Highlights

- Cryptoassets may not be correlated, and one or more may rise even when BTC is under stress

- Request crypto has gained recently, with its trading volume having soared over 4,500 per cent

- REQ token is said to be deflationary, and its circulation can decrease with time due to burning

Can any altcoin rise when the broader cryptoverse is in red? CoinMarketCap data suggests that not one, but many assets may surge even when BTC is down.

As of writing, BTC was down almost three percent on a 24-hour basis. ETH too was in red, nearly 2.5 per cent. In contrast to this, tokens like Anchor Protocol (ANC), and Beta Finance (BETA) were up 100 per cent and 70 per cent, respectively. This shines light on how cryptoassets can defy their correlation to add to cryptoverse’s unpredictability.

One crypto trending and gaining as of writing was Request crypto or REQ token.

Request Finance

The project claims to build a financial world for the new version of internet -- Web3. Request Finance is a network where individuals and companies can raise crypto invoices. Tracking financial data, which includes salaries and expenses, is stated to be enabled on Request Finance.

The official website of the project mentions that over 1,400 companies are using Request services.

The website states Request supports over 70 cryptoassets including stablecoins, and over 10 blockchain networks. It is claimed that fiat currencies are also supported.

Also read: Top 5 costliest NFTs ever sold

REQ token

REQ, it is said, performs multiple functions as native token. It makes the network a DAO, where users can vote on proposals using REQ token. The token can be staked. REQ crypto also provides discounts to Request Network participants.

The token is said to be deflationary, with supply decreasing with increased use of Request Network. It is claimed that the project burns REQ tokens when the need arises.

REQ token price

REQ token has grown to become a top 200 asset on the CoinMarketCap list. As of writing, the market cap was over US$135 million.

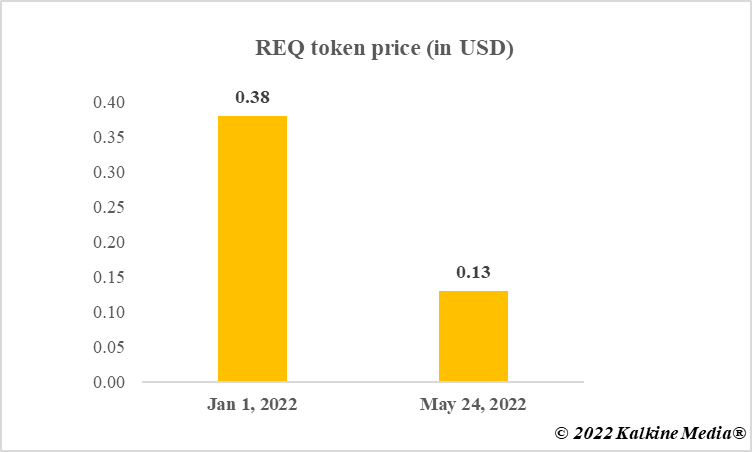

The 24-hour trading volume had gained by over 4,500 per cent, and the price was up nearly 18 per cent. REQ token at the time of writing was trading at almost US$0.13.

Said to be available on major exchanges like Binance and Crypto.com, REQ crypto was rising at a time when BTC and ETH, the two major assets, were losing.

Data provided by CoinMarketCap.com

Also read: BTC and S&P 500 Index correlation over past 5 years

Bottom line

Request crypto claims to create an enabling financial ecosystem for cryptocurrencies. REQ token acts as the network’s native asset, with deflationary features. The token was trading in green when top assets like ETH and DOGE were in red. The exact reason behind the rise of REQ crypto cannot be ascertained. Cryptoassets can gain or lose on sentiments, even in absence of any fundamentals. Request crypto price prediction can be speculative.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.