Highlights

- Stocks are the securities that a company issues to investors for growing and expanding their business.

- Bonds function as a loan to a company that provides interest income to investors.

- Bonds work like a debt instrument whereas stocks are an equity investment.

Stocks are different from bonds. They lend partial ownership to the stock buyers, whereas bonds are a type of a loan that is issued by creditors to the company in return for fixed interest. So, in this article, we will learn what stocks and bonds are and their differences.

What are stocks?

A stock is an investment that provides some part of the company's ownership to the investors. It means when you buy a company’s stocks, then you get some ownership of that company and become a holder of that small or big part of the company.

Stocks are the securities that the company issues to investors for growing and expanding their business. So, when a person purchases stock in a company then he/she becomes a shareholder in that company. It means, if that company earns a profit, then you would be entitled to profit and if that company faces loss, then you would also incur some loss.

Through a stock market exchange, public companies issue stocks to investors. The company provides stocks for various reasons, such as entering a new market, presenting new products, paying off debt, and more.

Also read: Top 25 TSX stocks to buy in 2022

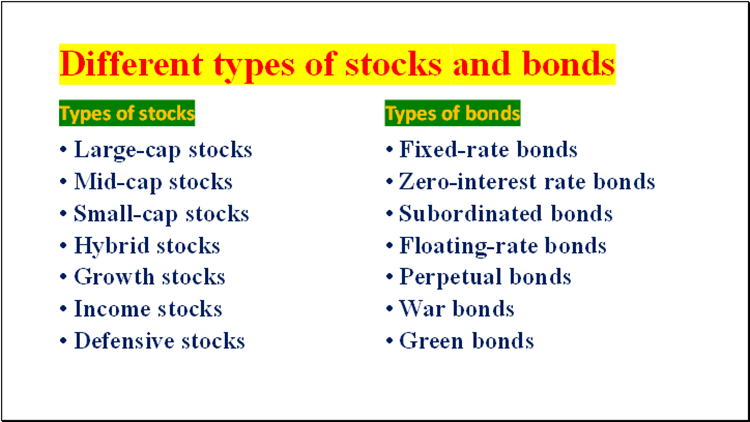

Various types of stocks

- Large-cap stocks

- Mid-cap stocks

- Small-cap stocks

- Preferred and common stocks

- Hybrid stocks

- Growth stocks

- Income stocks

- Defensive stocks

What are bonds?

Bonds function as a loan for a company that provides a fixed interest rate to investors. Instead of visiting a bank, the company raises money from investors who purchase its bonds.

Bonds are known as fixed-income instruments where a company borrows a loan from the public and in return provides them with a fixed rate of return. For funding projects and operations, various companies, governments and municipalities use bonds.

Various types of bonds

- Fixed-rate bonds

- Zero-interest rate bonds

- Subordinated bonds

- Floating rate bonds

- Perpetual bonds

- Bearer bonds

- War bonds

- Green bonds

- Serial bonds

Also read: Investing in corporate bonds? Here are 3 things to look at

Difference between bonds & stocks

Stocks are provided by the company to the public where a buyer can purchase the stocks from the primary market or the secondary market. A company issues its stock to the investors to generate money and that investor becomes a partial holder of that company by buying some per cent of stocks in that company. But when a company generates capital by issuing bonds to investors, then here bonds work like a loan, where bond owners lend to the company by buying their bonds.

- Investors generally use bonds and stocks to increase their portfolios. Bonds work like a debt instrument where stock is an equity investment.

- Credit institutions, and public sector institutions generally provide bonds. Stocks are often provided by corporations and joint-stock corporations.

- Stocks may provide some voting rights to investors where they can decide on certain company issues, but bonds do not come with such voting rights.

- Bonds provide interest income to investors but in stocks, returns are provided in the form of dividends which are not fixed. So, the risk level associated with bonds is low in comparison to stocks.

Also read: Stocks Vs Bonds: Which is better to invest?

Image credit: © 2022 Kalkine Media®

Equity & debt

Companies generally provide equities for expanding their business and generating cash. In return for equities, investors get a chance to become partial owners of the company and can get various benefits if the company grows well in future. Bonds are like a debt instrument where investors issue funds to a company by buying their bonds in return for interest.

Bottom line

In the stock market, you buy a company’s stocks, whereas bondholders issue debt to the borrowing company. So, if you want to invest, then you can invest in both stocks and bonds as both generate profits differently.