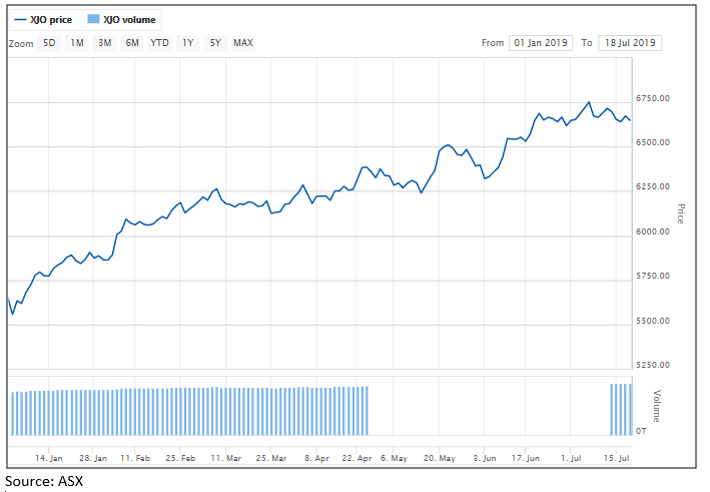

Amidst gloomy global scenario and trade war, S&P ASX 200 has been riding high this year. Given the lower interest rates, investors have remained optimistic for making investments in equity market. With RBA reducing interest rates in 2 consecutive attempts and somewhat stabilizing housing sector, market participants are adopting sound fundamental and technical analysis, while making sound investment decisions.

Below are four stocks that have soared high this year:

Magellan Financial Group Ltd

Magellan Financial Group Ltd (ASX:MFG), an Australian based company that is into the business of funds management, with funds offering to the institutional & retail investors of Australia & New Zealand.

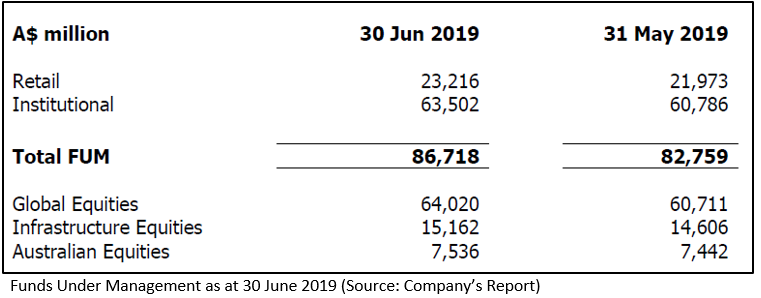

For the first half of 2019, the company had reported 62% rise in the adjusted net profit after tax to $176.3 million as compared to previous corresponding period. The company had posted 35% increase in the average funds under management to about $72 billion. Therefore, the company witnessed 28% rise in the fee revenue related to management and services to about $228 million. MFG had posted 66% rise in the interim dividend per share to A$73.8 cents, compared to A$44.5 cents during previous half yearly period.

Additionally, for the month of June 2019, the company had witnessed the aggregate net inflows of $488 million. The company had received $132 million of net retail inflows in June & $356 million of net institutional inflows. For the period of one year ending 30 June 2019, the companyâs average FUM grew to $75.8 billion compared to $59 billion in the corresponding period last year.

MFG stock has risen 38.67% in three months as on July 18th, 2019. As per market analysts, the stock is overvalued with some correction expected. MFG is currently trading at A$58.140, up 2.8% (as at 1:49 PM AEST, 19 July 2019).

Charter Hall Group

Charter Hall Group (ASX: CHC), is an Australian company, which is into the management and investment of high quality properties.

Acquisition of global Telstra headquarters: The company had recently on 12 July 2019, announced that along with its partner it had bought 100% freehold interest in the global Telstra Corporation Ltd (ASX: TLS) headquarters for the aggregate value of $830 million. The property is situated at the âParis endâ of Melbourneâs CBD. The partners of the company for this deal were Charter Hall Prime Office Fund (CPOF), the Public Sector Pension Investment Board (PSP Investments) and the Group. There is an upgrade works program which is undergoing for building the base. The company expects that this deal would strengthen its relationship with Telstra Corporation, increase the quality the companyâs office portfolio on the back of strong outlook for Melbourne CBD and the Fundâs cash flow. Besides, the deal would get settled during the first half of fiscal 2020. Meanwhile, CPOF is raising funds of approximately $300 million.

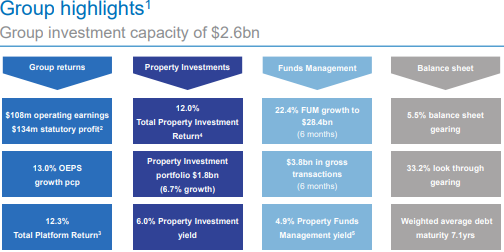

Raised the Projection for FY 19 OEPS: On 1 July 2019, CHC mentioned that for the second half of 2019 it expects the net revaluations to be approximately of $450 million and FUM to rise 6.3% to $30.2 billion. The company expects in fiscal 2020, there will be 125% rise in the number of projects.

Source: Companyâs Report, dated 22 February 2019

CHCâs stock has given a return of 19.79% in the last three months as on July 19th, 2019 and is trading at a P/E ratio of 20.67x. The Charter Hallâs stock was trading at the price of A$11.570, down by 0.942% (as at AEST 3:00 PM).

Goodman Group

Goodman Group (ASX: GMG) is an Australian company that deals with the properties and have operations across various continents. The company has businesses in Australia, New Zealand, Asia, Europe, the United Kingdom, North America and Brazil.

Stock added to S&P/ASX 20 Index: On 14 June 2019, the company notified that there were changes in the S&P/ASX indices, wherein, GMG stock was added to the Australian benchmark index; S&P/ASX 20 Index, effective 24 June this year.

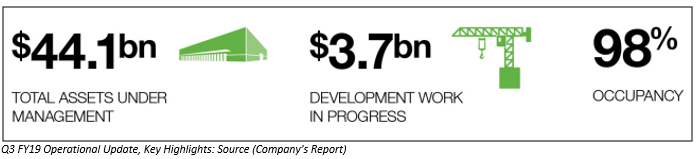

Moreover, for the third quarter 2019, ending on 31 March 2019, the companyâs total assets under management stood at $44.1 billion. The company during the third quarter 2019, experienced 3.3% increase in the like for like NPI in the managed Partnerships. The company had occupancy of more than 98% across the whole group. The companyâs development WIP stood at more than $3.7 billion, had commenced developments of more than $2.4 billion in which 83% of it are undertaken in Partnerships.

Additionally, the company has reaffirmed its forecast for FY19 operating earnings per security and expects it to increase by 9.5% to 51.1 cents on FY18. The company for FY 19 expects 7% increase in the distribution per security to 30 cents on FY18. By June 2019, the company was expecting that Partnership returns and AUM growth will be more than $45 billion. Further, the company expects that in fiscal 2020, the companyâs work in progress will reach the $5 billion mark.

GMGâs stock was trading at A$15.150, up by 0.066% (as at 1:34 PM AEST, on July 19th, 2019) at a P/E of 18.42x.

Telstra Corporation Ltd

Telstra Corporation Ltd (ASX: TLS) is an Australian leading telecommunications company that provide mobile services and broadband services.

Outlook: On 29 May 2019, the company provided the transcript from the market release wherein, it mentioned that it is undergoing through the restructuring and expects to receive $1.5 billion from the sale of the property and projected to receive $400-500 million from its data centre portfolio. TLS has also released recently first 5G device and pricing of the 5G plan. By fiscal 2022, the company expects that the company will able to improve the net productivity by $2.5 billion For FY 19. The company anticipates that its restructuring costs will rise by ~$200 million to $800 million.

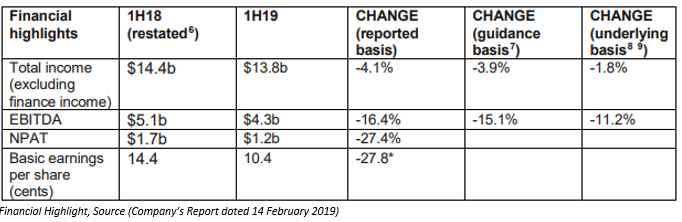

As mentioned in the companyâs financial results for the half-year period ended 31 December 2018; for FY 19 period, the company anticipates the total income to be in the range of $26.2 - $28.1 billion and EBITDA (excluding restructuring costs) is projected to be in the range of $8.7 to 9.4 billion. The company expects the EBITDA, in the range $1.5 to $1.7 billion to come from net one-off nbn Definitive Agreement receipts less nbn net cost to connect. TLS expects the FY 19 capital expenditure to be in the range of $3.9 and $4.4 billion and 2019 Free cashflow is projected to be in the range of $3.1 and 3.6 billion. However, the company anticipates that free cashflow will be at the lower end of the forecasts. This is on back of rise in cash capex, as the company would grab the opportunities present in the enterprise and wholesale fibre markets. Further, the cash redundancies are expected to increase.

Meanwhile, TLSâ stock has generated a return of 11.73% in the last three months as on July 19th, 2019 and is trading at a P/E ratio of 14.6x. The stock of the company was trading at a price of A$3.830, up by 0.525% (as on 19 July 2019, at AEST 2:33 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.