Definition

Related Definitions

Reinsurance

What is reinsurance?

Insurance is a cover taken by individuals or business to protect them against risks. Reinsurance is an arrangement wherein the insurer seeks insurance from other insurance companies agree to secure the risk for the insurance claims that may be made. Reinsurance is also called insurance of insurance. Reinsurance may involve complete or partial indemnification of the risk by the. In the case of reinsurance, the original insurer now becomes the insured. The insurer who gets the risk reinsured is called the original insurer or reassured or reinsured or ceding company or primary insurer. The ceding company's money is freed up, and reinsurance helps to boost the solvency margin. It also allows the ceding firm to expand its underwriting capabilities while lowering its underwriting costs.

Summary

- Reinsurance is the insurance of insurance.

- Reinsurance is an arrangement wherein one or more insurance companies agree to secure the risk for the insurance policy coverage offered by another insurance company.

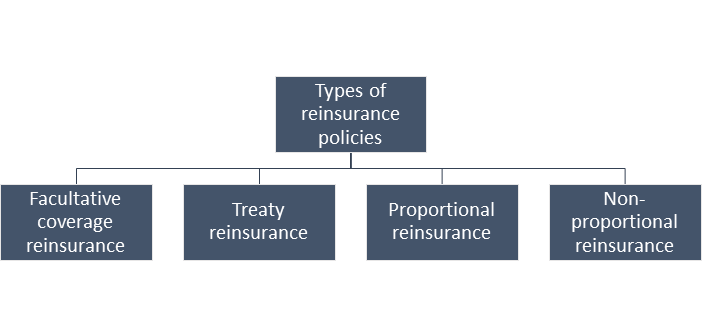

- The main types of reinsurance policies are – facultative coverage reinsurance, treaty reinsurance, proportional reinsurance and non-proportional reinsurance.

Frequently Asked Questions

Some important terms to understand reinsurance

- Ceding company- The ceding company is the primary insurer that seeks reinsurance. Cedent company may also be referred to as cedent.

- Cession- Cession is the amount reinsured or the amount of risk ceded for reinsurance.

- Retrocession- Retrocession is the reinsurance done by the reinsurer of the ceding company.

- Retention- Retention refers to the amount of risk that remains with the ceding company- the balance is the reinsured amount.

- Primary insured- The entity initially seeking insurance cover against risk is called the primary insured.

- Reciprocity- The concept of reciprocity can be understood with a hypothetical example. Suppose Mr. A gets his mansion insured against fire for US$1million with company X. Company X cedes the risk of US$0.6million with company Y. Reciprocity has to do with taking care of mutual benefits i.e when company X cedes to company Y it expects company Y to cede to it in future.

© Rummess | Megapixl.com

What are some things to consider while entering a reinsurance arrangement?

Reinsurance arrangements should consider certain aspects. First, the relative financial strength of the reinsurer must be tested by checking the record for claims payments in various business conditions. The reinsurer must have a sound strategy for managing risk and capital- this indicates the company's strategy for reinsurance with the essential insurance portfolios. Third, the structuring of the reinsurance plan must be thoroughly assessed. Fourth, there should be clarity on the total exposure to one or more reinsurers. Finally, the proportion of net risks retained should be commensurate with the financial resources to meet them.

What are the types of reinsurance policies?

Depending on the way coverage is provided, reinsurance policies can be of the following types:-

Copyright © 2021 Kalkine Media

Facultative Coverage Reinsurance

After receiving an insurance proposal, the insurer determines how much he can keep on that particular risk. If there is still a retention balance, he goes to the facultative market with the request to entice reinsurers to take on the risk. This request is typically made stating all of the risk's details. Then, if a reinsurer is interested in taking on the risk, he accepts it, explicitly expressing the percentage or amount of risk he is willing to take on. In this manner, the insurer moves from reinsurer to reinsurer until the risk is fully absorbed.

Facultative reinsurance is a type of reinsurance in which the ceding business offers each risk it wants to reinsure to the reinsurer in separate single transactions. Each risk that the ceding business wants to reinsure requires the submission, acceptance, and a subsequent agreement. That is, for each policy, it will reinsure, the ceding company will negotiate a separate reinsurance deal. The reinsurer, on the other hand, is not obligated to accept all or any submissions.

Treaty Reinsurance

Treaty reinsurance is a type of reinsurance in which the ceding company and the reinsurer agree to cede particular business classes to each other. The reinsurer, on his part, undertakes to accept all business that qualifies under the "treaty." A reinsurance treaty assures the ceding company that any of its risks that fall within the treaty's terms will be reinsured according to the treaty's conditions.

© Rummess | Megapixl.com

The ceding entity transfers all risks within a book of business to the reinsurer in treaty reinsurance contracts. The two parties will sign a contract in which the reinsurer agrees to accept all covered business. In most cases, the reinsurer expects to generate a profit, although these expectations are monitored and changed over time.

Reinsurers, unlike facultative arrangements, do not conduct individual underwriting on risks accepted through treaty agreements. Instead, that obligation is left to the ceding firm, which is why reinsurers will conduct extensive due diligence before entering a treaty to verify the ceding company is using proper underwriting procedures.

Proportional reinsurance

Proportional reinsurance is another name for pro-rata reinsurance. According to the underlying contract, the primary insurer and reinsurer share liabilities in a precisely specified proportion. The reinsurer normally pays a ceding commission to the ceding business to repay for expenditures connected with issuing the underlying policy Premiums and claims are also divided according to the degree of risk that each party bears (i.e. proportionally).

As a result, when claims are filed, the reinsurer will be responsible for a percentage of the losses. The reinsurer will split a percentage of the premiums and losses according to an agreed-upon percentage. The reinsurance firm will also reimburse the insurance company for all associates costs in proportional manner. Such charges, sometimes known as ceding commission, may be paid to the insurance company in advance.

Non-proportional reinsurance

In the case of non-proportional reinsurance, the reinsurer pays losses over the ceding company's retention limit, up to a certain amount. The reinsurance premium is computed separately from the insured's premium. The non-proportional contract reduces the reinsurer's risk by requiring the ceding insurer's loss to surpass a certain threshold before the reinsurer becomes liable. Non-proportional reinsurance is less expensive for reinsurers, but it might result in significant losses and uncertainty. Excess-of-Loss it a type of non-proportional reinsurance. The reinsurer will cover only damages that exceed the insurance company's retention limit.