US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 7.24 points or 0.19 per cent lower at 3,903.99, Dow Jones Industrial Average Index dipped by 2.69 points or 0.01 per cent lower at 31,373.14, and the technology benchmark index Nasdaq Composite traded lower at 13,970.30, down by 37.40 points or 0.27 per cent against the previous day close (at the time of writing, before the US market close at 1:15 PM ET).

US Market News: The major indices of Wall Street traded in the red zone amid more corporate earnings announcements and inflation data. The U.S. consumer price index rose by 0.3% during January 2021 compared to an increase of 0.4% during December 2020. Among the gaining stocks, Lyft shares jumped by approximately 10.10% after it said that it would return to profit by the third quarter. Twitter shares jumped by around 8.50% after it had beaten quarterly sales and profit expectations. Shares of Uber went up by about 5.20% ahead of its quarterly earnings announcement. Among the declining stocks, shares of General Motors plunged by around 0.82% after it had warned of semiconductor chip shortage.

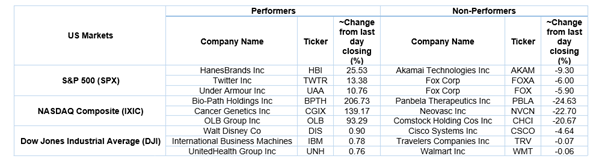

US Stocks Performance*

UK Market News: The London markets traded on a mixed note amid ongoing worries regarding the economic impact of prolonged Covid-19 lockdowns. FTSE 100 inched higher by around 0.21% lifted by the positive corporate earnings and investor hopes on U.S. stimulus package. British retailer, Dunelm Group shares, went up by around 6.19% after it had resumed the interim dividend and reported an increase in its first-half profit driven by a boost in online sales, partially offset the temporary closure of stores. The Company said its first-half pre-tax profit grew by 34.4% to 112.4 million pounds. Britain’s second-largest supermarket Sainsbury’s said that it would price match the German-owned discounter Aldi in several product categories such as chicken, vegetables, fruits and dairy. Its shares were jumped by around 0.51% after the update. Packaging company Smurfit Kappa Group shares surged by approximately 2.49% after it reported FY20 results. The Company had shown an increase of 8% in its final FY20 dividend, and it had repaid all the money received from various government schemes regarding Covid-19 pandemic. Britain’s housebuilder Redrow had reported significant growth of 11% in its half-year profit. The Company had declared an interim dividend of 6 cents per share. However, the shares went down by about 3.76%.

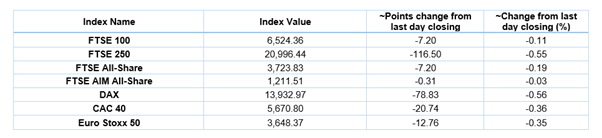

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 10 February 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); Glencore Plc (VOD).

Top 3 Sectors traded in green*: Basic Materials (+2.39%), Financials (+0.94%) and Utilities (+0.75%).

Top 3 Sectors traded in red*: Consumer Cyclicals (-1.64%), Energy (-0.71%) and Industrials (-0.40%).

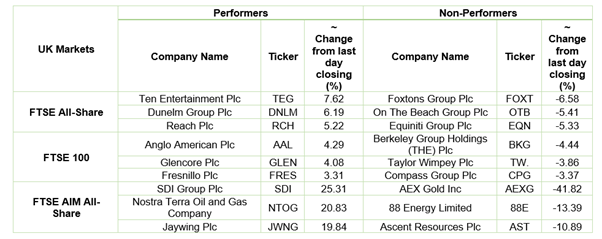

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $61.47/barrel and $58.74/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,843.00 per ounce, up by 0.30% against the prior day closing.

Currency Rates*: GBP to USD: 1.3849; EUR to GBP: 0.8762.

Bond Yields*: US 10-Year Treasury yield: 1.141%; UK 10-Year Government Bond yield: 0.490%.

*At the time of writing