Summary

- The next RBA policy meet is likely to see the cash rates going down to 0.1%, according to market experts.

- Cash rates allow the RBA to inject or release money to and from the economy.

- Changes in cash rates have a transmission effect on several economic indicators like unemployment, inflation, consumer spending and investment.

- The transmission mechanism comprises of 2 stages- the first one is the change in other market interest rates, while the second one involves transmission through various channels.

- These channels include: Savings and investment channel, cash channel, asset prices and wealth channel and finally the exchange rate channel.

- Banking sector has suffered as a result of interest rate lowering.

- RBA is hopeful that long run impacts would overshadow the short run challenges.

The RBA is expected to hold its next monetary policy meet on 3 November. Till then speculations persist on whether interest rates will be cut down to nearly 0%. Recent speech given by RBA governor Phillip Lowe has fuelled the speculations of rates dropping down to 0.1%. The RBA currently maintains a cash rate of 0.25%.

RELATED READ: Key Takeaways from Phillip Lowe’s stance on rate cuts and stimulus

Against the backdrop of rising unemployment and contracted demand, Australia has been dependent on its financial sector for stability. Being the backbone of economic recovery under the pandemic, banks have a huge responsibility to fulfil. Any tightening imposed by the RBA on these banks would be passed down onto their customers.

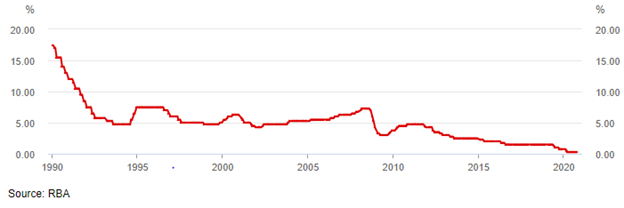

The possibility of decreasing interest rates has been on the cards for Australia for a long time now. RBA decreased the interest rates starting in mid-2019 from 1.5% to 1.25% and then to 1%. Then in October 2019, the rates were slashed to 0.75%. Pandemic-driven uncertainty further witnessed rates dipping to 0.25% in March 2020.

Cash Rate and Market Interest Rate

Cash rate refers to the interest paid by banks when they take “overnight loans” from each other. Banks make overnight transactions amongst each other in order to maintain daily settlements and the cash rate determines how much interest a bank must pay upon taking such loans.

The RBA announces the cash rates post its monetary policy meet which takes place on the first Tuesday of every month, barring January.

Cash rate has multifold implications on economy activities. Any change in the cash rate would have a domino effect on various aspects of the economy like inflation, unemployment, investment and consumer spending. This allows the RBA to inject or release cash into or from the economy, contingent on the current economic scenario.

Unlike the market interest rate, the cash rate does not have direct implications on bank deposit holders. However, there is an indirect effect that is passed onto customers called the transmission process.

The Monetary Policy Transmission Mechanism

- First Stage: The cash rate can be thought of as a benchmark rate upon which other interest rates depend. This stage involves how much of the change in cash rates is reflected onto other interest rates in the market. This is known as the ‘interest rate pass-through’.

The degree of interest rate pass-through can vary over time and can be influenced by factors other than cash rate. Loans with variable interest rates have a quick response to cash rate changes, while loans with fixed interest rates do not show any response to cash rates. However, these variations do not impact the effectiveness of monetary policy transmission on the economy.

- Second Stage: This stage involves analysing how the cash rate changes reflect onto the economy. This can happen through the following channels:

- Saving and Investment Channel- With lower interest rates, it becomes relatively cheaper for households and businesses to borrow. As a result, spending right now is incentivised as compared to spending in the future. Thus, there is an increased demand as well as investment, and as a result economic expansion is a probable outcome.

- The Cash Channel- The ‘cash’ in cash channel refers to the disposable income left behind with people net of their liabilities and investments. This cash is affected by the cash rate and it has the opposite impacts on borrowers and lenders.

When the rate of interest is lowered, borrowers would be left behind with more cash as their repayments would decrease, while lenders would receive lesser interest payments and so their disposable income falls.

This channel is stronger in case of the borrower, firstly because the Australian household market is a net debtor. Secondly, because borrowers are likely to get more constrained by the amount of cash they have.

- The Asset Prices and Wealth Channel- Just as in the case of loan borrowings, asset investments would also become incentivised as the present discounted value of these assets increases with a decrease in interest rates.

- Exchange Rate Channel- As domestic interest rates are lowered, investing in home country becomes less incentivized. This means that foreign investors would not be interested in investing in the home country. As a result, the demand for domestic currency would decline. This would lead to a depreciation of the home currency.

RELATED : Effectiveness of Monetary Policy

Cash Rate as a Tool to Battle the Pandemic

The RBA can manipulate consumer spending based on various tools, one of which is the cash rate. With current lowering being offered on the cash rate, there is an obvious push towards investment. However, most banks have not waited till November 3rd to reduce their interest rates close to 0.

Westpac cut its savings rates by 0.1% after a 0.15% reduction in September this year. ANZ also cut its savings rate by 0.1% after Governor Lowe’s speech. Undoubtedly, banks are on the suffering end under the current policy. The big four banks have suffered a hit because of the reduced interest rates and the reactions that followed.

Savings accounts like Commonwealth Bank Smart Access account, ANZ Access Advantage and a few Canstar accounts offer a flat 0% interest.

Thus, the financial sector, which was thought to have been the anchor behind the current economic recovery, has suffered a setback following the monetary policy changes and the speculations that followed. This has led to a state of speculation and confusion as people with deposits are not receiving returns, more so, in the case of retirees.

These impacts in the short run are likely to be settled by the long-run changes that are expected to occur in the form of an expansion in consumer demand and spending. While a cash rate lowering from 0.25% to 0.15% would seem incentivising to an extent, a further reduction to near-zero levels could be more harmful than beneficial, unless coupled with measures that make it sustainable.