Definition

Related Definitions

Equity Financing

What is equity financing?

Equity financing is a method through which companies raise capital by selling their shares to investors. This set of investors can range from the public to institutional investors to financial institutions. Those investors who end up buying the shares become shareholders.

Companies may choose to opt for equity financing during the initial stages of operation. It allows a company to liquidate its shares and raise money. This sum of capital can be used to expand the business at a time when there is a dearth of funds.

Equity financing is one of the two methods through which companies raise money, the other method being debt financing. The shares are sold to these investors in the form of common stock, which means that the company must first be incorporated. Each share represents a unit of ownership in the company. Thus, when additional shares are issued, previously owned shares are diluted.

Summary

- Equity financing is one of the most popular way of capital raising for any company.

- Type of equity financing depends on the phase the company is into currently. For example: Funding for start-ups is usually through Venture capitalists, whereas for settled companies through IPO or secondary public offerings.

- The most important characteristic of an equity financing is no liability on the balance sheet.

Frequently Asked Questions (FAQ’s)

How does equity financing work?

Often, new businesses that need capital to expand their business turn to equity financing instead of taking debt. Equity investors can be industrialists, venture capitalists or even family members and friends at times.

The process through which equity financing is done depends highly on the investors engaged in the process. The investors and owner can personalize the deal to fit their requirements better. When a big company opts for equity financing, the process is highly regulated, and the shares are offered on a public exchange. However, for small companies, the process may not be as formal and can be conducted by means of a contractual agreement.

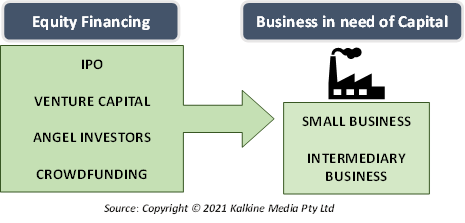

What types of equity financing are there?

The following methods allow businesses to raise capital through equity financing:

- Initial Public Offering (IPO): This is the most sought-after method as many businesses often resort to this method. This method involves going public, which means making the company a publicly traded one.

The process of an IPO involves following the necessary guidelines to issue the shares of a company publicly. Once approved, the business is given a listing date, post which the company becomes open to be traded. Before the listing date arrives, the business must contact potential investors and make them aware of the listing.

- Venture Capital: Venture capital firms often invest in companies in exchange for part ownership in them. These firms often look for those businesses that are guaranteed to provide returns. This requires a hefty amount of research work which is often done by delegated teams within a venture capital firm.

These firms obtain money through other investors who pool their money together to invest in start-up businesses that appear promising. In return for these funds, venture capitalists receive ownership of shares in the company and may also become a part of the board of directors in the company.

- Angel Investors: These are also like venture capitalists, except they are not a part of an organization, and they often work alone. Angel investors are big industrialists and players who have large sums of money to spare.

Unlike venture capitalists, angel investors use their personal funds to invest in a company. These investors may also help fresh businesses with the technical know-how of running a company as well as with marketing techniques and better opportunities to sell. In exchange for providing these funds, angel investors often ask for a share in the company.

- Mezzanine Financing: This type of financing is a combination of equity financing and debt financing. Intermediate-sized businesses mostly use this for raising capital. Under this financing, the lender gives out a loan to the business, which must be paid back. However, there are certain terms and conditions which make this a hybrid of debt and equity financing.

Mezzanine financing gives borrowers a lower debt-to-equity ratio, and the capital given under this financing can give more value than that given by a traditional lender.

- Crowdfunding: This involves selling the shares of a company to the crowd instead of pre-selling the shares through a platform. Crowdfunding allows businesses to remain private and obtain funding from the crowd.

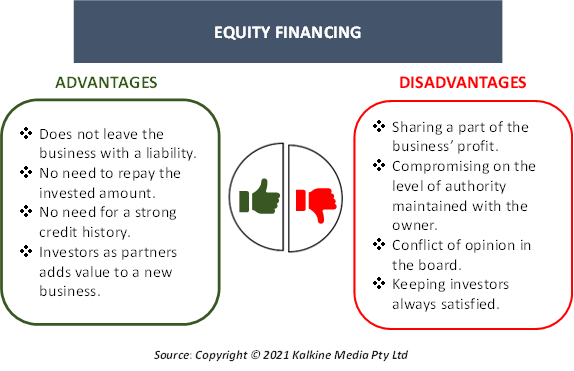

What are the advantages of equity financing?

Equity financing is different from a loan as it does not leave the business with a liability on its balance sheets. Offering a part of ownership may seem like a better idea to many businesses than having to repay the amount given by investors.

This is also helpful for those business owners that do not have a credit history or have a poor track record in repaying loans. Equity financing removes the need to have strong creditworthiness to obtain funds.

Additionally, having investors as partners often adds value to a new business. Most investors are experienced with large sums of money at their disposal. This allows them to give business insights to these young professionals who are new to the game.

What are the disadvantages of equity financing?

Sharing ownership means sharing a part of the business’ profit as well. Companies that allow investors to buy their shares also lose out on the profit that the business brings. Business owners must carefully consider what part of their profits they are willing to lose out on to obtain the funding.

Apart from profits, business owners also must compromise on the level of authority they have on the board. Often, investors asked to be included in the board of directors to make important decisions for the company, leading to a conflict of opinion at times.

Thus, businesses must rely on their own judgement apart from the expertise offered by outside investors. It may sometimes be a lengthy process as investors would often ask for detailed information regarding the business. Constant efforts would have to be made to ensure that the board and shareholders are content with the firm’s current situation.