Automotive Holdings Group Limited (ASX: AHG), Australiaâs largest motoring group and A.P. Eagers Limited (ASX:APE), the seller of new and used motor vehicles, are into a discussion and process of merger of the two businesses, since the first offer made by APE in April 2019. By 29 August 2019, the parties have come to a point where APE has released a postcard to AHG shareholders requesting them to accept the proposed merger offer in order to avail the opportunities such as 14 cents per share interim dividend, share in future growth of the newly merged group and also become a part of leading Automotive Retail Group in Australia.

A detailed look into the merger journey;

A.P. Eagers Limitedâs first Offer to Automotive Holdings Group Limitedâs shareholders

On 5 April 2019, A.P. Eagers Limited announced its intention to make a conditional, all-scrip offer to acquire all shares in Automotive Holdings Group Limited via off-market takeover bid. At the time of offer, A.P. Eagers was the major shareholder in Automotive Holdings Group, holding 28.84% interests in Automotive Holdings Group.

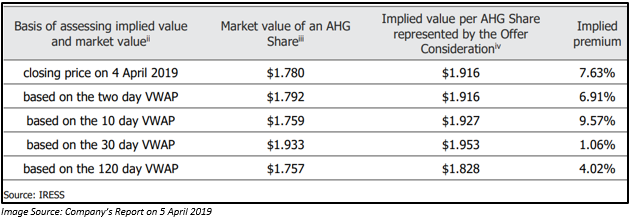

As per the initial offer made by APE, the shareholders of AHG apart from the foreign shareholders would be receiving 1 fully paid ordinary share for every 3.8 shares of AHG. The calculation was as per the below table:

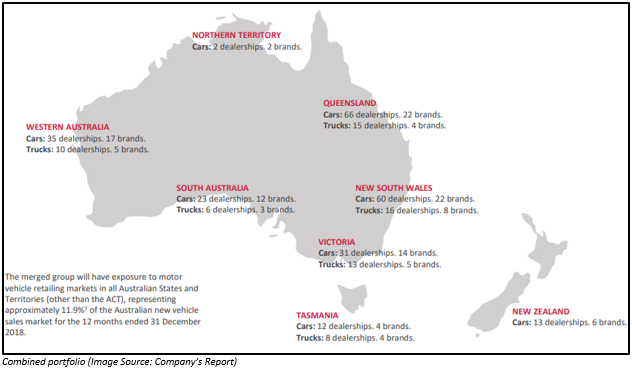

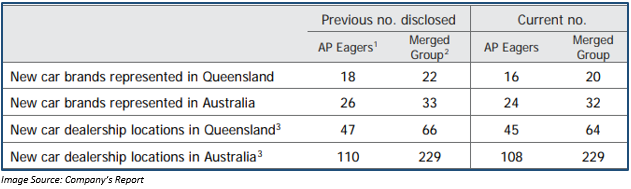

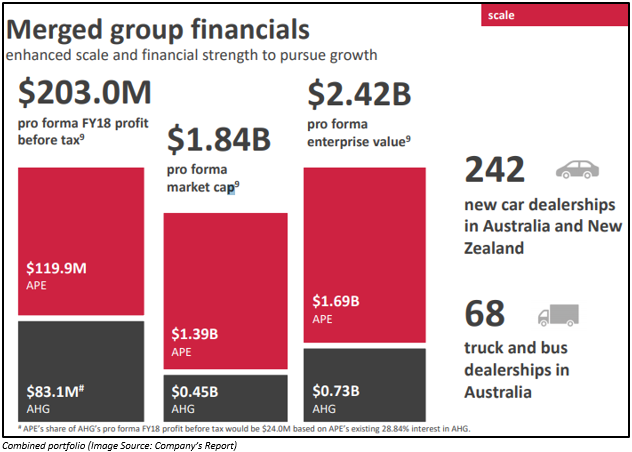

With the merger of both the company, APE expected that it would lead to better future growth opportunities via geographical portfolio diversification, improved brand portfolio diversification along with a larger and flexible balance sheet. Other than this, the merged group was anticipated to benefit via management expertise which had helped APE in delivering consistent profit, dividend and EPS growth.

The offer was conditional upon ACCC approval as well as the conditions mentioned in the Bidderâs statement. Some of the conditions were:

- There would be no regulatory actions which impact the offer adversely.

- No prescribed occurrences as per section 652C Corporations Act in respect of AHG.

- There would be no material acquisitions, disposals or significant events being commenced by AHG.

- Any third party which could end a material agreement with AHG due to the merger, consenting to the merger or stating an intention not to exercise its rights in that regard.

On 23 April 2019, APE had dispatched the Bidderâs Statement. On the same date, AHG requested its shareholders an open letter to take no action on the Bidderâs Statement of APE, as AHG stated that the offer was highly conditional, and that the shareholders of AHG would not be able to receive any shares in APE with those conditions being outstanding. AHG also stated in the in case, the shareholders accepted the offer, they could not sell them on the market. Moreover, AHG shares were valued more on the market than as per the offer.

So, the board and the management of AHG along with the advisers were examining the offer, and the target statement was to be posted to the stockholders by 8 May 2019. The target statement had details related to the recommendation provided by the board related to the offer along with the basis for that recommendation.

First Supplementary Bidderâs Statement:

In the first Supplementary Bidderâs Statement, APE provided information related to its ASX announcement regarding the sale and leaseback of Newstead property. It also provided correction of details regarding AHG Performance Rights on issue. The application for merger authorization was lodged with ACCC on 23 April 2019, and the validity of AP Eagersâ application was scrutinized by the ACCC.

Second Supplementary Bidderâs Statement:

In the second Supplementary Bidderâs Statement, released to the market on 1 May 2019, AP Eagers provided information related to the acquisition of the business assets of Adelaide BMW and Adelaide MINI Garage from Adelaide Motors Pty Ltd. The second Supplementary Bidderâs Statement also contained information that APE received confirmation from ACCC that it received a valid application for a merger authorisation from AP Eagers.

On 7 May 2019, AHG Board unanimously recommended its shareholders to agree to take the Improved offer of APE. APE agreed to differ its all-scrip offer in order to acquire shares in AHG. The previous offer, 1 A.P. Eagersâ Share for every 3.8 Automotive Holdings Group shares, was changed to 1 A.P. Eagersâ Share for every 3.6 Automotive Holdings Group shares.

Third Supplementary Bidderâs Statement:

In the third Supplementary Bidderâs Statement released to the market on 8 May 2019, APE highlighted that it had signed an implementation deed with AHG under which the board of AHG agreed to unanimously recommend its shareholders accept the Improved Offer, in the absence of a superior proposal and the shareholders accept the offer once APE confirms no material adverse change bid condition as per the implementation deed. Also, the directors of AHG announced their intention to accept the improved offer with respect to any AHG Shares they own or control in the absence of a superior proposal.

Fourth Supplementary Bidderâs Statement:

The fourth Supplementary Bidderâs Statement, released on 15 May 2019, provided updates from the APEâs 2019 AGM. It also highlighted the sale of Audi Centre Sunshine Coast and Volvo Cars Sunshine Coast which was scheduled to complete on 17 May 2019.

On 24 June 2019, APE noted the market feedback and preliminary view from ACCC which was released on that date regarding the proposed merger with AHG. As per ACCC, the proposed merger was not likely to significantly reduce competition for the supply of new cars in Sydney, Brisbane, and Melbourne or nationally.

APE continued with the review of ACCCâs preliminary views and believed that the merger would not reduce competition in the market. Even in a few geographic locations, APE was of the opinion that there would be choice and competition.

Fifth Supplementary Bidderâs Statement:

The fifth supplementary bidderâs statement, released on 27 June 2019, highlighted the announcement related to sale and leaseback of Newstead property which was owned by APE in Brisbane.

Sixth Supplementary Bidderâs Statement:

Sixth supplementary bidder's statement, released on 5 July 2019, highlighted on APEâs proposal to divest the Kloster Motor Group pursuant to an undertaking it was recommending to offer the ACCC as per section 87B of the CCA.

Seventh Supplementary Bidderâs Statement:

Seventh supplementary bidderâs statement highlighted on ACCCâs determination to grant merger authorization. On 25 July 2019, A.P. Eagers Limited announced that ACCC had decided to allow merger authorisation for AP Eagers so that it can acquire shares in AHG under its offer which was subjected to APEâs undertaking for its Kloster business divestment. The merger authorization at that point of time was supposed to be effective on 16 August 2019 on the expiration of the statutory period available for the parties with enough interest to apply for a review of the determination of ACCC.

Other than this, the bidder statement also highlighted that APE had given an undertaking to ACCC regarding the divestment of its Klosters business to the Tony White Group.

Eighth supplementary bidderâs statement:

In the eighth supplementary bidderâs statement, APE highlighted on the offer being unconditional and requested all the shareholders to accept the offer.

On 16 August 2019, AP Eager limited announced that the merger authorisation of ACCC became effective after the expiry of the statutory period for any third party to apply for a review of the ACCCâs determination without any application requirement.

APE also declared that the shares in AHG which it does not own were free from all remaining bid condition, i.e. the offer became unconditional. Based on this, APE requested all the shareholders to accept the offer who had not yet accepted without any delay as the conditions which were discussed before got fulfilled. Those shareholders who would agree to accept the offer would be issued with the shares of APE within 7 business days. Also, to be eligible for the dividend, the shareholders have to accept the offer before the offer closes on 16 September 2019 at 7:00 pm, Sydney time.

On the same date, AHG also released an announcement where its board recommended its shareholders to welcome the offer in the absence of a superior proposal.

On 21 August 2019, the directors of AHG accepted the offer made by APE for all the shares which were under their control or which they owned.

Stock Information:

On 30 August 2019, the shares of AHG closed at $3.39, up by 4.954% and APE shares closed at 12.370, up by 4.831%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)