Summary

- Australian Materials Sector Index has moved up ~35% since 23 March 2020, on the back of shooting iron ore prices, government stimulus packages to support businesses amid impacts of COVID-19, and gradual reopening of the economy.

- Boral Limited, a key supplier to the building and construction material market, is building a strong liquidity position including access to the US capital markets.

- James Hardie Industries’ net operating profit increased 17% for Q4FY20 and FY20, while adjusted EBIT went up by 21% for Q4 and 20% for FY20.

- Amcor and Orica, both recorded net profits for third quarter and half year ended 31 March 2020, respectively.

Materials sector comprises companies engaged in the mining and refining of metals, chemical products (fertilizers, industrial gases, etc.), as well as forestry products, which all are processed and manufactured as raw materials for other industries/companies that further develop them into finished goods for consumers.

As a key supplier to the construction market, materials sector is quite susceptible to fluctuations in the economy and tend to thrive during a boom. Thus, a flourishing construction market offers a conducive economic environment for material sector companies to make profits.

Since 23 March 2020 to date, S&P/ASX 200 Materials Sector Index has moved up by ~35%, particularly rallying in May 2020, owing to breaking records by iron ore prices, financial stimulus packages released by governments, globally, as well as steps being taken to gradually reopen the Australian economy, as the coronavirus pandemic (COVID-19) has begun to subside.

Do Read: Guide to Portfolio Strategies and Investment Avenues to Wade Through COVID-19 Crisis

On 12 June 2020 (AEST 12:37 PM), S&P/ASX 200 Materials Sector Index was trading at 13,248.1, down 1.57% from its previous close.

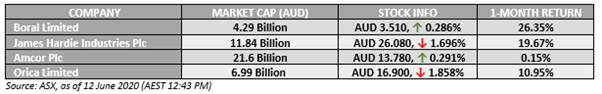

Discussed below are four of the key ASX-listed materials sector stocks and their recent developments.

Boral Limited (ASX: BLD)

Australia-based Boral Limited (ASX:BLD), established in 1946, manufactures and sells building and construction materials in the US, Australia, and Asia, particularly for the residential and non-residential construction, engineering and infrastructure markets.

Debt Facilities Update: Early June 2020, the Company announced successful completion of its new US Private Placement (USPP) note issue of US$ 200 million, as per the market update on 15 May 2020, comprising two tranches with five and seven-year bullet maturities with an average coupon of 4.49% and terms and conditions in line with the Company’s existing USPP notes.

Moreover, Boral has successfully completed execution of its new bilateral 2-year bank loan facilities amounting to ~AU$ 365 million, consistent with credit approvals announced on 15 May 2020. The Company also completed its new bilateral loan facilities totalling US$ 740 million and maturing in June 2024. These loan facilities replace BLD’s US$ 750 million debt facility that was scheduled to mature in July 2021.

During mid-May 2020, Mike Kane, Boral’s CEO & Managing Director, stated that impacts of coronavirus-led measures on the Company’s people and markets have been substantial and are expected to be there for some time. To respond to the changes, BLD has aligned production and cost structures with demand while access to the US debt capital markets and strong support of the banks have strengthened Boral’s liquidity position.

Do Read: Don’t Miss! Latest ASX Capital Raising of Iress, Vicinity Centres & Boral

James Hardie Industries Plc (ASX: JHX)

James Hardie Industries plc (ASX: JHX) manufactures building products such as fibre cement siding, backer board, and pipes for various markets including new home construction and remodelling in the United States, Philippines, Europe, Canada, Australia and New Zealand.

Q4FY20 & Full Year Results: James Hardie Industries released its financial results update for the fourth quarter of fiscal year 2020 (Q4 FY20) and the full year ended 31 March 2020 (FY20), posting:

- Group Adjusted net operating profit of US$ 86.6 million for Q4 and US$ 352.8 million for FY20, both increasing by 17% relative to the prior corresponding period (pcp).

- Group Adjusted EBIT of US$ 121.0 million for Q4 and US$ 486.8 million for FY20, an increase of 21% and 20%, respectively, on pcp.

- Net sales for the Group totalled US$ 673.2 million for Q4 and US$2,606.8 million for the full year, marking an uptick of 8% and 4%, respectively, compared to same period a year ago.

The robust financial performance delivered by the Company has demonstrated its ability to consistently execute in both growing and highly volatile markets, particularly in North America, as per Dr Jack Truong, CEO, James Hardie.

Do Read: Why Is James Hardie Topping the Charts Today on S&P/ASX200?

Amcor Plc (ASX: AMC)

Amcor Plc (ASX: AMC), operating in more than 40 countries, is a global leader in developing and producing flexible and responsible packaging for different products including pharmaceutical, food, beverage, medical, and home- and personal-care. The Company is focused on creating lightweight, recyclable and reusable packaging.

On 12 June 2020, S&P Dow Jones Indices announced changes in the S&P/ASX indices, as per which Amcor will be removed from S&P/ASX 20 Index, effective at the open on 22 June 2020.

Third Quarter Results: On 12 May 2020, Amcor Plc announced the Group financial results for the third quarter ended 31 March 2020, posting net sales of US$ 3,141.0 million, up from US$ 2,309.9 million in the pcp. Gross profit totalled US$ 652 million, also depicting an increase from US$ 419.8 million.

Net income attributable to Amcor Plc amounted to US$ 181.5 million, up from US$ 112.6 million in the same period a year ago. Diluted earnings per share also increased from US$ 0.097 to US$ 0.114.

Group’s cash and cash equivalents at the end of period stood at US$ 537.8 million, including US$ 470.3 million provided by operating activities and US$ 116.4 million provided by investing activities undertaken during the quarter.

Must Read: The Tale of Defensive Packaging Giant: Amcor

Orica Limited (ASX: ORI)

Orica Limited (ASX: ORI) is the world leader in provision of commercial explosives and innovative blasting systems to the mining, quarrying, oil & gas and construction markets. The Company also supplies sodium cyanide for the process of gold extraction, and ground support services for mining and tunnelling activties.

Half-Year 2020 Results Update- Orica released strong financial results for the half year ended 31 March 2020, recording statutory net profit after tax (NPAT) of AU$ 165 million for the reporting period, compared to AU$ 33 million in the pcp, amid severe bushfire and weather issues in Australia, and the first impact of the coronavirus. The EBIT also increased 2% for the period (5% after adjusting for an ownership structure change of the Company’s China business).

The strong results have mostly been in line with the Company’s expectations, with earnings growth led primarily by a 4% increase in AN volumes, a strong underlying performance observed across all regions and further improvement from Minova, according to Alberto Calderon, MD and CEO, Orica Limited. He added that the Company’s safety performance has largely improved over the years, with the serious injury case rate recorded at its lowest level since past three years.

The Board also declared an unfranked interim ordinary dividend of 16.5 cents per share to be paid on 8 July 2020, representing a payout ratio of 40%.

Do Read: ASX Stocks under Discussion: NCM, COE, ORI, PLS, AGS, DAV