Lingering uncertainties around Brexit are creating weak global growth and trade barriers, which might hit the UK economy. The UK exit from the European Union would lead to imposition of tariffs on several outbound goods, while the country will charge fewer tariffs. This means that the United Kingdom would be required to pay higher taxes and import duties for the products imported from other parts of Europe. The citizens would face higher inflation followed by erosion of real income.

Brexit Impacts:

The existing sentiment remains weak, impacting the overall demand scenario along with the stock market index. Several companies from Australia carry out business in the European nations including England. UK-focused companies are reporting tepid business growth from this region. It seems investors are also going through a selling mode, thereby affecting the investing activities across the region.

Moreover, fund managing companies with operating activities in the United Kingdom are going through turbulent times and their major funds are being redeemed by the investors due to prevailing lower sentiments. The companies are undertaking diversification and incurring higher marketing expenses across the nation.

In this article, we will be discussing Pendal Group Limited, which has an operating segment in the UK. Let us have a look how uncertainties around the Brexit deal are impacting the business.

Pendal Group Limited (ASX: PDL)

Pendal Group Limited is engaged in the provision of investment management services and operates across Australia, United Kingdom, Asia, Europe and the United States.

FY19 Performance Highlights (Period ended 30 September 2019):

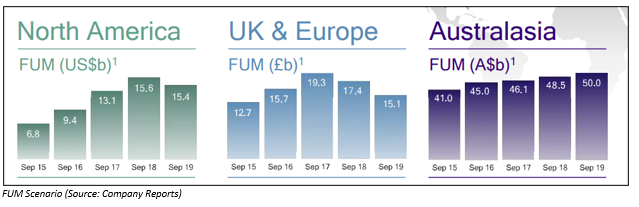

Amid the ongoing Brexit event, the business witnessed outflows across the UK region and particularly in European investment strategies during the 12 months to 30 September 2019. Whilst the ongoing uncertainty surrounding the Brexit negotiations and concerns regarding growth in the EU, Pendal Group witnessed a major outflow of $2.7 billion from the European segment and $0.4 billion from the UK segment.

According to the companyâs Chairman James Evans, due to cautious investor sentiments, significant shifts are being witnessed from equities into bonds, affecting both flows and margins. Majority of the companyâs outflows have been from the European equity strategies, largely owing to the turmoil of Brexit, in addition to the trade tensions impacting on global growth and the general 'flight to security' by investors.

During FY19, average FUM went down by 1% on a y-o-y basis to $98.8 billion followed by a 4% reduction in base management fees to $482.6 million. The business reported an 89% lower performance fees at $5.9 million. While the operating profit excl. performance fees decrease 8% on a y-o-y basis to $198.5 million. The business reported an 8% decline in expenses at $290.2 million. The company boasts diversified business across markets, distribution channels and asset classes.

Balance Sheet Analysis of Pendal Group Limited:

At the end of the financial year to 30 September 2019, the company had a strong balance sheet, providing strength to the business. It had a growing net tangible asset base with no debt. Pendal Group is well positioned for growth and to take advantage of opportunities as they present themselves.

PDL reported total current assets of $224.58 million for FY2019, which includes cash and cash equivalents of $149.04 million and trade and other receivables of $68.56 million. The company reported increase in plant, property and equipment at $9.05 million as compared to $5.392 million in FY2018. PDL reported financial assets at $278.075 million for FY2019, up from $255.687 million in the year ago period. The intangible assets were reported at $540.346 million as on 30 September 2019.

Trade and other payables of the company came in at $41.57 million during FY19. Pendal Group is debt free and have lease obligations of $0.957 million. Total assets of the company came in at $1,095.54 million while net assets stood at $910.7 million during FY19. The business delivered improved retained earnings at $232.954 million from $229.040 million on the previous financial year.

FY2019 Initiatives:

During FY19, the business opted for diversification across markets, distribution channels and various asset classes. The company invested in additional sales resources in the UK and US, followed by modifications in the Australian sales team by client segment in order to provide better services to its clients. The company-initiated brand campaigning in Australia to increase Pendal brand awareness, targeting the adviser community. The company also increased promotion across UK Equity Income, Global Select, Global Opportunities, Global Emerging Markets Opportunities and Global Income Builder through several marketing campaigns, roadshows and client events

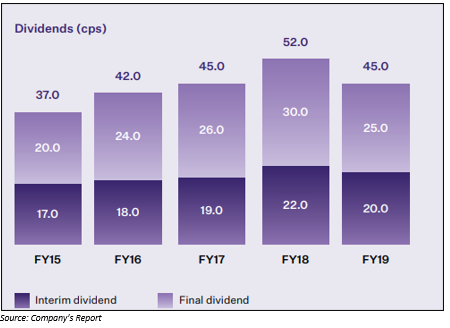

FY2019 Dividend Distribution:

Full year dividend reported a decline in FY2019 when compared with the prior year. The company paid 45 cents per share in the year to 30 September 2019, representing a decline of 13% from 52 cents per share in the same period a year ago.

Outlook:

As per the management guidance, the business is expected to be impacted by macroeconomic and geopolitical uncertainty in the short-term. The management expects starting FY20 FUM to remain slightly higher than FY19 average FUM. During the starting of the financial year, the business witnessed improved net flows. The management is focused on investing in new capabilities and workforce followed by focus on new product development and extension strategies. The company plans to boost focus on income-based products.

Pendal Group is also planning to launch its new ESG / RI products while investing in technology platform in coming years.

Stock Update:

The stock of PDL closed the dayâs trading at $7.840 on 8 November 2019, down 1.384% from its previous closing price. The stock has a market capitalisation of $2.57 billion, while the annual dividend yield of the stock stands at 5.66%. The stock is available at a price to earnings multiple ratio of 14.61x. The stock has generated returns of 14.06% and 11.34% in the last one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)