Highlights

- NZ aims to generate all its energy from renewable sources by 2030.

- Meridian Energy enters into a Swaption Deal with Nova Energy.

- NZ Windfarms aims to reward its shareholders by paying them sustainable quarterly dividends.

New Zealand is one of the few countries in the world which boasts generating around 84% of its energy requirement from renewable sources. Hydro, wind, geothermal, and bioenergy are prime contributors to electricity generation in the Pacific country.

Moreover, by 2030, the nation has pledged to achieve 100% renewable energy production and go carbon-neutral by 2050.

That said, this article will cover the five NZX-listed renewable stocks worth exploring this year.

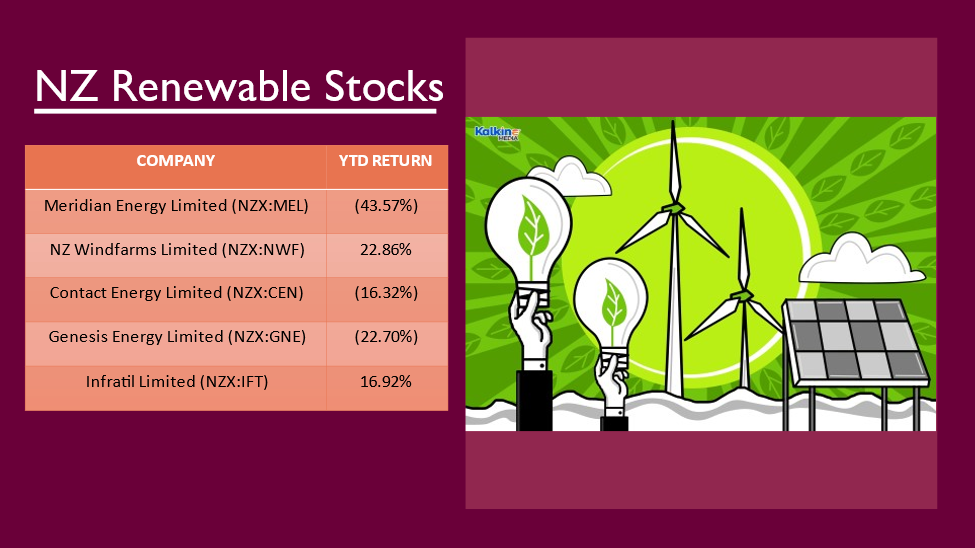

Source: © 2021 Kalkine Media® data source- Refinitiv

Meridian Energy Limited (NZX:MEL; ASX:MEZ)

Meridian Energy Limited is one of the most prominent renewable energy companies across New Zealand, which generates 100% energy from renewable sources like wind, sun, and water. Recently, it entered into a Swaption Deal with Nova Energy Limited for a five-year period, starting from January 2023, thereby providing additional portfolio flexibility to MEL.

Related Read: Would these 5 NZX dividend stocks make one richer through 2022?

Further, it would release its interim results during the last week of February 2022.

On 5 January, Meridian Energy was trading down by 0.10% at NZ$4.845, at the time of writing.

NZ Windfarms Limited (NZX:NWF)

Next on the list is NZ Windfarms Limited, which generates its revenue from the sale of sustainably generated electricity from its wind farm. A few days ago, it had announced the appointment of its new director and intended Chair, Craig Stobo.

Do Read: NZ Windfarms (NZX:NWF): What is it offering in its latest market update?

He would assume office from next month onwards.

Further, on 31 December 2021, it had paid 0.15 cps as a gross unimputed dividend and will continue to pay sustainable quarterly dividends.

Moreover, NWF anticipates its FY2022 EBITDAF to remain higher than FY2021.

On 5 January, at the time of writing, NZ Windfarms was up by 2.33% at NZ$0.220.

Contact Energy Limited (NZX:CEN; ASX:CEN)

The third is Contact Energy Limited, which produces over 80% of its electricity from renewable geothermal and hydro stations and continues to work toward its commitment to renewable energy.

Interesting Read: Contact (NZX:CEN): How would NZ become a 100% renewable electricity market?

The energy generator would unveil its half-yearly performance, ended 31 December 2021, on 14 February 2022.

On 5 January, Contact Energy was down by 2.22% at NZ$7.92, at the time of writing.

Genesis Energy Limited (NZX:GNE; ASX:GNE)

Coming up next is Genesis Energy Limited, which boasts generating electricity from a diverse portfolio of renewable and thermal assets located across different parts of the nation.

Sometime back, the Company had disclosed that both its Chief Operations Officer as well as Chief Digital Officer were seeking a departure from GNE and moving back to Australia.

A Quick Read: Genesis (NZX:GNE): What steps has it taken towards solar development?

While its COO would resign in June, its CDO would step down next month.

GNE is actively looking for suitable replacements for the said positions.

On 5 January, Genesis Energy was up by 0.87% at NZ$2.885, at the time of writing.

Infratil Limited (NZX:IFT; ASX:IFT)

Topping off the list is Infratil Limited, which has significant investments in renewable energy projects located across Kiwiland. The Company announced the allotment of shares last month, under its Dividend Reinvestment Plan.

Also Read: Infratil (NZX:IFT): How did it perform in the interim results?

Further, it has revealed the retirement of its director, Catherine Savage, w.e.f. 31 January.

The Board acknowledged Catherine's valuable contribution to the Company.

On 5 January, Infratil’s was up by 2.38% at NZ$8.190, at the time of writing.

Bottom Line

The NZ government is making significant strides in its renewable energy sector, thereby focusing on building a cleaner and sustainable tomorrow for its people.

_01_09_2025_07_01_12_631371.jpg)