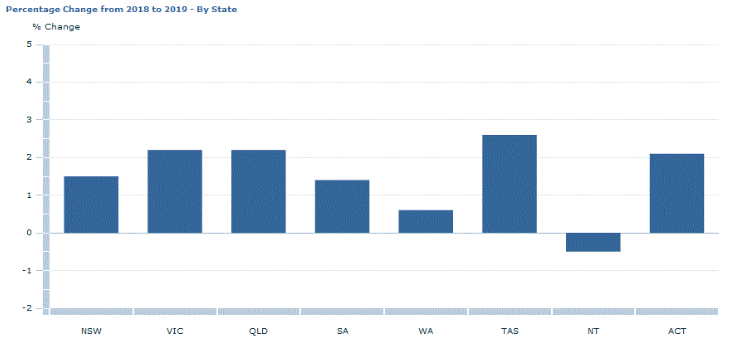

As of 31 January 2019, number of registered motor vehicles in Australia stands at 19.5 million. On a year-on-year basis, the national fleet grew by 1.7% from 2018 to 2019.

Source: Australian Bureau of Statistics

Source: Australian Bureau of Statistics

In this article, we will discuss three companies that are operating in the automotive related landscape. Let us have a broader look at these companies along with their performance on ASX.

GUD Holdings Limited

GUD Holdings Limited (ASX:GUD) is a leading provider of automotive products, pumps, pool & spa systems, and water pressure systems. It is engaged in the manufacturing, import, distribution and sale of its products. The company operates in Australia, New Zealand, France and Spain.

According to a company announcement on 1 August 2019, it is scheduled to hold its 2019 annual general meeting at the RACV City Club in Melbourne on 24 October 2019. The company plans to send a notice regarding the meeting to its shareholders in September 2019.

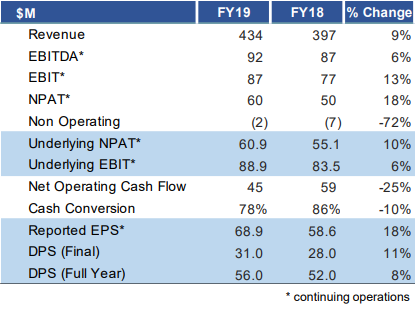

FY19 Financial Results: Recently, the company released its results for the financial year 2019, reporting a 9% year-on-year increase in revenue from continuing operations to $ 434 million, backed by organic growth and automotive acquisitions and a 6% year-on-year rise in underlying EBIT from continuing operations to $ 88.9 million. During FY19, the company reported a net profit after tax from continuing operations of $ 60 million, up 18% from $ 50 million in the same period a year ago.

FY19 Highlights (Source: Companyâs Report)

Its automotive segment delivered solid results despite challenging environment, registering a 12% increase in revenue against the same period a year ago and a 5% increase in its underlying EBIT to $ 87.4 in FY19. The company also reported strong performance in both domestic and export sales, primarily driven by Disc Brakes Australia (DBA), acquired in July 2018 for $ 22.2 million. Meanwhile, the companyâs

water business saw modest revenue and EBIT growth in down market. GUD Holdings reported an 11% increase in final dividend to 31 cents per share for FY19 when compared with FY18. Its full year dividend for FY19 stood at 56 cents per share, up 8% from 52 cents per share in FY18.

FY20 Outlook: For fiscal 2020, the company expects modest revenue and EBIT growth in both automotive and Davey segments. Moreover, for FY20, it anticipates the cash conversion to be approximately 80%. During the period, the company intends to focus on boosting key customer relationships for the medium and long term, continuing innovation and expanding product range, and leveraging dedicated acquisition resource.

Stock Performance :On 1 August 2019, GUD stock last traded at a price of $ 9.315, down 2.05% from its previous closing price. It has a market cap of $ 822.48 million and 86.49 million outstanding shares. The stock has an annual dividend yield of 5.89% and a PE ratio of 7.98x, while its EPS stands at $ 1.192. The stock has given negative returns of 7.31%, 21.21% and 15.39% in the last one month, three months and six months, respectively.

carsales.com Ltd

carsales.com Ltd (ASX: CAR) is an automotive website that runs business related with cars, motorcycle and marine classifieds through which the customers can buy or sell cars, motorcycles, boats, caravans and trucks. The company has started a strategic review for selling its 50.1% stake in vehicle finance broking business Stratton Finance Pty Ltd, as per a market update by the company in mid-June 2019. CAR is conducting the strategic review with the help of Miles Advisory Partners, to focus on its core business and to grab the opportunities for growing its business in Australia and international markets.

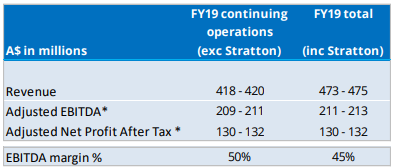

FY19 Results Update: Meanwhile, the company updated regarding its estimates for the results of financial year 2019, which will classify Stratton as a discontinued operation. For FY19, the company expects revenue from continuing operations to be in the range of $ 418 million - $ 420 million, adjusted EBITDA from continuing operations in the range of $ 209 million - $ 211 million and adjusted net profit after tax from continuing operations to be in the range of $ 130 million â $ 132 million. The company expects EBITDA margin from continuing operations to be 50% and total EBITDA margin (including Stratton) to be about 45% for the financial year 2019. The company is due to release its full year results for FY19 on 21 August 2019.

FY19 results estimates (Source: Companyâs Report)

Stock Performance: On 1 August 2019, CAR stock last traded at a price of $ 14.885, up 0.779% from its previous closing price. It has a market cap of $ 3.61 billion and 244.35 million outstanding shares. The stock has an annual dividend yield of 2.99% and a PE ratio of 26.38x, while its EPS stands at $ 0.560. The stock has given positive returns of 8.30%, 10.55% and 19.71% in the last one month, three months and six months, respectively.

A.P. Eagers Limited

A.P. Eagers Limited (ASX:APE) is a pure retail automotive player, representing a diversified portfolio of automotive brands. The company operates in Queensland, Adelaide, Darwin, Melbourne, Sydney and New South Wales. It is engaged in new and used vehicle sales, servicing of vehicles and parts, financing of vehicles, leasing of vehicles, among others.

APE Credentials (Source: Companyâs Report)

APE Credentials (Source: Companyâs Report)

ACCC Determination for APE-AHG Merger: On 25 July 2019, the company announced that the Australian Competition and Consumer Commission (ACCC) has determined to award a merger authorisation for the acquisition of shares in Automotive Holdings Group Limited (ASX: AHG) by APE. The merger authorisation will come into force on 16 August 2019, after the expiry of the statutory period available for parties with a sufficient interest to apply for a review of the regulatorâs determination. Meanwhile, expressing his delight on the ACCC grant, AP Eagersâ CEO Martin Ward asked AHG shareholders, who are yet to give their acceptance for the offer, to do so to get eligible for scale and synergy benefits afforded by the merger, in addition to dividends sanctioned by the APE board prior to the end of the offer period.

Further, APE has given an undertaking to the ACCC for the divestment of the Kloster Motor Group to the Tony White Group, for which the negotiations are going on between both the parties. The sale price is projected at $ 54 million for Klosterâs net assets and goodwill. The sales transaction is likely to close in November 2019, subject to the fulfilment of some conditions.

Stock Performance: On 1 August 2019, APE stock last traded at a price of $ 10.770, down 3.839% from its previous closing price. It has a market cap of $ 2.14 billion and 191.31 million outstanding shares. The stock has an annual dividend yield of 3.26% and a PE ratio of 21.54x, while its EPS stands at $ 0.520. The stock has given positive returns of 11.67%, 27.27% and 74.45% in the last one month, three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.