual Businesses are the hot topics. Amid these, the basics of business has remained the same, and continue to get exposed to the good and not-so-good phases. It can hence be safely said that change does surround us, but some phases continue to stay.

In this article, we would concentrate on the present business standing of financial group AMP Limited (ASX:AMP), and the events that are directing market experts and investors to question whether the company has hit rock bottom.

Company Profile: A 170 years old wealth management company, AMP offers solutions, financial advice and services in the areas of investment management, banking, superannuation, self-managed superannuation funds, investing, life insurance and retirement income. With the aim to aid customers in managing their finances and achieving their goals, the company, based in Australia, caters to the Middle East, Europe, Asia, North America and the UK. It is operational in eleven countries and has over 3.5 million customers alone in the ANZ region. The company trades on two stock exchanges- Australian Securities Exchange (ASX:AMP) and the New Zealand Stock Exchange (NZE: AMP).

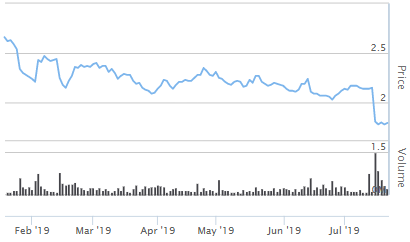

Tumbled Stock Performance: The AMPâs shares have settled the dayâs trading session at A$1.780, as on 22 July 2019, down by 0.84 per cent. The 52-week low of the company has been A$1.740 (close to its present value) and the high has been A$3.690. With a market capitalisation of A$5.29 billion, the AMP stock has approximately 2.95 billion outstanding shares.

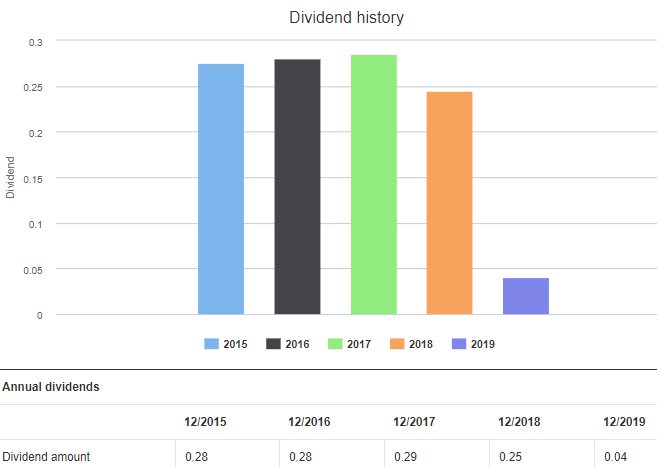

The annual dividend yield of the stock is 7.8 per cent and the EPS stands at A$0.010, with the P/E ratio of 179.5x. The 2019 dividend was lower than it has been over the years at A$0.04 for December 2019, lower than A$0.25 of pcp (December 2018).

AMP stockâs dividend history (Source: ASX)

On the shareholderâs return front, AMPâs stock has delivered negative returns of 13.29 per cent, 21.27 per cent and 31.49 per cent in the last one, three and six months, respectively. The YTD return has been a negative at 26.43 per cent.

AMP stockâs 6-month return (Source: ASX)

Uncertainty around the AMP Life transaction: On 15 July 2019, the company updated the market with the uncertainty prevailing over the sale of its Australian and New Zealand wealth protection and mature businesses, AMP Life to Resolution Life, driven by the issues pertaining to the mandate conditions of the Reserve Bank of New Zealand approval. The condition necessitates an RBNZ approval of a change of control for AMP Life in a form which should be in sync with its present branch structure, which exempts AMP Life from various legislative requirements of New Zealand.

This uncertainty and the anticipation that the sale would not proceed further is a huge disappointment for AMP, given that the sale of AMP Life had been regarded as a foundational element of the companyâs strategy.

New solutions are presently being formulated by the company along with Resolution Life, to figure out a way to address policyholdersâ interests, regulatory requisites and look upon a certainty of execution.

AMP had been notified by Resolution Life on 13 July 2019 that RBNZ would cease to consider Resolution Lifeâs change of control application unless there was an independent and ringfenced assets held in New Zealand in the best interest of the NZ policyholders, which presently was inconsistent with the branch structure. AMP believes that adhering to this mandate would have an adverse implication on the commercial return of the sale for both the involved parties.

Various factors would impact future sale price- best estimate assumption changes since 30 June 2018, (dip by almost A$400 million) and the impact of Protecting Your Super legislation, (dip by almost A$300 million) and the effects of the Putting Membersâ Interests First Bill.

In a situation wherein the revised transaction regarding the AMP Life sale does not materialise, the company would retain it and manage it as a specialist life insurance and a mature business, aiming at positive policyholder outcomes and better cost and capital efficiency.

Capital Position and Zilch Interim Dividend: AMP notified that its 1H19 accounts had not been finalised and a Level 3 eligible capital surplus would be reported, as per the company. This would be above the minimum requirements and in sync with the target surplus capital which was set by AMPâs Board.

Continuing its apprehensive phase, the company announced that there would be no interim dividend that would be paid for 1H19, driven by the uncertainty of the AMP sale, forcing the Board to consider a practical approach to capital management.

Legal Accusation: Legal bashes are a turmoil for a business entity and affect almost every sphere of their operations. On 30 May 2019, AMP stated a superannuation class action proceeding has been filed on behalf of superannuation customers and their beneficiaries by Maurice Blackburn in the Federal Court in Melbourne. The accusation was filed for few of the companyâs subsidiaries and related to the fees charged to members.

AMP had âfalteredâ from its purpose: In the companyâs Annual General Meeting of 2019, Chairman David Murray stated that in 2018, AMP had faltered from its purpose which led to shareholders suffering. The dark phase was highly driven by the unique inspection that arose out of regulators, politicians, media and the community, with The Royal Commission being the main catalyst. Customer issues were highlighted, risk management along with controls and governance was questioned, and an accountability and consequence management were made the focus.

On the financial end too, AMP posted lower numbers. The underlying profit for 2018 was A$680 million and the profit attributable to stakeholders stood at A$28 million. The total dividend for 2018 was reduced to 14 cents per share.

With a motive to move on from the adversities witnessed in 2018, the company is regarding 2019 to be the year of transition, wherein a hoard of initiatives would be implemented to bring in positive changes and implications in the overall business. The company would work towards separating the Australia and New Zealand insurance and strengthen the internal controls, risk management an overall governance. The AMP Bank would be focussed upon and growth momentum would be inflicted in AMP Capital.

Continued Weakness in Inflows and Higher Outflows: AMP notified about its Q1FY19 cashflow update on 2 May 2019, stating that the Australian wealth management net cash outflows amounted to A$1.8 billion, depicted the continuity of weak inflows and surged outflows. AMP Capital net external cash outflows amounted to A$20 million. Even though the AMP Bank increased its deposits by A$218 million, the total loan book went up by A$127 million and was recorded at A$20.1 billion.

On a good note, there was increase in AUM across businesses, an implication of the prevailing stronger investment markets- Australian wealth management went up by 5 per cent, New Zealand wealth management was up by 7 per cent whereas the AMP Capital surged by 4 per cent.

Amid the phase of transition and transformation, and a business environment which is surviving the Royal Commission environment and interest rate cuts, it would be interesting to witness the events and proceeds of AMP, while investors and market experts await the companyâs unfolding of its moves and decisions in the rest of the year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.