Summary

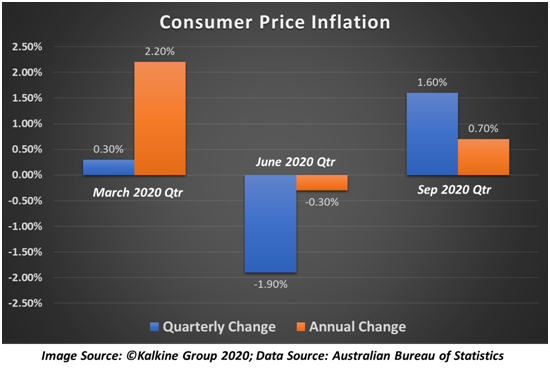

- Australia’s CPI marked an uptick of 1.6 per cent in the September 2020 quarter.

- The conclusion of free childcare program in mid-July 2020 and a rebound in global oil prices stimulated the rise in CPI.

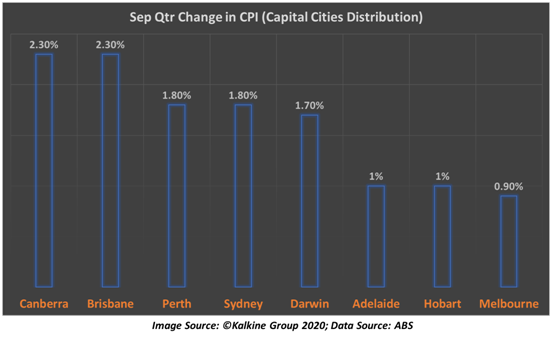

- Brisbane and Canberra observed maximum rises of 2.3 per cent each in the price index.

- NAB expects inflation levels to remain subdued for the next few years amidst weak demand and elevated unemployment.

Following the conclusion of free childcare programin mid-July 2020, Australia’s Consumer Price Index (CPI) has marked an uptick of 1.6 per cent in the 2020 September quarter. The latest figures from the Australian Bureau of Statistics (ABS) also revealthat the nation’s CPI rose by 0.7 per cent over the twelve months to the September quarter.

The September quarter surgefollows a record decline of 1.9 per cent in CPI during the June 2020 quarterwhen petrol prices plunged 20 per cent, and childcare was free.

Key Contributors to September Quarter CPI

Importantly, childcare contributed 0.9 percentage points to thequarterly movement in headline CPI during Q3 2020. According to the ABS, the CPI would have increased just 0.7 per cent, excluding the impact of the childcareprogram.

Amidst a rebound in global oil prices, significant increases were recorded inthe price of automotive fuel (9.4 per cent) during the September quarter. Besides, a considerable rise was recorded in the price of pre-school and primary education (11.1 per cent)with pre and post school care no longer being free.

ABS further revealed that robust demand and supply constraintsresulted in less discounting and price increases for many durable household goods over the quarter. Consequently, furniture, major appliances and small applianceswitnessed notable increases of 6.4 per cent, 5.3 per cent and 5.8 per cent, respectively.

City-Wise Distribution of CPI Data

All the eight capital cities of Australia recorded an upsurge in CPI during the quarter, with Brisbane and Canberra observing maximum hikes of 2.3 per cent each. Melbourne noted a minimum rise of 0.9 per cent in quarterly CPI over the period.

It is imperative to note that all capital cities witnessed an increase in transport fares amidst price escalations in automotive fuel. The hike inautomotive fuel prices ranged from 0.1 per cent in Darwin to 11.1 per cent in Melbourne, with Hobart being the only city to observe a decline of 1.5 per cent.

Owing to the discontinuation of free childcare, which impacted before and after school care, education costs also grew in most capital cities. Increase in preschool and primary educationcost ranged from 0.2 per cent in Hobart to 19.2 per cent in Sydney.

Australia’s Inflation Levels Remain Subdued

While Australia’s CPI bounced back sharply in September 2020 quarter, it is prevailing well-below the Reserve Bank of Australia’s (RBA) target band of 2 to 3 per cent. Consequently, speculations are rife that the central bank will reduce the cash rate to 0.1 per cent in the November Monetary Policy Meeting.

Related Read: RBA Cash Rate Decision Under the Spotlight

While speaking at a conference in October, the RBA Governor mentioned that it is unlikely to increase interest rateuntil actual inflation is sustainably under the target range. He also mentioned that attaining inflation levels consistent with the target bandmay require restoration to a tight labour market.

Experts at National Australia Bank Limited (NAB) expect Australia’s inflation levels to remain subdued for the next few years amidst weak demand and elevated unemployment.