Dividend yield refers to the amount of dividend paid as a percentage of a companyâs current market price. A company with high dividend yields often pays substantial returns to its shareholders. It is a measure that accounts the amount of cash flow an investor gets back for the capital he/she invested in the business.

The formula for calculating dividend yield: Dividend Yield=Dividend Per Share/Current Market Price Per Share

Below discussed are some ASX listed players with annual dividend yield of over 4%.

Harvey Norman Holdings Limited (ASX: HVN)

Harvey Norman Holdings Limited (ASX:HVN) operates as an integrated retail, franchise and property entity.

HVN Renounceable Pro Rata Entitlement Offer Update: The company recently announced the results of the pro rata entitlement offer, targeted to raise approximately $173.49 million. Under the offer, eligible shareholders were offered to acquire one fully paid ordinary share for every seventeen shares held, at an issue price of $2.50 per new share. The company received valid applications for 66,270,064 shares, representing approximately 95.5% of the shares offered.

Dividend: During FY19 ended 30 June 2019, the company made dividend payments of approximately $342.12 million compared with the FY18 dividend payments of $267.34 million, representing an increase of $74.79 million year on year. This growth was mainly due to the higher 2018 final dividend, which was paid in December 2018.

The directors had also recommended a fully franked final dividend of 21.0 cents per share, which was paid on 1 November 2019. The total dividend in respect of the year ended 30 June 2019 of 33.0 cents per share represented 96.77% of profit after tax and non-controlling interests.

Stock Performance: As on 21 November 2019, the market capitalisation of the company stands at $5.31 billion. As per ASX, the stock of HVN gave a return of 11.79% in the past 6 months and a return of 4.85% in the past 30 days. In terms of valuations, it is trading at a P/E multiple of 12.280x with annual dividend yield of 7.75%. The stock closed the dayâs trade on 21 November 2019 at $4.220.

Wesfarmers Limited (ASX: WES)

Wesfarmers Limited (ASX: WES) is engaged in retail operations, covering home improvement and office supplies; general merchandise and specialty departments stores, gas processing and distribution; chemicals and fertilisers; and industrial and safety products.

Dividend/Distribution â WES: The company paid a dividend of 78 cents per share on fully paid ordinary shares on 9 October 2019 for the six-month period to 30 June 2019, bringing the full-year ordinary dividend to $1.78 per share (FY19). Moreover, the company paid a special dividend of one dollar per share in April 2019. With the special dividend payment, the total fully franked dividends paid for each share stood at $2.78 for the year.

Business Highlights: In the recently held Annual General Meeting of the company, the top management stated that during the year ended 30 June 2019 (FY19), elevated contributions from Bunnings, Officeworks and Industrials and other activities, including a 15% share in Coles Group resulted in a 13.5% increase in net profit from continuing operations from $1.7 billion to $1.9 billion. For the year, revenue of the company went up by 4.3% to $27.9 billion. Also, with a strong balance sheet, the company is well placed to witness continued growth and returns.

Stock Performance: As on 21 November 2019, the market capitalisation of the company stands at $47.88 billion. The stock of WES gave a return of 15.04% in the past half year and a return of 3.73% in the past 30 days. This led the stock to trade close to its 52-week high of $42.650. In terms of valuation, it is trading at a P/E multiple of 8.670x with annual dividend yield of 4.22%.

G8 Education Limited (ASX: GEM)

G8 Education Limited (ASX:GEM) is engaged in the operation of early education centres owned by the group and ownership of early education centre franchises.

Dividend: On 3 October 2019, the company paid a fully franked dividend of 4.75 cents per share on fully paid ordinary shares for the half?year ended 30 June 2019, being a 0.25 cents per share increase on the prior year H1 dividend. As per ASX, GEM has a market cap of $906.55 million with annual dividend yield of 6.47% (as on 21 November 2019).

What to Expect: The company is expecting an acceleration in EBIT growth in CY20. The expectation can be primarily attributed to the centre turnaround program using tried and tested methodology to be applied to 80 centres, and portfolio optimisation to maximise network capital allocation and returns. Other factors that would drive the anticipated EBIT growth are the ramp up of Greenfield occupancy and EBIT, and non-recurring costs of $10 million, with costs fully funded by program benefits. GEM, therefore, anticipates full-year underlying EBIT to be in the range of $131 million to $134 million for the year. The impact of AASB16 would increase this EBIT range by circa $30m for the year.

Stock Performance: As per ASX, the performance of the stock went down by 31.6% in the past 6 months and declined by 22.75% in the past 30 days. This led the stock price to trade close to its 52-week low of $1.915. In terms of valuation, the stock is trading at a P/E multiple of 13.340x.

Navigator Global Investments Limited (ASX: NGI)

Investment management solutions provider, Navigator Global Investments Limited (ASX:NGI) is headquartered in Queensland.

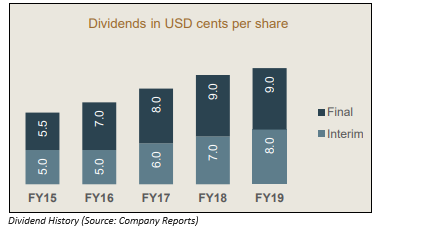

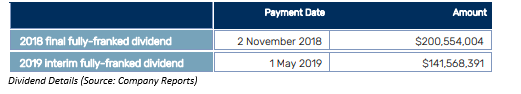

Dividend/Distribution â NGI: The company, which has a policy of paying a dividend of 70% to 80% of the earnings before interest, tax, depreciation and amortisation and impairment losses (EBITDA), paid a dividend of 9 US cents per share on fully paid ordinary shares on 30 August 2019. For FY19, the company paid total dividend of 17 US cents per share, up by 6% on the previous year from 16 US cents per share. As per ASX, the stock of NGI has an annual dividend yield of 9.08% (as on 21 November 2019).

FY20 Outlook: The company expects to deliver a full year FY20 EBITDA of approximately $33.5 million, consistent with the $17.6 million of EBITDA achieved by the Navigator Group in the second half of the previous financial year. The company has rationalised its cost structure by identifying the level of overall resources needed for the business and expects to incur approximately $0.8 million of severance costs in relation to the redundancies.

Stock Performance: As per ASX, the stock of NGI generated a return of 67.08% in the last 5 years and a return of 4.67% in the past 30 days. As on 21 November 2019, the market capitalisation of the company is $436.18 million. On the valuation front, it is trading at a P/E multiple of 11.4x.

Cadence Capital Limited (ASX: CDM)

Cadence Capital Limited (ASX:CDM) invests in an actively managed portfolio of securities listed in Australia and globally. As on 21 November 2019, the company has an annual dividend yield of 6.71%.

Dividend: The company paid a fully franked final dividend of 2 cents per share on fully paid ordinary shares on 30 October 2019. This brings the 2019 fully franked dividend to up to 5 cents per share, equating to an annual dividend yield of 6.71% on the current market price of $0.735 (on 21 November 2019). Since listing, the company has paid out $1.00 per share in dividends and $1.42 per share if franking is included, which is more than its current market price.

Full Year Performance: Since there was significant volatility through the year in global equities, FY2019 proved to be a challenging year for Cadence Capital Limited. For the financial year ended 30 June 2019, Cadence Capital Limited reported a loss after tax of $59.3 million.

Stock Performance: As per ASX, the stock gave a negative return of 13.37 in the past 6 months and declined by 2.61% in the past 30 days. This resulted the stock to trade close to its 52-week lower levels of $0.715. As on 21 November 2019, it has a market capitalisation of $234.57 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.