Definition

Related Definitions

Dividend Reinvestment Plan (DRP)

Retired CEO of the Vanguard Group, John Bogle rightly stated-

His logic is simple, yet solid- investing is about owning businesses and reaping the rewards of their growth. Now, these rewards come in the form of business growth as well as dividends.

In this backdrop, let us walk through the interesting concept of Dividend Reinvestment Plan. Before that, we encourage you to brush up a few dividend basics HERE: DIVIDEND BASICS.

What Is Dividend Reinvestment Plan (DRP)?

A DRP is a formal program that is offered by a publicly-traded company to its existing shareholders. As per the program, investors are provided with the opportunity to reinvest their cash dividends into additional shares of the underlying stock on the dividend payment date.

Breaking this down further- when dividends are paid, they are received by shareholders as a direct deposit in their bank accounts or as a check. DRPs give stock market enthusiasts the option of reinvesting the amount of a declared dividend into additional shares, bought directly from the same company.

In a nutshell, in a DRP, the dividend declared is not paid but re-invested to buy additional security units. Thus, an investor who has opted for the DRP is bound to see a higher number of units allocated to him, periodically.

ALSO READ: All About Smart Dividend Investing

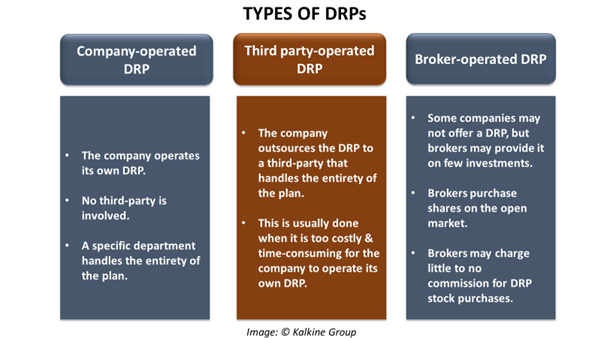

What Are the Types Of DRP?

There are three common types of DRPs-

Why Is DRP Significant?

There are numerous benefits of buying shares through a DRP. These can be reaped by the company issuing the shares as well as the shareholders.

Significance for Investors:

A DRP is a great way for shareholders to accumulate more shares. There are no commissions attached to a DRP, and there prevails the possibility of a price discount. Consequently, the cost basis for purchasing the shares through a DRP can be considerably lower, compared to buying them from the open market.

Further, investors can also buy fractional shares (a portion of an equity stock that is less than one full share).

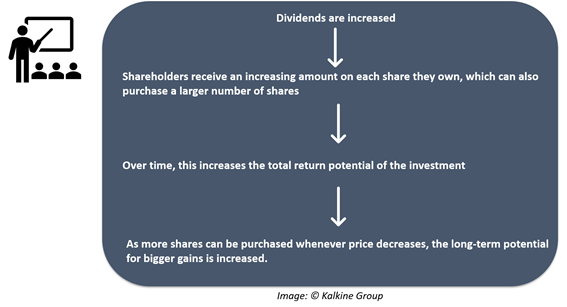

In the long term, the effect of automatic reinvestment on the compounding of returns is an added advantage. The below flow chart clarifies this process-

Significance for the Company:

Companies that pay dividend benefit from DRPs in the following ways-

- When shares are bought from the company for a DRP, there is creation of more capital for the company to use.

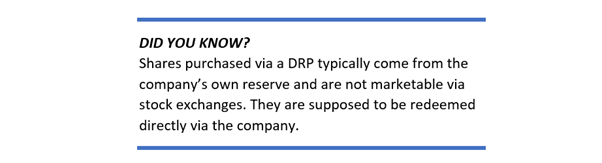

- Shareholders who partake in a DRP are less likely to sell their shares when the stock market drops. The focus ideally remains on long-term investing and long-term growth. Besides, DRP-purchased shares can only be redeemed via the company and are not as liquid as shares purchased on the open market.

GOOD READ: Why is a Dividend Stock Investing Strategy Important For An Income Stream?

Are There Any Drawbacks Associated with DRP?

Like any other instrument and activity in the share market, DRPs have both an upside and a downside. Few disadvantages of DRP are-

- As the company issues more shares to shareholders, more shares tend to become outstanding in the market. Consequently, shareholders that do not participate in the DRP may see their ownership base diluted.

- Shares acquired through DRPs are not exempted from taxes as they are deemed to be an income for the shareholder. Tax reporting (record of a transaction, cost base, capital gains/losses) is an added responsibility for DRP participants, which can be a time-consuming process.

- As the investor acquires more shares via a DRP, his/ her portfolio will naturally be heavily exposed to the company. This could curtail diversification and necessitate periodic rebalances to the investment

Should One Elect For DRP?

Now, the main question that arises is- should DRP be chosen?

In today’s evolving times, there are numerous investment opportunities for an investor in the financial market- mutual funds, banks, shares, bonds, gold, real estate etc., depending upon the risk appetite and investment duration. Nonetheless, it is a well-accepted fact not all investment modes can be suitable for every investor.

DRPs can be opted if shareholders wish to save on transaction costs while purchasing shares. Besides, those with a long-term perspective can choose a DRP to receive compounding returns (explained in the figure above).

On the flip side, some market experts believe that DRPs are not always a feasible option, especially in the case of equity or a balance scheme. This is because as the value of investment under the growth option and the dividend reinvestment option remains the same at the end.

GUIDE CHECK: Guide to investing in Dividend Stocks

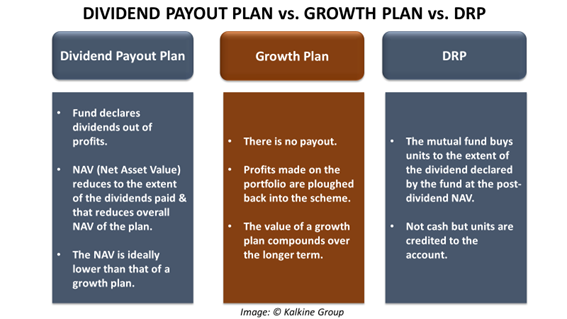

Dividend Payout Plan vs Growth Plan Vs DRP

We will understand this comparison in the backdrop of mutual funds, which provide a choice of three plans- Growth Plans, Dividend Payout Plans and DRPs.

GOOD READ: Dividend Yield or Dividend Growth!

Bottomline

The consensus opines that for long term financial planning, growth plans are the best. The ones on a hunt for a source of regular income can prefer a dividend payout plan. DRPs, on the other hand, are an automatic reinvestment arrangement. They encourage long-term investment instead of active trading. Besides, they tend to have a stabilising influence on stock prices.

An investor can assess his/ her investing motive, style, and risk appetite to select the plan of his/ her choice.

DON’T MISS: 5 Tips for finding sustainable dividend yield stocks