In its latest economic outlook, Organisation for Economic Co-operation and Development (OECD) has trimmed the global GDP growth forecast to about 3 per cent in 2020 and 2021 from its previous projection of 3.4 per cent in 2020. The organisation has also lowered the global GDP growth projection to 2.9 per cent for 2019, which is the weakest pace since the global financial crisis.

As per OECD, the global outlook is fragile and global trade is stagnating due to continued deepening of trade policy tensions, which is taking a toll on investment and confidence. The organisation believes that global growth could be weaker if the following downside risks materialise or interact:

- Continued uncertainty about Brexit

- A further escalation of trade and cross-border investment policy restrictions

- Financial vulnerabilities from the tensions between slowing growth

- A failure of policy stimulus to prevent a sharper slowdown in China

- Deteriorating credit quality

- High corporate debt

Moreover, OECD has downgraded the growth expectations for Australia, raising concerns over a downturn in domestic dwelling investment and weaker trading partner growth.

OECD Downgrades Australia?s Growth Forecasts

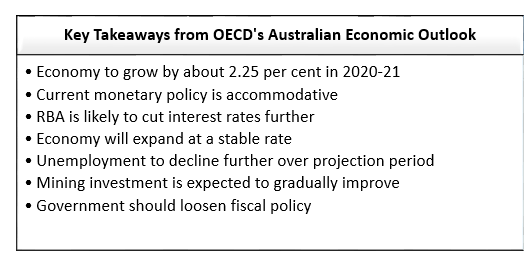

OECD expects the Australian economy to grow by about 2.25 per cent in 2020-21. The organisation believes that the country?s economy will expand at a stable rate, with a decline in export growth amid a slowdown in economies of major trading partners. This is likely to affect business investment, while the mining investment is expected to gradually improve over the projection period.

The organisation anticipates the inflation to remain below target and the unemployment rate to decline much further over the forecasted period. In light of this scenario, the Australian central bank is likely to provide additional monetary policy stimulus, reducing interest rates further.

OECD?s forecasts were less optimistic than the Reserve Bank of Australia?s (RBA) projection of 2.75 per cent GDP growth over 2020 and 3 per cent over 2021. The central bank?s outlook was supported by accommodative monetary policy, recent tax cuts, the upswing in housing prices in some established property markets, a pick-up in mining investment and ongoing spending on infrastructure.

Recently, the International Monetary Fund (IMF) has also reduced its Australia growth forecast to 1.7 per cent in 2019, 2.3 per cent in 2020 and 2.6 per cent in 2024.

To boost the country?s economic growth, RBA has already reduced the cash rate thrice this year, taking it to 0.75 per cent. However, the central bank is of the view that further reduction in interest rates might have a different effect on confidence than in the past, when interest rates were at higher levels.

OECD Calls for Fiscal Policy Stimulus

The organisation has advised Scott Morrison?s government to loosen the fiscal policy that may help, given the fact that Australia?s economy is growing well below its potential and has a relatively low public debt burden.

The outlook stated that Australia?s monetary policy is accommodative, and the RBA is expected to go for a further rate cut to achieve the inflation target. Given this backdrop, it is essential to tighten macroprudential policies in case lower interest rates fuel house prices and expose the country?s economy to downside vulnerabilities.

OECD believes that the current fiscal policy is likely to offer little support to the country?s economic growth, pursuant to the government?s commitment to future budget surpluses. However, the recent tax cuts for low and middle-income earners and the launch of government services under the National Disability Insurance Scheme (NDIS) is expected to reduce income inequality and provide some support to household spending over the forecast period.

As per the organisation, the government should consider additional public investment in green infrastructure and introduce ready-to-start capital projects from its Infrastructure Investment Programme. It has called for prioritisation of growth-enhancing tax reforms, which include shifting the tax mix away from inefficient taxes and direct taxes to land taxation and the goods and services tax (GST).

Morrison Government to Accelerate Infrastructure Spend

In order to stimulate the economy, the Australian government has decided to spend $3.8 billion in infrastructure in the next four years, including $1.8 billion in the coming two years. The government will use the infrastructure fund to fast-track the progress of major, state-approved projects across Australia.

The RBA was already urging for more spending on infrastructure as the bank is of the view that further interest rate cuts might not provide the desired effect. Moreover, the effect of the Morrison government?s tax cut plan was not so visible on the country?s growth progress. Market experts are of the opinion that the recent tax cuts have been used by the households to pay off their mortgage faster instead of boosting their discretionary spending.

The experts believe that the current infrastructure spending boost is likely to support the economy in the following ways:

- Realizing longer run productivity gains more rapidly.

- Speeding up construction activity and encouraging jobs in the near future.

Since being elected, the Morrison government has provided a fiscal stimulus of over $9 billion, including $7.2 billion in tax cuts. The government has also rejected the calls for any additional stimulus in the near future, insisting that it is not panicking about the country?s economic conditions.

Key Initiatives and Projects - Budget 2019-2020

In the 2019-2020 budget, the Australian government announced the following key initiatives and projects:

- A record $100 billion investment to provide safer and faster commutes across the country, ensuring that regions and towns are better connected.

- A total Commonwealth commitment of about $5.7 billion was given for Adelaide, Launceston, Townsville, Darwin, Western Sydney, Geelong and Hobart.

- To boost more reliable, sustainable and affordable energy, investment of $1.4 billion was announced for the Snowy 2.0 project in New South Wales.

- To unlock Tasmania?s energy capacity, $56 million was provided for a feasibility study for the Bass Strait interconnector (Marinus Link).

- For the fourth round of the Building Better Regions Fund, a further $200 million was given to drive economic growth, create jobs and build stronger regional communities.

- A new $220 million investment was announced for improved internet and mobile services via Stronger Regional Connectivity Package.

- Investment of $100 million was declared for infrastructure upgrades of Regional Airport.

- To boost tourism, $543 million was announced.

- To eliminate barriers to women participation in sport, $150 million was allocated.

- Regional Deals were rolled out - Barkly Deal ($45.4 million), Hinkler Deal ($173 million) and Albury Wodonga Deal.

- Provision of $6.3 billion to farmers and farming communities was declared for drought assistance and concessional loans.

- To prepare for future droughts, $3.9 billion investment was announced for the Future Drought Fund.

- Up to $300 million in grants was announced for flood-affected farmers in North Queensland.

It is worth noting that despite these key initiatives and projects, the country is facing rising budget pressure due to sluggish growth and record spending programs. News are doing rounds that Australia might receive additional cash in May 2020 from the government to support economic growth.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.