Cairn Energy Plc

Cairn Energy Plc (LON:CNE) is an Edinburgh, United Kingdom based Oil and Gas company that engages in the business of extraction, exploration as well as development of oil and gas based assets. The companyâs primary strategy is to deliver value to its shareholders, by acquiring and maintaining assets of oil and gas in various stages of oil and gas exploration lifecycle. The companyâs entire portfolio of these assets is present across the world in countries and regions like United Kingdom, Norway, Republic of Ireland, Israel, Mauritania, Senegal, Cote dâIvoire (Ivory Coast), Mexico, Nicaragua and Suriname.

CNE Share Price Performance

On 5th December 2019, at 10:25 A.M GMT, at the time of writing, Cairn Energy Plcâs share price was reported to be trading at GBX 182.40 per share on the London Share Exchange, an increase of 1.22 per cent or GBX 2.20 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 180.20 per share. When this was being written, the Cairn Energy Plc share has been reported to be trading 32.17 per cent above the 52-week low share price, which was at GBX 138.00 per share, that the companyâs shares set on December 27, 2018. The market capitalisation (M-Cap) of the company has stood at a value of GBP 1.062 billion reportedly, in reference to the share price of the company.

The beta of the companyâs share has stood at a value of 1.5473. By this, it can be easily inferred that the movement in the share price of the company, is more volatile, as opposed to the movement of the comparative benchmark index.

Zenith Energy Limited

Zenith Energy Limited (LON:ZEN) is a Calgary, Canada domiciled oil and gas production company that concentrates on the purchase and development of onshore oil and gas assets. The companyâs main operations and assets are located in the countries of Azerbaijan and Italy. In Azerbaijan, the country holds interest in one of the largest onshore fields through its subsidiary. In Italy, the company owns a diversified portfolio of natural gas, natural gas condensate and electrical assets.

ZEN Share Price Performance

On 5th December 2019, at 10:30 A.M GMT, at the time of writing, Zenith Energy Limitedâs share price was reported to be trading at GBX 2.38 per share on the London Share Exchange, an increase of 5.78 per cent or GBX 0.13 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 2.25 per share. When this was being written, the Zenith Energy Limited share has been reported to be trading 10.70 per cent above the 52-week low share price, which was at GBX 2.15 per share, that the companyâs shares set on December 02, 2019. By the time, this piece was being written, the share price was also trading 44.00 per cent below the 52-week high price at GBX 4.25 per share, which the companyâs share achieved on September 23, 2019. The market capitalisation (M-Cap) of the company has stood at a value of GBP 9.34 million reportedly, in reference to the share price of the company.

The beta of the companyâs share has stood at a value of 1.4576. By this, it can be easily inferred that the movement in the share price of the company, is more volatile, as opposed to the movement of the comparative benchmark index.

WM Morrison Supermarkets Plc

WM Morrison Supermarkets Plc (LON:MRW) is a Yorkshire, United Kingdom based consumer services company, that is engaged in the operation of large scale retail supermarkets in the name of the Morrisons brand. The company has both brick and mortar stores as well as online presence to keep pace with the up and coming trends in the retail consumer services sector. Morrisons brandâs product offerings include all kinds of groceries, such as Fresh and Frozen food, Drinks, Alcoholic drinks and other beverages, personal care offering such as toiletries and beauty care items as well as Kitchen & home appliances and home décor products. This range of products makes the company a market leader in the retail supermarkets business in the United Kingdom. The company also has manufacturing facilities through which they source the fresh food that they sell, which gives them control over provenance and quality. The company currently has a customer base of over 11 million passing through the brick and mortar stores each week while they serve around 11 million households through their website service.

MRW Share Price Performance

On 5th December 2019, at 10:35 A.M GMT, at the time of writing, WM Morrison Supermarkets Plcâs share price was reported to be trading at GBX 194.95 per share on the London Share Exchange, an increase of 1.12 per cent or GBX 2.15 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 192.80 per share. When this was being written, the WM Morrison Supermarkets Plc share has been reported to be trading 11.30 per cent above the 52-week low share price, which was at GBX 175.15 per share, that the companyâs shares set on August 15, 2019. By the time, this piece was being written, the share price was also trading 18.55 per cent below the 52-week high price at GBX 239.35 per share, which the companyâs share achieved on February 06, 2019. The market capitalisation (M-Cap) of the company has stood at a value of GBP 4.635 billion reportedly, in reference to the share price of the company.

The beta of the companyâs share has stood at a value of 0.7039. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

Diageo Plc

Diageo Plc (LON:DGE) is a London, United Kingdom based global alcoholic beverage company that offers a broad collection of over 200 brands across spirits and beer in more than 180 countries across the world. The groupâs operations are differentiated in geographical segments: Latin America and the Caribbean, Africa, Europe and Turkey, North America, Asia Pacific and ISC countries. These brands include Captain Morgan, Johnnie Walker, Baileys, Don Julio, Cîroc and Ketel One vodkas, J&B, Smirnoff, Crown Royal, Buchananâs and Windsor whiskies, Tanqueray and Guinness amongst others.

DGE Share Price Performance

On 5th December 2019, at 10:40 A.M GMT, at the time of writing, Diageo Plcâs share price was reported to be trading at GBX 3076.00 per share on the London Share Exchange, a decline of 0.24 per cent or GBX 7.50 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 3083.50 per share. When this was being written, the Diageo Plc share has been reported to be trading 14.41 per cent above the 52-week low share price, which was at GBX 2688.50 per share, that the companyâs shares set on January 28, 2019. By the time, this piece was being written, the share price was also trading 15.34 per cent below the 52-week high price at GBX 3633.50 per share, which the companyâs share achieved on September 04, 2019. The market capitalisation (M-Cap) of the company has stood at a value of GBP 72.317 billion reportedly, in reference to the share price of the company.

The beta of the companyâs share has stood at a value of 0.6843. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

Compass Group Plc

Compass Group Plc (LON:CPG) is a British multinational company headquartered in Chertsey, United Kingdom. The company is engaged in providing food and support services in more than 50 countries, with clientele ranging from armed forces to schoolchildren, and is the largest contract foodservice company in the world. The companyâs operations are differentiated in five segments: Healthcare & Seniors, Sports & Leisure, Business & Industry, Defence, Offshore & Remote, and Education. Operations are distributed in three geographical segments as well: North America, Europe and Rest of the World.

CPG Share Price Performance

On 5th December 2019, at 10:45 A.M GMT, at the time of writing, Compass Group Plcâs share price was reported to be trading at GBX 1835.50 per share on the London Share Exchange, a decline of 0.43 per cent or GBX 8.00 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 1843.50 per share. When this was being written, the Compass Group Plc share has been reported to be trading 16.50 per cent above the 52-week low share price, which was at GBX 1575.50 per share, that the companyâs shares set on January 28, 2019. By the time, this piece was being written, the share price was also trading 14.63 per cent below the 52-week high price at GBX 2150.00 per share, which the companyâs share achieved on September 04, 2019. The market capitalisation (M-Cap) of the company has stood at a value of GBP 29.276 billion reportedly, in reference to the share price of the company.

The beta of the companyâs share has stood at a value of 0.7956. By this, it can be easily inferred that the movement in the share price of the company, is less volatile, as opposed to the movement of the comparative benchmark index.

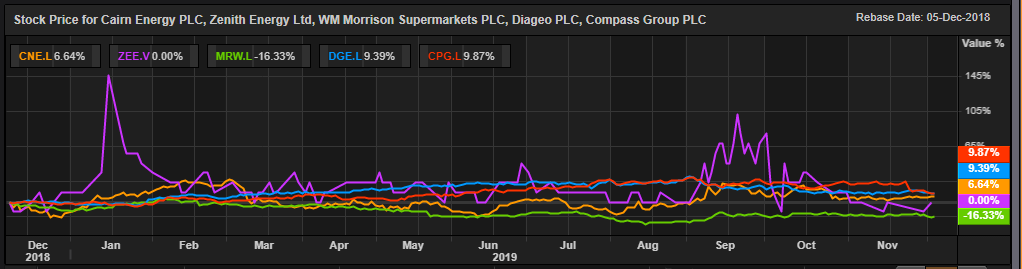

Comparative Share Price Chart of CNE, ZEN, MRW, DGE and CPG

(Source: Thomson Reuters) Daily Chart as on 05-December-19, prior to the close of the market