Highlights

- Demand for aged care services is predetermined to grow. However, it doesn't mean stocks from the sector are sure to provide returns as the government heavily regulates the sector

- When picking individual stocks within an industry, it is advisable to look at how the stock is faring against its peers

- A company whose profit increases with time seems to have financial and operational stability

Investing in stocks can provide good monetary returns in the long term or within a short time frame. Sometimes, it seems tempting to pour money into a particular sector given the industry is performing well or is expected to balloon in the future. However, one must do meticulous research and due diligence before trying out hand at stock picking.

This article will provide a glimpse into the aged care sector for the purpose of investing. Read further to know more!

Aged care: A highly regulated sector

Well, demand for aged care services is predetermined to grow as there is a growing proportion of older people. However, it doesn't mean stocks from the sector are sure to provide returns as its possibility depends on several factors.

In the 2022-23 budget, the Australian government invested AU$522 million in aged care reforms, growing the total commitment to AU$18.8 billion.

Image source: © 2022 Kalkine Media®

Government funds highly regulate the aged care industry. The Aged Care Approvals Round (ACAR) mainly controls the supply of bed licences. The regulation is also a major obstacle for new operators to get an entry.

The industry is regulated for the services provided and the standard. Its method of making profits is quite different from other businesses in terms of cost and pricing. The amount of fees is pretty much dictated by the government, which might be a major problem for operators to collect revenue.

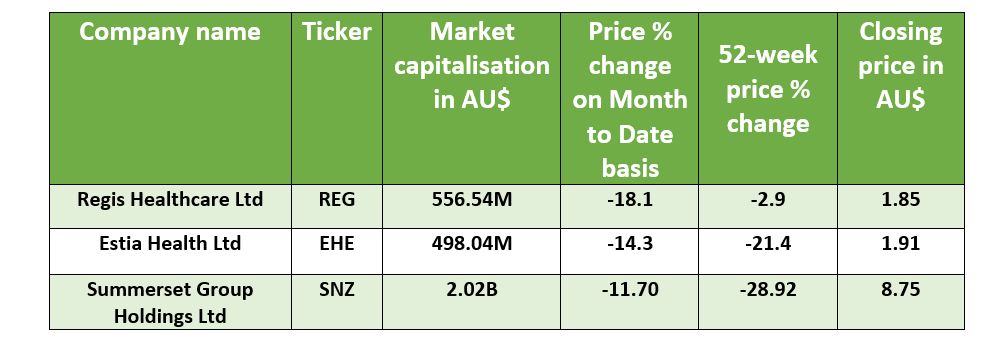

A quick view of financials of the companies providing aged care services in Australia

Basics in stock investing

Before picking up stocks for investing, one must keep a few essential things in mind. You must find a business with strong fundamentals, especially if you intend to hold on to ir for quite a time.

Trends in earnings growth

A company's profits must generally increase with time. Companies with positive earnings growth tend to have financial and operational stability. It must have a proven strategy to uplift sales and develop new products.

Performance compared to its peers

When picking individual stocks within an industry, it is advisable to look at how a stock is faring against its peers. The stock's profitability and performance must be compared to other similar stocks over a period.

Price-earnings ratio

Price earnings, or P/E, indicates how well a stock's price reflects the company's earnings. The P/E ratio is one of the gauges of whether a stock is undervalued or overvalued by the market.

Dividends

Dividend-paying stocks show the company's stability. It is a good indicator that a company has increased its payout consistently each year over decades.