Highlights

- Pragmatic shift from full-time retirement to part-time, gig jobs or self-employment a hit among the retirees

- Government sponsored retirement plans and social security schemes may supplement the risky income-producing investments

- The retirement income should be a balance between two conflicting needs: safety net and need for growing income

- Retirees may prefer reliable and low-risk income stream in the initial years

- Fixed annuities provide guaranteed income but are volatile to inflation and economic downturns

The demography in Canada is presently witnessing a fundamental shift as senior citizens are among the rapidly growing segment of the population.

In the 2016 Census report, it was highlighted that there were 5.9 million seniors in Canada, representing 16.9 per cent of total population. As of July 1, 2021, the people aged 65 years and older represents 18 per cent of the total population.

The trend in the proportion of senior Canadians is expected to continue with nearly 9.5 million seniors, making up 23 per cent of total Canadians by 2030.

Two decades ago, the number of centenarians per 100,000 persons was 18.8. In 2020, it increased to 30.3.

Owing to the increasing number of senior citizens in the country, retirement has become the focus of attention of provincial and federal governments and the general public in Canada.

It is believed that more than eight million baby boomers could exit the work force over the coming 15 years or so.

It is likely to have implications for the financial status of these future retirees, the output levels and productivity rates for the Canadian economy, and labor market opportunities among others.

It needs substantial rethinking of entire pension system in Canada.

Also read: Tips For Early Retirement For Canadians

Earlier, the retirement was seen as a shift from full-time work to full-time retirement at a particular age, say 62 or 65. But given the remarkable change being witnessed in the global retirement environment, the present scenario reflects a period of transition that involves some sort of self-employment activity or part-time work among the retirees.

The recent pandemic hit financial strain raises obvious questions on the present incomes of those already retired and the future financial health of those who planned or are planning to retire shortly.

Retirement income planning is pretty much like a constant job, as it needs constant monitoring and changes as needs because:

- Investment may lose value

- Unexpected financial difficulties

- Shift from saving to withdrawing in initial months post retirement

Saving for post-retirement life has become a prerequisite to sustain acceptable standards of living.

Mostly it is done out of self-interest. But majorly public sector workers participate in office pension schemes as part of their employment conditions.

The government usually implement compulsory contributory pension schemes for these public sector workers so that they save some minimal amount out of their earnings for their own retirement. For the less well-off retirees, the government provides transfer payments, which is mostly financed out of general tax revenues.

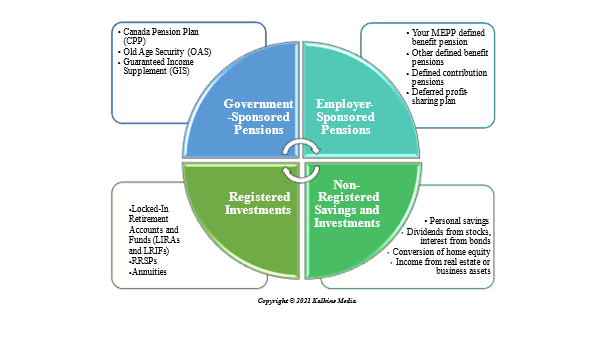

This approach to retirement income reflects a set of three pillars: compulsory public pensions, public transfers to the needy elderly, and tax-assisted private savings.

In Canada, the first pillar consists of non-contributory Guaranteed Income Supplement (GIS) and Old Age Security (OAS) that are geared-to-income transfers to all persons above 65 years.

The second pillar, Canada Pension Plan, is a compulsory contributory social insurance program that is largely funded. CPP is managed by Canada Pension Plan Investment Board, an independent body.

The third pillar consists of tax-sheltered savings by Registered Retirement Savings Plans or Tax-Free Savings Accounts (TFSA).

TFSA do not provide an income cut for contributions but simply allows for tax-exempted future capital income. It is deemed as more favorable savings instruments for those who expect their income to rise over the life cycle and into the retirement.

These three pillars form the fundamental source of retirement income support for majority of Canadians. In addition, the work-related pensions also provide a safety net to the retirees. It majorly includes defined contribution pension plan, locked-in retirement account and defined benefit pension plan.

Also read: How to Choose the Best Retirement Plans

Four factors to consider before you invest for retirement

- How much of retirement income you need once you exit the workforce?

- How much you expect to save before retiring?

- Expectation of return on savings

- How much of the return will be left post tax deduction?

8 places to invest for your retirement

- Registered Retirement Savings Plans (RRSPs)

RRSP is a form of tax-deferred savings plan, where in the account contributions are subject to tax deductions, while the investments grow tax-free. The funds are later taxed as ordinary income when one begins to withdraw it from RRSP post retirement. It is one of the best-known tax shelters in Canada.

- Dollar-cost averaging

The best retirement plan is to start saving in the early work years. One can invest a rising or steady amount in the stock market annually. In retirement, unlike active buying or selling, one can simply choose to live off the dividends, and sell stocks only when he/she needs more money.

- Retirement Income Funds

It is a unique type of mutual fund, where in the individual place capital in the fund, and it is managed by a professional. The fund manager allocates the capital across a diversified portfolio of bonds, stocks, and other investment instruments on behalf of you.

Initially, you need to place a minimum amount into the fund. Retirement income funds could suit those who still have few decades left for retirement as the capital in the fund will grow in value over time.

Copyright © 2021 Kalkine Media

- Annuities

Annuities is a kind of insurance and not investment in particular as its sole purpose is to produce income for retirement. It is based on a simple concept, wherein an individual gives a lump sum of money to the annuity provider, and the latter promises to give fixed amount of income at specific periods.

- Investing in Bonds

A bond is a debt owned by a corporation or the government, wherein the borrower pays the lenders interest for a predetermined amount of time and return the principal.

The yield or interest income one receives from a bond can be considered as a steady source of retirement income.

Bonds are usually ratings-approved by organizations like Moody's, Standard & Poor's Global Ratings, and Fitch Ratings. These ratings tell the credibility of the issuer or the borrower’s ability to give back the principal and pay the yields.

Bonds can be short, medium, or long-term with different rates, including fixed rate and floating rates.

High-yield bonds have lower quality ratings but tend to have higher coupon rates, while low-yield bonds have lower risks and have high quality ratings.

Each can be used differently in a retirement plan.

Do not miss: Steps to build portfolio for early retirement

- Investing in rental real estate

Rental property could be a stable source of retirement income as it is also a sort of long-term investment.

It is feasible for those who think investment property is a real-time business and can sacrifice time for it having some degree of real estate experience.

The rental property comes with unexpected expenses, including maintenance costs. One should take into account all the potential costs that may arise over the time frame one intends to own the investment property.

It is pertinent to mention that one must also consider the vacancy rates on these rental properties. As not all properties are 100 per cent occupied all the time.

- Closed-end funds

It is an investment company that raises funds through an initial public offering and offers shares on the stock market for trade.

The money doesn’t flow in and out instead the fund is built to produce quarterly or monthly income. This income comes from dividends, interest or return of principal in certain circumstances.

Each fund is built with a different objective.

Few close-end funds use leverage and are able to pay a higher yield as they borrow against the underlying securities to buy more income-producing securities. Leverage means additional risk and one must acknowledge the fact the fund’s principal value tend to be volatile.

- Dividend Income Funds

It is for those who prefer to choose a pool of investment than buying dividend-paying individual stocks. Dividend income funds are managed and owned by designated managers who invest in dividend-paying stocks on behalf of the investor.

If the companies increase their dividend payouts, once can expect a rise in their retirement income. But during bad economic times like the pandemic-hit financial crunch, the companies could reduce or stop paying dividends.

Bottom line

As retirement nears, one should consider stashing money somewhere it is safe and accessible. It could be either high-yielding savings accounts or short-term bonds with low risk.

Saving money for a comfortable and peaceful retirement is all about finding a right balance between return and investment risk.

Ideally, soon-to-be retirees should seek help from financial advisors to review their investment plans and individual savings for clear picture.